The Ultimate Retirement ETFs for Conservative Investors

Post on: 10 Май, 2015 No Comment

By John Whitefoot | Yahoo Small Business

Ultimate Retirement ETFs for Conservative Investors Do you want to save more or less by the time you reach 65? It might seem like a question with an obvious answer, but

Back in the 1950s and 1960s, Americans on the cusp of retirement had their defined pension plans to look forward to and didnt really worry too much about saving for retirementor running out of money. All of that changed in the 1980s, when many companies rolled their retirement plans over to 401(k) accounts. That one simple act meant a workers retirement savings now fluctuated with the ebb and flow of the stock market.

While its important to invest in your 401(k), its also important to know what your moneys being invested in and where its going. Unfortunately, most of us dont. A recent study that looked at American investing knowledge found theres a large gap between what we think we know and what we really know.

The study found that nine out of 10 Americans (92.6%) dramatically underestimated the total 401(k) fees the average household will pay over the course of a lifetime. When asked how much the average American household with two working adults will pay in 401(k) fees over the course of their lifetime, only 3.3% of respondents answered correctly, at $150,000$200,000. The largest group (38.1%) was the most off the mark, saying it would cost less than $10,000. (Source: The Online Investing Knowledge Gap: 2013 Investment Literacy Survey, NerdWallet. March 18, 2013.)

So if you want to save more money for your retirement, there may be better options out there. If youre looking to take advantage of the stock market, whether its going up or down, and want to save tens of thousands of dollars in fees, exchange-traded funds (ETFs) might be more up your alleyor a great addition to your current retirement portfolio.

ETFs track segments of the market and try to match a benchmark stock or bond indexnot beat it. With one ETF, investors can hold a wide variety of stocks they could not afford to own individually. Unlike mutual funds, ETFs can be traded throughout the day like stocks; mutual funds, on the other hand, are priced only at the close of daily trading.

While the ETF market was hatched just 20 years ago (Index Participation Shares 1989 & Toronto Index Participation Shares 1990), the field has blossomed. At the end of 2012, there were 1,193 ETFs domiciled in the U.S. with total net assets of $1.3 trillion. (Source: Frequently Asked Questions About the U.S. ETF Market, Investment Company Institute web site, last accessed May 22, 2013.)

And that number is only going to grow. By 2016, the number of dollars in ETFs is expected to climb more than 160% to $3.45 trillion in 2016. (Source: ETF assets said to tripleyes, tripleby 2016, InvestmentNews, November 13, 2012, last accessed May 22, 2013.)

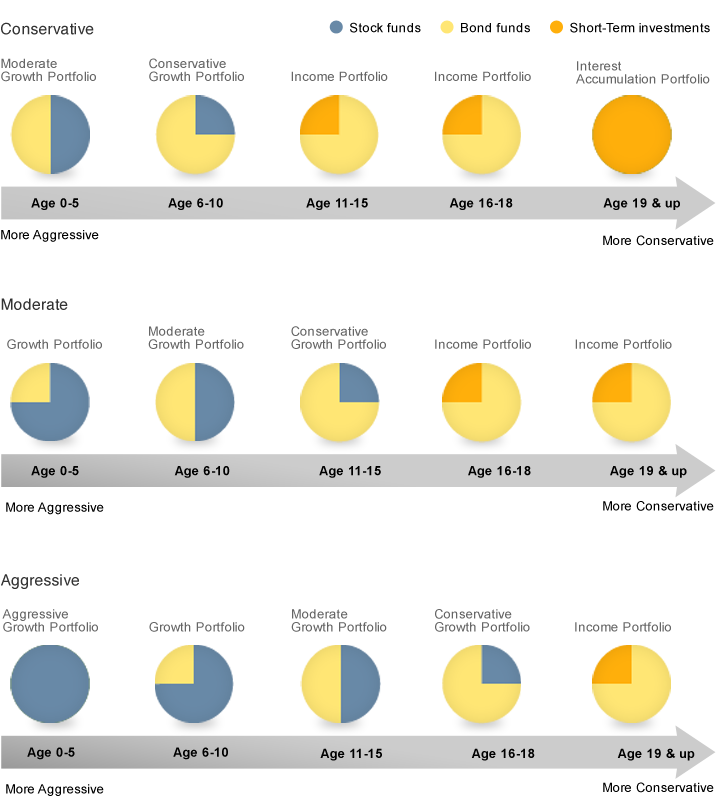

With so many ETFs to choose from, it can be difficult to know where to start. If youre a conservative investor with long-term plans, you might want to consider a target retirement date ETF. The ultimate buy-and-hold strategy, investors select a target retirement date ETF that corresponds to when they expect to retire.

For those nearing retirement, there is the iShares S&P Target Date 2015 (NYSEArca/TZE), which comprises stocks and bonds for investors who are planning to retire around 2015 and tracks the S&P Target Date 2015 Index.

The iShares S&P Target Date 2020 (NYSEArca/TZG) comprises stocks and bonds for investors who are planning to retire around 2020 and follows the price and yield performance of the S&P Target Date 2020 Index.

If you want to consider ETFs to take you well into retirement, there is the iShares S&P Target Date 2035 (NYSEArca/TZO), iShares S&P Target Date 2045 (NYSEArca/TZW), and iShares S&P Target Date 2050 (NYSEArca/TZY).

Just like the broader stock market, there are ETFs to suit every investment strategy and risk level. When it comes to fees, its also a good idea to understand how your ETFs operate. Since ETFs trade like stocks, there is a commission each time you buy or sell, but because target retirement date ETFs are for long-term buy-and-hold investors, the fees should be very minimalat least a very far cry from the $150,000$200,000 you might pay for some investment vehicles.