The Ultimate DeflationFighting ETF

Post on: 17 Июнь, 2015 No Comment

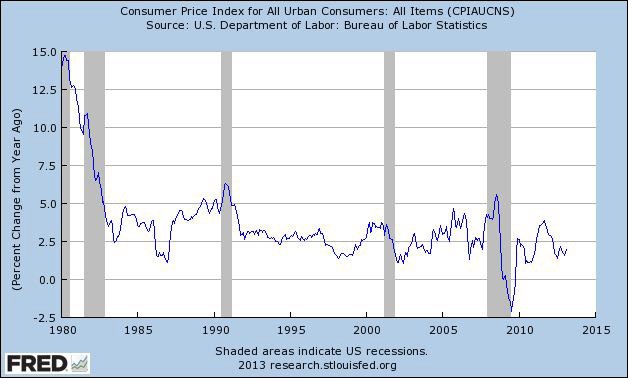

It doesnt seem like all that long ago that investors around the world were bracing for the fallout from massive stimulus plans implemented to lift the global economy out of a recession. The consensus opinion was that the increase in global money supply stemming from billion dollar capital injections would put firm upward pressure on prices, causing inflation to test the high end of central bank comfort zonesand perhaps even climb above 10% in parts of the developed world. Some well-known hedge funds started making bets on a hyperinflationary environment, while smaller investors flocked towards assets they believed would hold value if CPI spiked. For most, that asset class was inflation-protected bondsfixed income securities that see the face value adjusted as CPI increases. Cash inflows into the Barclays TIPS Bond Fund (TIP ) approached $9 billion for all of 2009, as the ultra-popular fund doubled in size.

What a difference a few months makes. Fast forward to the fourth quarter of 2010, and the primary concern on the minds of many investors isnt inflation, but deflation. Prices arent spiraling out of control, but rather are in danger of reversing course and heading lower. And while that might seem like good news for consumerslower prices for food and gas certainly seems attractiveperiods of deflation can be devastating from a higher level economic perspective. When prices are falling consumers have a tendency to delay purchases, as the passage of time only makes goods and services more affordable. Moreover, because wages tend to be significantly more sticky than commodity costs, deflation can eat into profit margins of all types of companies. Thats why Fed chairman Ben Bernanke recently indicated that he was uncomfortable with the current level of inflation, and willing to intervene if prices show more serious signs of sliding [see also Worried About Fixed Income Bubbles? Try A Dividend ETF ].

Deflation is both a rare and complicated economic phenomenon. While investors have lists of tried and true asset classes that perform well when inflation is at the high end of of the Feds comfort zone (such as gold ), it is more challenging to identify securities that will hold up if inflation slides into negative territory. At the risk of sounding boring, cash is a sound investment option in deflationary environments; as prices fall, the buying power of a pile of cash rises, thereby growing real value. Similarly, fixed income investments have obvious appeal, as the real economic value of a stream of cash inflows rises with each decline in prices. The longer the term of the fixed income security, the more appealing it becomes in a deflationary environment. (Though some investors also like dividend-paying stocks, deflationary environments can wreak havoc on equity markets, and the presence of a reliable cash payment may not be enough to offset the damage done across equity markets).

There is no shortage of long-term bond ETFs available to investors concerned about the prospect of deflation, including products focusing on Treasuries (TLT ), investment grade corporates (VCLT ), and even munis (MLN ). For those investors looking to buy some insurance against falling prices without shifting all of their holdings into fixed income, there is another interesting option out there that may be a valuable tool to have in the anti-deflation toolkit. PowerShares and Deutsche Bank recently teamed up to offer the 3x Long 25+ Year Treasury Bond ETN (LBND ), an exchange-traded note linked to the performance of a benchmark comprised of Ultra T-Bond Futures. If long-term bond exposure is good, leveraged exposure to the same asset class can be even better [see also Why An ETF Can’t Collapse ].

Under The Hood

LBND offers investors leveraged exposure to long-term bonds, seeking to deliver monthly results that correspond to three times the change in the Deutsche Bank Long U.S. Treasury Bond Futures Index. Because that index is comprised of futures contracts whose underlying assets are Treasuries with a time to maturity of no less than 25 years, the unleveraged index maintains a fairly long duration. But leveraging up that exposure gives investors a way to either bet on a rally in long-term bonds (which usually accompanies general economic uncertainty) or hedge against a deflationary environment.

Its important to note that the leverage offered by LBND isnt quite the same type associated with many of the products issued by ProShares and Direxion. LBND resets leverage on a monthly basis, while most leveraged ETFs reset daily. Thats an important distinction that can change the way investors monitor and have a major impact of the bottom line returns, especially over an extended period of time. Assume that at the beginning of the month LBND was trading at $25. If the underlying index (in this case the Deutsche Bank Long U.S. Treasury Bond Futures Index (300%) ) added 5% during the month, LBND would gain 15%, or $3.75, even if the related benchmark exhibited significant volatility. So unlike daily leveraged ETFs, it is possible to predict the performance of monthly leveraged products over multiple trading sessions if the change in the underlying index is known [see also Five Facts Every Investor Should Know About Leveraged ETFs ].

Monthly leveraged products are still subject to return erosion or amplification related to compounding, but because rebalancing occurs only 12 times per yearinstead of 250 or sothe impact is muted. So if the underlying index gained 5% over the course of a year, LBND wouldnt necessarily be up 15%; returns could be more or less (and even negative), depending on the volatility of the underlying index during the period in question.

No Slam Dunk

LBND is, of course, not risk-free. The returns to LBND are computed by adding 3x the return on the Deutsche Bank Long U.S. Treasury Bond Futures Index with the return on a short-term T-Bill index, meaning that this ETN can be subject to some pretty big price swings over a relatively short period of time. While deflation is certainly a possibility given the current macroeconomic factors, it certainly isnt inevitable. Some investors worry that a bubble has formed under bond markets, asserting that investors are naive in their assessment of the credit risk associated with obligations of the U.S. government. “The bond market is the mother of all bubbles right now and I think when it bursts the losses will dwarf the combined losses of the stock market bubble and the real estate bubble,” said Peter Schiff recently. “This decade will be the worst decade for bonds in U.S. history.” [see Seven ETFs Peter Schiff Might Not Hate ]

Moreover, while inflation readings appear tame at present, there is a case to be made that all the additional liquidity now sloshing around in global financial markets will eventually lead to rising inflation. Because one of the primary tools used to combat inflation is a hike in interest rates, that scenario could deal a blow to investors in long-term bonds. And because LBND offers leveraged exposure to an index that already maintains a duration in the neighborhood of 20 years, the interest rate risk certainly cant be overlooked. If Bernanke & Co. begin a rate hike campaign, LBND would likely be among the hardest hit (the bear counterpart to this ETN, SBND. would be an appealing investment in that environment) [see also PIMCO Launches Two New Bond ETFs (BABZ, CORP) ].

Given the volatility associated with any leveraged productdaily or monthlymaking a huge allocation to LBND likely isnt appropriate for many investors out there. But this product can perhaps be thought of in the same light as many view the iPath Short-Term Volatility ETN (VXX): portfolio insurance against an unlikely but potentially devastating economic development. Because LBND offers 3x leverage, it doesnt take a huge position to establish a safeguard. Moreover, because the assets underlying LBNDs index (i.e. long-term bonds) can be expected to generate a positive long-term return, there isnt necessarily a premium paid for the protection (unlike VXX, which generally faces stiff headwinds from contangoed VIX futures markets).

Disclosure: Photo courtesy of Daniel Schwen. No positions at time of writing.