This Billionaire s Case For Saving Fannie Mae and Freddie Mac (FMCC FNMA)

Post on: 12 Май, 2015 No Comment

Flickr / insider_monkey.

After researching a recent article I wrote on the aftermath of the financial crisis, I decided to dig deeper into the story that Bill Ackman (rockstar hedge fund manager, CEO of Pershing Square Capital, and on-again/off-again arch-nemesis of Carl Ichan) has been boosting a large position in Fannie Mae ( NASDAQOTCBB: FNMA ) and Freddie Mac ( NASDAQOTCBB: FMCC ) .

To understand why Ackman would choose to bet on these two government-run casualties of the financial crisis, we first need to take a look at some history.

What happened to Fannie and Freddie?

The tailspins in Fannie Mae and Freddie Mac started during the housing bubble when mortgage originators started approving sub-prime mortgages to borrowers with bad credit.

The idea seemed to be that by bundling a bunch of terrible sub-prime mortgages into a mortgage-backed security (MBS), you end up with a security that is not nearly as risky as each of the underlying mortgages itself was.

As it turns out, a bundle of crappy mortgages produces a crappy MBS.

The problem was that the investors that were buying these crappy MBSs had no idea how bad they were because many of them were still AAA-rated by credit agencies, the highest rating possible for a security.

When the sub-prime mortgage borrowers inevitably defaulted on their payments, Fannie and Freddie stopped receiving mortgage payments. That meant that the GSEs did not have the capital to pay the the guarantees they owed to MBS investors, and the market value of MBSs started to tank.

Unfortunately, Fannie and Freddie combined had over $1.5 trillion of these mortgage-related assets on their own balance sheets, which compounded the GSEs massive losses from their guarantee business.

Losses were so overwhelming that Fannie and Freddie required a $187 billion government bailout and were placed under conservatorship by the Federal Housing Finance Agency (FHFA) in 2008.

Initial terms of the bailout

In return for the liquidity to remain operational, Fannie and Freddie initially accepted the following bailout terms from the government. First, the Treasury received warrants to purchase 79.9% of the common shared of the GSEs for a nominal price of $0.00001 per share.

In addition, Fannie and Freddie each issued the Treasury $1 billion in shares of preferred stock that pay an annual 10% dividend. In order to make these dividend payments from 2008 to 2011, the GSEs issued even more shares of preferred stock to the Treasury. However, when Fannie Mae and Freddie Mac eventually returned to profitability in 2012, they were finally able to pay the 10% dividend from their own pockets for the first time.

Treasury changes the rules

Things were looking slightly up for Fannie and Freddie shareholders in 2012 until the Treasury dropped a bombshell: they amended the terms of their preferred shares to pay dividends amounting to 100% of the earnings of the GSEs.

In other words, this net worth sweep means that every single cent that Fannie and Freddie earn from this point forward will be siphoned off by the government.

Ackman’s Case

Bill Ackman and other Fannie and Freddie shareholders believe that this one-sided change in the terms of the bailout agreement is illegal and will eventually be overturned in court.

Ackman believes that, as a conservator, the FHFA has a duty to preserve and conserve the assets of the GSEs.

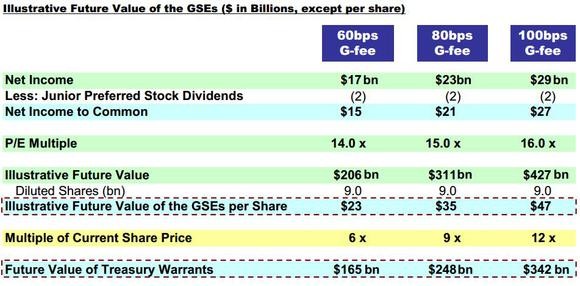

Last month, Ackman presented his argument that, if the net worth sweep is repealed, he sees plausible price targets for the GSEs ranging from $23 per share to $47 per share.

Source: Ira Sohn Conference Presentation.

Ackman’s plan for the GSEs involves dramatically raising their capital requirements and ditching their fixed-income arbitrage business all together. In his presentation, Ackman asserts,

If the GSEs increase their capital levels an d become pure mortgage guarantors, they can be a simple, low-risk, and effective solution for housing finance reform.

Ackman argues that relying on the private sector to take over the role that the GSEs currently serve in the housing market, is risky, untested, and impractical. In fact, Ackman shows that potential minimum capital requirements up to $500 billion for the GSEs existing $5 trillion MBS portfolio is more capital than was raised in all the U.S. IPOs from 2004 to 2013 combined!

Even if the private sector could come up with this unprecedented amount of capital, g-fees and interest rates could skyrocket to a level that would discourage mortgage originations and lead to another downturn in the housing market.

What’s a shareholder to do?

The takeaway message from Ackman’s presentation is not that shareholders should expect their $4 Fannie Mae stock to be trading at $40 in a few years. For Fannie and Freddie shares to get to Ackman’s target of $23 to $47, a series of favorable events need to take place first.

In fact, until the net worth sweep is overturned in court, Fannie and Freddie shares aren’t worth the paper they’re printed on.

One thing seems certain: the potential for large returns on these stocks exists, but for now shareholders are left with nothing more than hope.

Warren Buffett just bought nearly 9 million shares of this company

Imagine a company that rents a very specific and valuable piece of machinery for $41,000 per hour (That’s almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company’s can’t-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report details this company that already has over 50% market share. Just click HERE to discover more about this industry-leading stock. and join Buffett in his quest for a veritable landslide of profits!