There s A Lot Of Value In The Information Technology Sector The S&P 500 2015 Part 3

Post on: 20 Август, 2015 No Comment

Summary

- The Information Technology sector is the largest industry component of the S&P 500 comprising almost 20% of the entire index.

- When you stop and think about it, it was not that long ago when technology companies operated in a niche industry.

- Currently, there’s a lot of technology buzz discussing what many are referring to as the Internet of Things (IoT).

- There is a lot of fairly valued opportunities in the Technology Sector component of the S&P 500.

Introduction

This series of articles is offered as a sector by sector valuation perspective on the S&P 500 as calendar year 2015 begins. In Part 1 found here I presented a valuation overview of the S&P 500. In Part 2 I reviewed the Energy Sector component of the index. In this, Part 3, I will review the Information Technology Sector, which is the largest industry component of the S&P 500 comprising almost 20% of the entire index.

Information Technology: Calling This a Growth Industry is a Gross Understatement

When you stop and think about it, it was not that long ago when technology companies operated in a niche industry. As I was researching this article, I found an interesting report on the history of technology from The Wall Street Journal Classroom Edition that covered the Communications technology industry from circa 1920 to 1995, here is a link t o that report.

Clearly, the growth in technology from the beginning of this century to 1995 was extraordinary. But, as extraordinary as that growth was, it was nothing compared to what happened in technology from 1990 to 2013. Here’s a link to a report from the website Preceden.com that covers this more recent time frame. Remarkably, technological advances continue to expand at what can only be described as at exponential rates.

Currently there’s a lot of technology buzz discussing what many are referring to as the Internet of Things ((NYSEMKT:IOT )). For example, Trends Magazine published an article on October 11, 2014 titled: The Internet of Things Begins to Take Shape. What follows are a few excerpts from the article that forecast what the future growth of technology might look like and entail:

Today, people connect to the Internet by using dedicated devices like laptops and smartphones. But what happens when virtually every thing is an Internet device? The result will be the Internet of Things-a vast, invisible, global network in which nearly every product and physical object, including toasters, trees, milk cartons, mall parking spaces, cars, roads, wristwatches, and medical equipment will be tagged with sensors that will gather and transmit data about people’s consumption, usage patterns, location, and more.Consider that, in the 1990s, 1 billion people connected to the Internet with desktop computers and laptops. Then, in the first decade of the 21st century, 2 billion more people connected to the Internet with mobile phones. Now consider this. By 2015, according to Cisco Systems, 25 billion things will be connected to the Internet, and to each other-and five years after that, in 2020, the number will double to 50 billion.

The article offered several reasons why they believe that the Internet of Things is primed to explode now:

1. Cheap sensors- Sensor prices have dropped more than 100 percent over the past decade, to an average of 60 cents.

2. Cheap bandwidth- The cost of bandwidth has declined by a factor of nearly 40 times over the past 10 years.

3. Cheap processing- Processing costs have declined by nearly 60 times over the past 10 years.

4. Ubiquitous wireless coverage- With Wi-Fi coverage now ubiquitous, wireless connectivity is available for free or at a very low cost.

5. Big data- As the IoT will, by definition, generate voluminous amounts of unstructured data, the availability of big data analytics is a key enabler.

6.IPv6- Most networking equipment now supports IPv6, the newest version of the Internet Protocol standard that is replacing IPv4. IPv4 supports 32-bit addresses, which translates to about 4.3 billion addresses-a number that has become largely exhausted by all the connected devices globally. In contrast, IPv6 can support 128-bit addresses, translating to approximately 3.4 x 10 38 addresses-an almost limitless number that can handle all conceivable IoT devices.

Frankly, I believe that it’s truly impossible to accurately predict what future technological advances might actually manifest, and how much growth that might bring about. When people have tried to forecast technological advances in the past, they have usually missed the mark by a wide margin. The problem with forecasting technological advancements comes from what we don’t already know, not from what we do already know. In other words, the technology sector has continuously surprised and amazed us with things that prior to being invented, we often could not even imagine. Consequently, the only thing that I feel comfortable saying with any degree of certainty about technology is that it will continue to advance and grow.

