The Truth About Corporate Tax Rates US News

Post on: 16 Март, 2015 No Comment

The tax structure needs to be repaired to eliminate bad incentives that threaten our economy.

David Brodwin is a cofounder and board member of American Sustainable Business Council.

A furious debate rages between those wanting to cut taxes on U.S. corporations and those hoping to raise them. The two sides come armed with opposing and contradictory facts. Some claim U.S. corporate taxes rank highest in the developed world. Others argue the opposite. When we cut through the rhetoric, a clear but complex answer emerges: Corporate taxes should be increased for most companies—and decreased for a few. The tax structure needs to be repaired to eliminate bad incentives that threaten our economy.

Those urging lower taxes are right to argue that our economy stagnates if taxes are too high. High taxes discourage investment and risk-taking. But how high is too high? Many economists agree that when tax rates soar above 70 percent, growth suffers. Cutting taxes at this level definitely stimulates growth. However, these same economists also agree that when tax rates dip below 30 percent, further cuts don’t boost the economy. Entrepreneurs and investors simply don’t respond to an additional incentive. They are already as strongly incented as they can possibly be.

American history supports these economists’ conclusions. The economy took off dramatically in the 1960s when top marginal rates were slashed from the 90 percent level. But when taxes were cut sharply from relatively modest levels early in President George W. Bush’s term, no growth resulted.

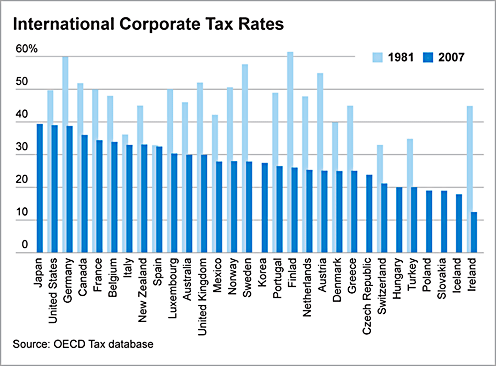

The real issue lies in understanding the huge gap between the nominal rate (the list price) and the real rate (the tax rate that most companies actually pay.) These two rates diverge widely. The nominal federal tax rate on the largest corporations is now 35 percent. State taxes, on average, bump this to 39.2 percent. This nominal rate ranks as the highest among developed countries.

[Read the U.S. News debate: Is Obama’s Corporate Tax Plan A Good Idea? ]

However, no major company really pays the nominal rate—just as no one walks into a car dealership expecting to pay sticker price. Big companies enjoy a huge buffet of credits, shelters, deductions, and other preferences that reduce their rate to an average of 13 percent. Many profitable companies pay no federal income tax at all. Regardless of our nominal rate, our real corporate tax rate is among the lowest. Further cuts cannot stimulate growth.

Moreover, cutting corporate tax rates would create two new problems. First, further reductions in federal budgets would directly undermine America’s competitiveness. (After 20-plus years of tax cuts, there’s little fat left to excise.) For example, federal belt-tightening has led states to slash support for higher education. College tuition has skyrocketed, far outpacing family income. Today’s college students struggle to get the education they need to hold well-paying technical jobs, and many must take on massive debt to pay their tuition.

The second problem: The corporate income tax does not affect all businesses equally. Large corporations pay much lower tax rates than small businesses, because they can exploit loopholes and establish offshore operations. However, small businesses provide more new private sector jobs, and function as the main employers in many parts of the country. Further, the tax code shields old industries at the expense of new more innovative sectors, and it protects industries that burden the rest of society. Why should we subsidize oil rather than renewable energy? Why should we subsidize corn syrup that promotes obesity and drives up healthcare costs?

The problem with the corporate tax code is not what many think. Frankly, we can change the nominal tax rate to practically anything. It doesn’t matter since hardly any corporations pay the nominal rate. What matters is this: Bring up the real tax rate (what companies actually pay) to support needed investments in productivity and competitiveness. Stop penalizing small business. And, end the gimmicks and loopholes that encourage investment in damaging business practices and obsolete industries.