There are some bargains in closedend mutual funds

Post on: 27 Март, 2015 No Comment

By John Waggoner, USA TODAY

You can find the best bargains in small, out-of-the-way markets.

Closed-end mutual funds, a $228 billion backwater of the $11 trillion fund industry, are one place in the stock market where you can find honest-to-goodness bargains and, if you’re an income investor, some nice dividend payouts as well.

A closed-end fund is a relic of the early days of mutual funds. Like traditional funds, properly called open-end funds, closed-end funds invest in a portfolio of securities, such as stocks or bonds. But that’s where the similarities end.

When you buy or sell an open-end fund, you do so through the fund company. Open-end funds issue shares continuously as investors move in and out. Closed-end funds, however, issue a set number of shares that trade on the stock exchanges.

The advantage of an open-end fund is that the share price mirrors the value of the fund’s holdings, minus expenses.

Peculiarly, however, the share price of a closed-end fund rarely reflects the value of its holdings with any great accuracy which means that you sometimes pick up a real bargain.

Consider Liberty All-Star Equity fund, which trades under the ticker USA. The fund’s holdings were worth $5.18 per share Wednesday, according to www.closed-endfunds.com. which tracks the funds. Shares of the fund, however, sold for $4.31, or a 16.8% discount, in closed-end parlance.

If the fund were liquidated tomorrow, in theory, shareholders would pocket an instant gain of 87 cents a share. In reality, shareholders would get somewhat less, because the fund would have to sell its holdings at fire-sale prices.

On the other end of the spectrum is Pimco Global StocksPlus & Income fund (PGP). Its holdings were worth $11.47 a share on Wednesday, yet shares closed at $18.44 a 60.8% premium. Except in rare cases when a closed-end fund is the only way to enter a foreign market, you should never pay a premium on a closed-end fund in fact, you should sell your closed-end fund if it rises to a premium.

Why? Funds that sell for a premium rarely live up to expectations. For example, five years ago, 162 closed-end funds sold for premiums. Average gain those five years: 12.4%, according to Lipper, which tracks the funds. Another 345 funds sold for a discount that year. They gained an average 20.9%.

Why do some funds sell for discounts, and others for premiums? One theory: Investors know that it’s highly unlikely that any fund will be liquidated. Rather than pricing the fund’s current value, they try to judge its future value.

Another reason: People are not always logical when they bid for stocks, as you may have noticed in the past few years. As a result, they push stocks down or up too far, depending on the market’s current mood. Sometimes that can create splendid opportunities as it did five years ago, for those who bought the Latin America fund at a 14% discount. The fund has jumped 208% since.

Sometimes, funds that sell at chronically steep discounts attract activist investors who push the fund to convert to an open-end fund or to take other steps to reduce the discount, such as making a tender offer for fund shares. Claymore Dividend & Income fund (DCS). for example, bought back 45% of its own shares last year, cutting its discount to about 16% from about 30%.

A discount is no guarantee of long-term gains. A few funds seem to sell at chronically large discounts. Any of these funds have holdings that are hard to value, making them unlikely candidates for activists, says Cecilia Gondor, executive vice president of Thomas J. Herzfeld Advisors, a Miami-based brokerage that specializes in closed-end funds.

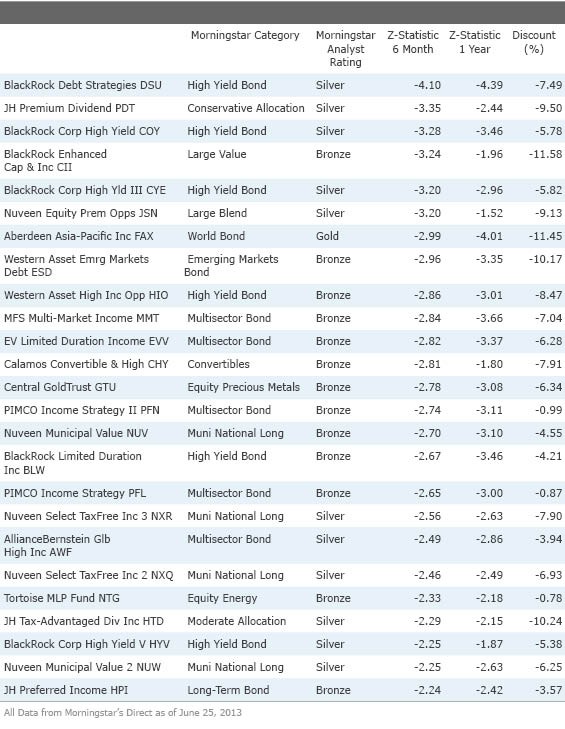

Currently, discounts are fairly narrow: 3.62% for all closed-end funds, vs. 12.7% at the end of 2008 and an astonishing 26.4% in September 2008, Gondor says. But there are still some bargains out there.

For the particularly brave, a number of real estate funds trade at steep discounts. Cohen & Steers REIT & Utility Income (RTU), for example, sells at a 16.7% discount and has a 3.81% yield.

Those who want to bet on a turnaround on the banking industry might consider John Hancock Bank and Thrift Opportunity (BTO). now selling at a 17.5% discount.

Two words of warning:

Some closed-end bond funds boost their returns by borrowing low-cost funds and reinvesting in higher-yielding bonds, a technique called using leverage. This has been a spectacularly good strategy the past five years. If interest rates start to rise, however, these funds will lag other bond funds.

Avoid newly issued bond funds. They almost invariably fall to a discount six months after you buy them. If you’re really intrigued by a new closed-end fund, revisit it in half a year.

In this era of eBay, it’s hard to find real bargains. But many closed-end funds give you the honest opportunity to buy $1 of assets for 80 cents or less and that’s not something you see every day.