Furthermore, I am confident that much of the future growth in technology is likely to come from technology companies that do not even yet exist today. On the other hand, I am also confident that many of today’s prime players in technology are likely to participate. Therefore, since I cannot write about companies that don’t exist yet, this article will look at today’s leading technology companies that currently are constituents of the S&P 500.

Most, but not all, of the S&P 500 technology constituents are already large and formidable enterprises. Therefore, although I expect many of them to continue to be participants in future technological growth, their current size precludes that growth from being as fast as it once was for most of them. On the other hand, their large size is also an advantage because of the enormous financial resources that many of them possess.

Information Technology: There’s a Lot of Value in the Information Technology Sector

Perhaps the most enticing aspect of today’s Technology Sector S&P 500 constituents is the current valuation of many of the leading companies. As the title of this article indicates, I believe there’s a lot of value in this sector. In contrast to the overall index, which I consider fully valued, and indicated so in Part 1 of this series, I see a lot of attractive valuations in some of the best of breed S&P 500 technology company constituents.

It’s important to emphasize that fair valuation is not specifically a short-term market timing concept. The stock market is capable of mis-appraising a business over longer periods of time than we would like. Consequently, I believe the true value of investing in common stocks when they are fairly valued or undervalued is risk assessment and control. In the long run, investing at attractive valuation will enhance returns while simultaneously doing so at a lower level of true risk.

Furthermore, I think it’s important to recognize that many of the leading companies in this sector have morphed from pure growth stocks into blue-chip dividend growth stocks. Once fast-growing technology companies such as Cisco Systems (NASDAQ:CSCO ), Apple Computer (NASDAQ:AAPL ), Microsoft (NASDAQ:MSFT ), Intel (NASDAQ:INTC ), Texas Instruments (NASDAQ:TXN ), QUALCOMM (NASDAQ:QCOM ) and many others, have recently become moderately growing dividend growth stocks with above-market current yields. As a result, I believe the Information Technology sector today offers the retired investor several high-quality dividend growth options that can be invested in at reasonable levels of risk.

Therefore, as the nature of these technology companies have changed, I believe that the way we think about them should also change. Although as I have indicated above, the Information Technology Sector today still offers significant growth potential, many of its blue-chip constituents now also offer above-average dividend growth as well.

Consequently, I have organized the following F.A.S.T. Graphs Portfolio Review on the 65 S&P 500 Technology Sector constituents by expected earnings growth and cap-size. For the convenience of the reader, I have highlighted those constituents that I believe they are currently attractively valued. As an aside, one of my underlying objectives for presenting this series on the 10 major S&P 500 sectors is to illustrate the vast differences that exist between one individual company to the next.

As regular readers of mine know, I believe that it is a market of stocks and not a stock market. Therefore, even though the S&P 500 is considered one of the best proxies of the overall market, it is nevertheless comprised of many unique individual companies. And these differences are also seen among each of the individual companies found within the same sector.

In order to accentuate the differences found with individual companies, I will as usual turn to the Fundamentals Analyzer Software Tool, F.A.S.T. Graphs. and feature a few examples from each subset of expected earnings growth and cap-size.

However, for the first time ever, I will offer a sneak preview of our soon-to-be-launched (late January or early February) new and improved version of our historical earnings and price correlated graphing tool. This new version of F.A.S.T. Graphs includes significant improvements of functionality and calculating capability that significantly enhances the user’s analytical capacity. Therefore, I hope the reader discovers that the important distinctions that I’m attempting to make with each individual company, is presented more effectively and efficiently.

Large Cap (Over 5 Billion) Under 10% Estimated Earnings Growth

The large cap under 10% estimated earnings growth segment contains several of the most widely-recognized blue-chip technology sector stalwarts. I will feature two examples that I consider interesting from the perspective of fair valuation and above-average current yield’s appeal. I will also include a third example as a turnaround opportunity with intriguing capital appreciation potential over the short to intermediate term.

Cisco Systems Inc

Cisco Systems Inc was featured in an article titled Top Technology Predictions for 2015 by John Mark Ivey. Based on that article it appears that Cisco is well-positioned to participate in technologies’ future growth. Below is a short excerpt:

With each passing year, it seems technology advances get faster and faster and grow in number. When was the last year that technology didn’t seem to take a huge leap forward? 2014 was no different, and 2015 is shaping up to be chock-full of advances on many existing technology fronts as well. We asked our subject matter experts, long-time instructors and learning architects which technological advances they think will be in store for us in 2015.

