This China Play Is a Better Bet (FXI GXC)

Post on: 26 Апрель, 2015 No Comment

If you’re looking for strong investing prospects in an economy that got through the global recession with barely a hiccup in its growth rate, you have to look at Chinese stocks. But given how popular emerging markets have become, you’ll find different ways to invest in the world’s most populous nation. Below, I’ll explain why I think one China play that many investors have given little attention offers better exposure to the emerging giant than some more popular alternatives.

Getting your China fix

For growth investors, China is the world’s hot spot among large countries. With the exception of Singapore and Peru, no other economies have seen faster growth rates recently, and estimates for 2011 and 2012 put future growth squarely in the 8% to 9% range. That compares to relatively sluggish growth of around 3% in the U.S. and 1% to 2% in most of Europe.

U.S. investors have access to several Chinese stocks that trade on major exchanges. But if you have only a limited amount of money that you plan to invest overseas, you may not be able to afford a diversified portfolio of individual Chinese stocks, which would expose you to some significant risks right now. That’s where exchange-traded funds come in.

The easy way to play

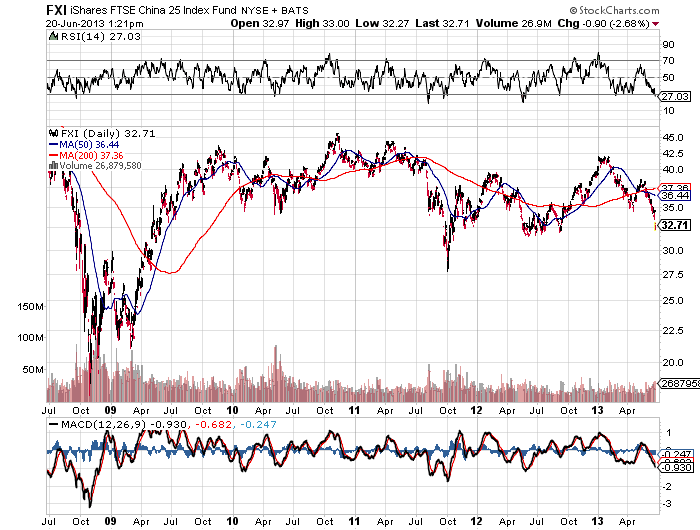

For investors who want a simple, diversified set of Chinese investments, ETFs offer an easy solution. The most popular China-focused ETF is the iShares FTSE China 25 ( NYSE: FXI ). which owns 25 select stocks representing some of the largest companies in the country.

At first glance, 25 stocks may seem like ample diversification for your portfolio. You’ll find plenty of well-known stocks there, including China Mobile ( NYSE: CHL ) and China Life ( NYSE: LFC ). But when you take a closer look at the portfolio of the iShares ETF, you’ll discover an alarming concentration in one particular sector: financials. The ETF invests more than half of its assets in financials, with banks and insurance companies making up five of the top 10 holdings of the ETF.

A huge concentration in a single sector is always a cause for alarm with a supposedly diversified investment. But here, the risk is even greater, because Chinese banks are under stress. As fellow Fool Nate Weisshaar explains in greater detail in this article. Chinese banks have made huge loans to try to sustain growth, with $2.6 trillion in loans in just the past two years. Already, the Chinese government is trying to rein in that growth, and when it does, it could have a big impact on financial companies.

The better way to play

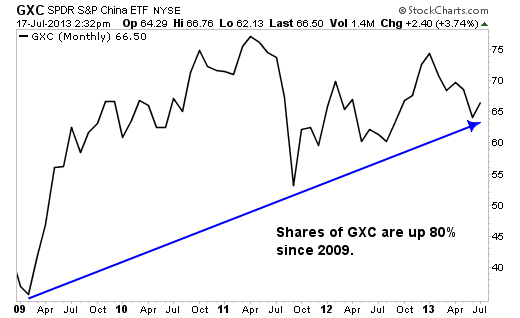

If you’re looking for another ETF that has a more attractive risk profile, you’ll want to check out SPDR S&P China ( NYSE: GXC ). The fund has about 140 different stocks under its belt, nearly six times more than you’ll find among the iShares ETF’s holdings. And although it, too, has a fairly big concentration in financials, they make up just a third of the ETF’s assets — leaving more room for crucial stocks that the iShares fund leaves out, including technology stocks Baidu ( Nasdaq: BIDU ) and Tencent as well as consumer-oriented stocks Ctrip.com ( Nasdaq: CTRP ) and New Oriental Education ( NYSE: EDU ) .

Moreover, despite having more stocks and fewer assets under management, the SPDR ETF gives investors a relative bargain on its expense ratio, at 0.59% versus the iShares ETF’s 0.72%. That’s not a huge margin, but even small differences can add up for long-term investors over time.

Look beyond the obvious

ETFs have been around long enough that when you look for funds covering a particular sector, you can usually find one that has become the most popular choice among most investors. But that doesn’t automatically make that ETF the best way to invest in that space. If you look beyond the most popular ETFs, you’ll often find better alternatives that give you more of what you really want for your portfolio. That’s worth a little extra effort.

Find out about some great ETF investments. Click here to read The Motley Fool’s special free report, 3 ETFs Set to Soar During the Recovery , which includes an international ETF that could bring you big profits.

Fool contributor Dan Caplinger is always looking for the best bet he can find. He doesn’t own shares of the companies mentioned in this article. Baidu and New Oriental Education are Motley Fool Rule Breakers recommendations. Ctrip.com is a Motley Fool Hidden Gems recommendation. The Fool owns shares of China Mobile, which is a Motley Fool Global Gains selection. Try any of our Foolish newsletter services free for 30 days . We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Fool’s disclosure policy will never end.