The TReport High Yield ETF Dividends – What and Why

Post on: 23 Июнь, 2015 No Comment

As we wait for the S&P to open and continue its relentless march to new highs (as opposed to closing highs) it is worth taking a look at what has been going on with fixed income ETF dividends. There are two important reasons for this

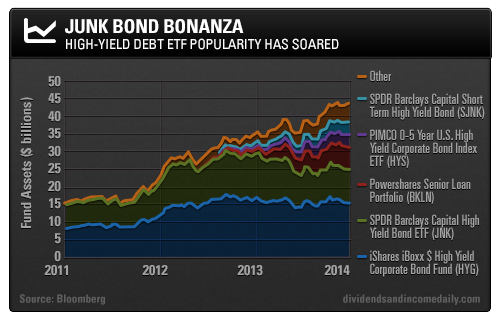

- With more dealers trading these ETFs in block sizes (please contact me for more on this) these trades arent just for retail but can be interesting on a larger scale

For the past 3 months, buying HYG just before the dividend and selling just after the dividend has been a profitable strategy. In fact, if you buy a couple of days before it is better as more investors seem to be buying ahead of the dividend.

These arent qualified dividends so there is no tax advantage, and the dividends have been close to $0.50 so a small profit, but in a world where monthly income is 50 cents, making an extra 20 cents in a couple of days seems interesting.

So a very similar pattern occurs in JNK where the dividend is just over 20 cents.

What I find even more interesting is how it has worked in BKLN.

BKLN pays dividends in the middle of the month for about 10 cents. That means not all the timing is just related to month end, which may be part of what we see in HYG and JNK.

Here we seem to see a slightly earlier and more aggressive ramp up and that it takes a day or two to risk in prices. This is a stock that has had a low of 24.93 and a high of 25.22 for the past 3 months. It is not volatile and yet there seems to be this pattern around dividends.

Why Could This Pattern Be There?

This pattern which has been particularly noticeable in the past few months may exist for several reasons:

I think this pattern is real and although it shouldnt exist, is tradable for now because

- The search for yield is getting to desperate levels so more people are looking at these ETFs and are buying the dips

- Too many investors treat these more like stocks than a portfolio of bonds, leading to some decisions that may not make sense, but occur.

As a whole, this pattern concerns me as it is an indication of how many people have waded into the thick of the fixed income market with limited in depth knowledge, so on the short term, trade it, in the longer run, be concerned about what surprises these investors will face.

The most likely surprise is that the current dividend yields are unsustainable. The HY ETFs are paying current dividends at a yield far above the yield to call of the portfolio and above the average coupons on new issues (which replenish the portfolio over time) so it will have to be cut eventually.

Relative Value versus Positioning

US Stocks

Stocks seem intent on hitting new highs on the S&P 500. This is in spite of some less robust data. It is still okay, but no longer as strong as it allegedly was back in Q1. The market is seeing strong performance from Healthcare and Utilities. Hardly that exciting. The Russell 2000 has actually been weaker. So the divergence between what is driving the S&P higher and what might be signs of real economic growth is increasing.

We are bearish US stocks and look for S&P 500 to hit 1,500.

Treasuries

We remain neutral on treasuries here. Non Farm Payroll on Friday should be very interesting for treasuries. Ahead of that our temptation would be to be short the long bond if anything, and if we had to be long, to choose the 10 year.

Credit Markets

Credit remains okay. High Yield and Leveraged loans have done okay, but in the case of high yield there seems less enthusiasm than earlier in the year and prices are exhibiting the pull to par effect as a whole.

The CDS market had a nice tightening the past few days. HY CDS in particular shone, which makes sense as there you have duration in your favor, a somewhat sketchier basket of names, and shorts. The lack of enthusiasm for the Russell 2000 is not good for HY as those two markets are more closely aligned. Russell is still doing well, but if it continues to underperform, look for pressure on HY spreads.

We are bearish CDS here temporarily, as the squeeze was too much, but prefer the equity short than being short via CDS, so would be flat.

Europe

European credit is in full rally mode this morning, stocks are selling off. I would bet on stocks. There is hopes for an ECB rate cut this week. So what. The transmission mechanisms havent been working, and a rate cut, and more empty promises from Draghi will not support the market for long.

Short Italian bonds and short the DAX.

Japan

Japanese stocks rebounded strongly and the yen didnt actually sell off.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investmen t. nor provide legal, tax or any other investment advice.