So what will drive the future? he asked. For Cisco, it will be the realization of the Internet of Things. Finally we will move from slick marketing copy to actual exobytes; 2015 will be the year of change, Watkins continued. What will drive this? The convergence of both industry and consumer connected technology generating more than 1,000 exabytes of IP traffic across 15 billion (yep, that was a ‘b’) connected devices — from your mobile phone, to your pad device, to your wearable tech like the T-shirt Ralph Lauren introduced at the 2014 U.S. Open.

The year ahead will see consumers and industry alike pushing more data across the Internet than ever before from an ever-increasing myriad devices. As they do, Cisco will be there to provide the underlying infrastructure and InterCloud connectivity to make sure each bit and byte translate into usable data to drive ever more sophisticated analysis and decision-making for businesses and consumers alike, Watkins concluded.

I consider Cisco fairly valued today at a blended P/E ratio of 13.3 and an above-average current dividend yield of 2.7%. The company has been paying a dividend since 2011 and has increased it every year. Therefore, it appears that Cisco is entering the status of a blue-chip dividend growth stock.

On the Earnings and Price Correlated graph below I utilized its calculator function to calculate Cisco’s Total Annualized Rate of Return since September 30, 2010 when the company was trading at a similar 13.6 P/E ratio. See the report circled in red on the graph.

Looking to the future, 42 analysts reporting to S&P Capital IQ expect moderate earnings growth of 3.88% for fiscal year ending 7/31/2015, and slightly faster growth for fiscal year ending 7/31/2016 of 5.14%. I have presented two what-if scenarios depicting Cisco’s intermediate return potential. The first scenario assumes that Cisco’s P/E ratio expands to a fair value P/E of 15. If that were to occur, investors could achieve a 16.04% total annual rate of return to fiscal year-end 2016. This would be an optimistic but realistic scenario.

My second scenario assumes the same earnings estimates but with Cisco’s P/E ratio remaining in the 13 range. I consider this a conservative valuation scenario. Under this scenario the total annualized rate of return out to fiscal year-end 2016 would be 7.55%.

Seagate Technology Public Limited (NASDAQ:STX )

Seagate Technology has a spotty or somewhat cyclical earnings growth history. The company has only been paying dividends since fiscal year 2011, but has grown the dividend aggressively since it was first initiated. The stock appears very undervalued in spite of its cyclicality and offers an above-average current dividend yield of 3.4%.

Below is a short business description courtesy of S&P Capital IQ:

Seagate Technology Public Limited Company designs, manufactures, and sells electronic data storage products in the Asia Pacific, the Americas, and EMEA countries. The company provides hard disk drives, solid state hybrid drives, and solid state drives that are designed for enterprise servers and storage systems in mission critical and nearline applications; for client compute applications comprising desktop and mobile computing; and for client non-compute applications, such as digital video recorders, personal data backup systems, portable external storage systems, and digital media systems.

It also offers data storage services, including online backup, data protection, and recovery solutions for small and medium-sized businesses. In addition, the company ships external backup storage solutions under its Backup Plus and Expansion product lines, as well as under the Samsung and LaCie brand names; Wireless Plus wireless drives; and network attached storage solutions under its Central, NAS, NAS Pro, and Rackmount NAS product lines. It sells its products primarily to OEMs, distributors, and retailers. The company was founded in 1979 and is headquartered in Dublin, Ireland.

If Seagate Technology were to grow as expected, and if the company were to trade at a fair value P/E of 15, the future total annualized rate of return to fiscal year ending 6/30/2016 would be 25.52%.

On the other hand, the reader should recognize that Seagate Technology has only commanded a normal P/E ratio of 9 over the last 11 fiscal years. If the company were to maintain that low P/E valuation in the future, the total annualized rate of return would be -10.55%. I present these scenarios to alert the readers that basing investment decisions on simple statistics can be dangerous.

Hewlett-Packard Company (NYSE:HPQ )

I offer Hewlett-Packard as an example of the opportunity that a turnaround situation can offer. In recent years the company has suffered with negative earnings growth and stock price reacted strongly. However, it is clear that the initial price drop was an overreaction. When a situation like this occurs, the short to intermediate return potential can be extraordinary, as depicted below. I calculated Hewlett-Packard’s rate of return after the price had fallen significantly, but I did not calculate from the exact bottom. Since 5/31/2012 Hewlett-Packard has generated a total annual rate of return of 24.59% for its shareholders.

As earnings growth is expected to continue to improve, albeit at a moderate 5% per annum rate, current undervaluation continues to represent a solid opportunity over this fiscal year and next. Assuming that the company’s P/E ratio only expands to 12.7, Hewlett-Packard offers shareholders the potential for a total annual rate of return of over 20% per annum.

Large Cap (Over 5 Billion) 10%-15% Estimated Earnings Growth

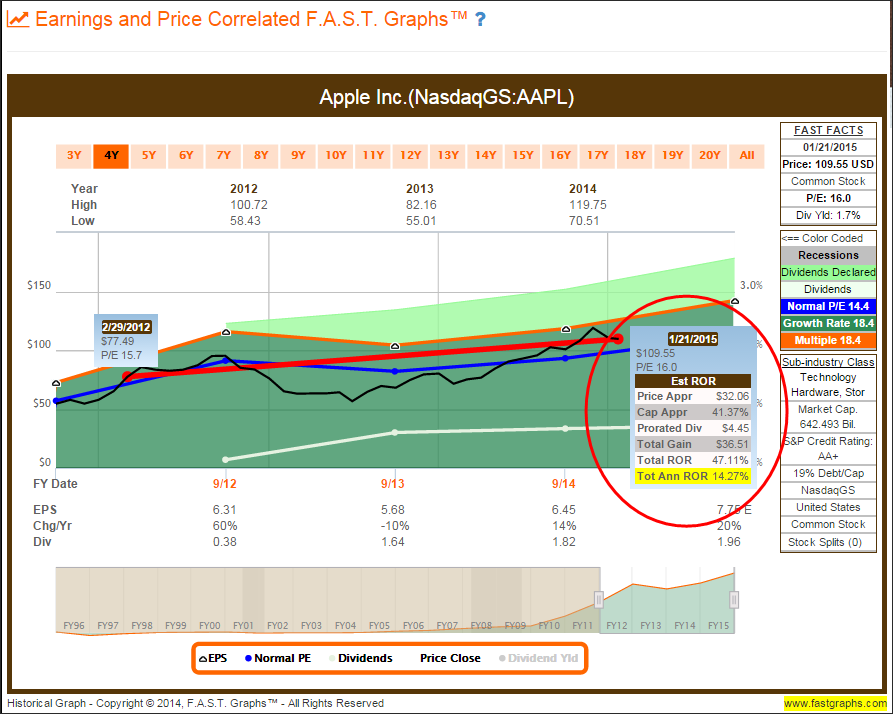

Apple Inc

A discussion about the S&P 500 Information Technology Sector would not be complete without taking a look at Apple Inc. This widely-followed and much written about technology bellwether has recently begun paying a dividend. Due to its enormous size, earnings growth has simultaneously slowed down. In the following earnings and price correlated graph I calculated Apple’s annual rate of return starting when the company was trading at a P/E ratio of 15.7 in April of 2012. Clearly, the company continues to be an exceptional return generator.

The following forecasting calculator shows that 48 analysts reporting to S&P Capital IQ expect fiscal year 2015 earnings growth of 20.16%, followed by an additional 9.68% growth in fiscal 2016. If the company were to achieve this earnings growth rate and only commanded a P/E ratio of 15 at fiscal year-end 2016, the total annual rate of return would be 11.12%.

With my second forecasting scenario with Apple I calculate the future return based on the company trading at its normal P/E ratio of 16.9 over the last 8 fiscal years. Under this scenario, Apple provides the opportunity of generating a total annual rate of return of 19%.

EMC Corporation (NYSE:EMC )

EMC is a high quality technology stalwart that has recently begun offering a dividend. With a blended P/E ratio of 14.5, I consider EMC to be soundly valued.

Below is a short business description courtesy of S&P Capital IQ:

EMC Corporation develops, delivers, and supports information infrastructure and virtual infrastructure technologies, solutions, and services. It operates in three segments: Information Storage, Information Intelligence Group, and RSA Information Security.

The company offers enterprise storage systems and software deployed in storage area networks ((NYSE:SAN )), networked attached storage (NAS), unified storage combining NAS and SAN, object storage, and/or direct attached storage environments, as well as provides backup and recovery, disaster recovery, and archiving solutions.

It also offers information security solutions that are engineered to combine agile controls for identity assurance, fraud detection, and data protection, as well as security analytics and GRC capabilities; and expert consulting and advisory services. In addition, the company provides information intelligence software, cloud solutions, and services, including EMC Documentum xCP for building business and case management solutions; EMC Captiva for intelligent enterprise capture; EMC Document Sciences for customer communications management; EMC SourceOne Kazeon for e-discovery; the EMC Documentum platform for creating, managing, and deploying business applications and solutions; and the EMC OnDemand private cloud deployment model for enterprise-class applications.

Further, it offers VMware virtual and cloud infrastructure solutions that enable organizations to aggregate multiple servers, storage infrastructure, and networks together into shared pools of capacity that could be allocated to applications as needed. Additionally, the company provides installation, professional, software and hardware maintenance, and training services. EMC Corporation markets its products through various distribution channels, as well as directly in North America, Latin America, Europe, the Middle East, South Africa, and the Asia Pacific region. The company was founded in 1979 and is headquartered in Hopkinton, Massachusetts.

On the earnings and price correlated graph below I have calculated EMC’s total annual rate of return since 3/31/2009 when the company was trading at a similar P/E ratio to its current value. However, as we will soon see, future growth is expected to be a little lower but still double-digits.

Based on the consensus of more than 40 analysts reporting to S&P Capital IQ growth for fiscal 2015 is forecast at 12.11%. If EMC were to trade at a fair value P/E of 15, this would indicate a total annualized rate of return in excess of 18%.

Qualcomm Inc

Qualcomm has been a steady grower and has paid and increased its dividend since 2003. Expectations for a flat to slightly down fiscal 2015 have brought the stock into attractive fair valuation territory.

Below is a short business description courtesy of S&P Capital IQ:

QUALCOMM Incorporated designs, develops, manufactures, and markets digital communications products and services in China, South Korea, Taiwan, and the United States. The company operates through three segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI).

The QCT segment develops and supplies integrated circuits and system software based on code division multiple access (OTCPK:CDMA ), orthogonal frequency division multiple access (OFDMA), and other technologies for use in voice and data communications, networking, application processing, multimedia, and global positioning system products.

The QTL segment grants licenses or rights to use portions of its intellectual property portfolio, which includes patent rights useful in the manufacture and sale of various wireless products, such as products implementing CDMA2000, WCDMA, CDMA TDD, GSM/GPRS/EDGE, and/or OFDMA standards, as well as their derivatives.

The QSI segment invests in early-stage companies that support the design and introduction of new products and services, as well as holds a wireless spectrum license. The company also plans to license its next generation IMOD display technology and to focus on wearable devices; and develops and licenses display technologies based on micro-electro-mechanical-systems structure for portable multimedia devices, as well as develops and supplies 3G/LTE and Wi-Fi products designed for implementation of small mobile base stations.

In addition, it provides software, content, and push-to-talk enablement services to wireless operators; development, and other services and related products to government agencies and their contractors; device-to-device communication, including software for the connected home; data center products; medical device connectivity and related data management services; and augmented reality system. QUALCOMM Incorporated was founded in 1985 and is headquartered in San Diego, California.

The consensus of 37 analysts reporting to S&P Capital IQ, expect fiscal 2016 earnings to grow at 9.83%. If we apply a normal fair value P/E of 15 to fiscal 2015 ending 9/30, it would calculate to a total annual rate of return of 15.35%.

Large Cap (Over 5 Billion) !5%- 20% Estimated Earnings Growth

Google Inc (NASDAQ:GOOG ) (NASDAQ:GOOGL )

I featured Google from this section because it represents an example of what a technology growth stock has customarily been thought of. The company does not pay a dividend and has achieved double digit earnings growth since 2009. However, as the company gets bigger, their earnings growth has slowed.

Even though the consensus of 46 analysts reporting to S&P Capital IQ continue to expect double digit earnings growth over the next several years, Google appears to be fully valued today. Consequently, if the market were to apply a P/E ratio equal to the company’s growth rate on fiscal year 2016, this would only equate to a 8% annual rate of return.

MasterCard Inc (NYSE:MA )

MasterCard has been a great performer since going public in 2006. On the earnings and price correlated graph below I have calculated performance since 4/30/2007 when MasterCard’s P/E ratio was similar to its current P/E. This company has produced exceptional long-term returns for its shareholders.

Although MasterCard appears fully valued to moderately overvalued currently, expected future double digit earnings growth indicates double digit return of 10.67% by fiscal year-end 12/31/2016. However, this calculation assumes a normal 9-year P/E ratio of 23.5.

In this next scenario I calculate MasterCard’s return based on the company’s stock price reverting to a more justified P/E ratio of 18.6. This scenario is offered simply to illustrate that there is a degree of risk associated with investing in this fast-growing company.

Facebook Inc (NASDAQ:FB )

I did not feel right about covering the Information Technology Sector of the S&P 500 without looking at Facebook. I believe this represents a quick essential example of the unbelievable potential of technology as a sector. Even though the company has only been public since May of 2012, it has already achieved a market cap in excess of $200 billion dollars. However, the reader should note the extremely high P/E ratio that the company trades at and has historically commanded.

The consensus of leading analysts following Facebook expects the company to continue growing at high rates over the next couple of years. However, the company is not expected to grow as fast in the future as it has in the past. Consequently, future returns associated with investing in this company could disappoint if the market valued it more in line with its growth rate.

On the other hand, if the market were continue to value Facebook at its historical normal P/E, future returns could still be extraordinary — caveat emptor.

First Solar Inc (NASDAQ:FSLR )

With my final example, I thought it would be interesting to look at First Solar Inc, especially since my last article covered the energy sector. A quick examination of its historical earnings and price correlated graph illustrates how the market can be enamored with an idea. Many investors look to solar and other alternative energy sources to eventually replace oil and gas. However, the earnings record of this company since 2009 have brought stock price and valuation in alignment with reality. Solar might be an interesting and important future technology, but the industry continues to face headwinds. Low oil and gas prices could potentially mute intermediate future growth.

Below is a short business description courtesy of S&P Capital IQ:

First Solar, Inc. provides solar energy solutions worldwide. The company operates through two segments, Components and Systems.

The Components segment designs, manufactures, and sells solar modules, such as CdTe modules that convert sunlight into electricity for project developers, system integrators, and operators of photovoltaic (PV) solar power systems.

The Systems segment provides turn-key PV solar power systems or solar solutions, such as project development; engineering, procurement, and construction; operating and maintenance; and project finance services to investor owned utilities, independent power developers and producers, commercial and industrial companies, and PV solar power system owners.

The company was formerly known as First Solar Holdings, Inc. and changed its name to First Solar, Inc. in 2006. First Solar, Inc. was founded in 1999 and is headquartered in Tempe, Arizona.

The following forecasting calculators calculate performance based on an earnings recovery in fiscal 2015, followed by a potential drop in earnings for fiscal years 2016 and 2017. Simply stated, this is still an industry and a company trying to find its footing.

Summary and Conclusions

I believe the information technology segment of the S&P 500 offers several fairly valued investment opportunities in spite of the fully valued nature of the index overall. Moreover, I believe this segment offers investment opportunities that span the entire universe of investment options. Within this segment opportunities are available for those investors desirous of growth, growth and income and above-average current yield.

In the past the technology sector was associated almost solely with growth. However, as technology has become such a large and important part of our lives and economy, the industry and many of its most widely-recognized companies within the industry have grown and matured. Although it is still relatively early, many technology stocks are approaching the status of blue-chip dividend growth stocks.

In Part 4 of this series I will take a look at the valuation of the Financial Sector, the second largest segment of the S&P 500.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure: The author is long AAPL, ACN, ADP, CSCO, CTSH, GOOGL, HPQ, IBM, INTC, MA, MCHP, MSFT, ORCL, PAYX, QCOM, V. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.