The Top Sites For The Latest Stock Market News

Post on: 16 Март, 2015 No Comment

With computer aided ultra-short term high frequency, arbitrage and speculative trading becoming dominant over manual trading, profitable opportunities vanish within seconds (or even milliseconds). Traders struggle to find efficient ways to trade based on news, as news items are generally in multiple formats from various sources and timely availability remains a challenge.

This article lists the top websites, news portals and other sources which allow traders and investors about timely availability of news for stocks, forex, economy, etc.

News requirements based on trader’s profile :

News requirements vary based on trader’s profile. Long term investors usually don’t trade based on news items, as it has short term impact. It is mainly the short term traders and marketmakers who may need timely access to news for their selected stocks on which they bet money for quick profits.

Access to historical news items may be needed to backtest and study specific patterns, price changes and other effects based on news items.

How do news sites work ?

News sites usually have their own content creators, or they are authorized to source and redistribute news by partnering with other news sources. Most of the financial news providers go with a mixed approach. Here is the list of most popular news websites for stock markets, economy, finance and related business news:

· MarketWatch News Viewer. The dedicated News Viewer section on MarketWatch portal provides easy access to news items with timestamps. Its auto-streaming feature ensures instant availability of any new item getting updated automatically. Coverage includes global markets for stocks, commodities, forex and other asset classes, including fundamental analysis and reporting of macroeconomic data at country level. A dedicated tab for “RealTime Headlines” is also available for streaming data.

· Bloomberg Portal. One of the top market data providers, the news section on Bloomberg news portal offers news segregated into different categories. News can be selected from appropriate sections — asset class, region, industry and general financial. The available search feature by default shows all news items related to the particular stock queried for, and lists the news results tagged with date with all available history. For e.g. a search for “Alibaba” shows 2,213 news items. Historical information is quiet useful in correlating impacts of news items on stock performance.

· Reuters. Another top market data provider, Reuters too has vast coverage of stock specific, sector specific, market specific news on their web portal. Available content is similar to that of competitor Bloomberg. Similar search features resulting in historical news items, with added auto-complete feature for stock names are quite useful. The results page integrates existing price quotes with news items, giving a unified view to the user.

· Forbes. The news section on Forbes offers real-time news updates without any paid subscription or registration. Easy to navigate with powerful search feature resulting in historical news items, Forbes offers detailed coverage on stocks and markets.

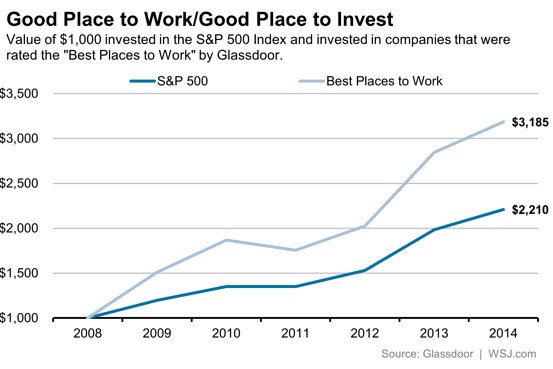

· The Wall Street Journal. WSJ is one of the top publications to be followed across the globe for business news. Apart from the usual news and price quotes with related details, the WSJ provides easy access to email alerts based on available criteria.

· The Financial Times. Another top publication for business news, the FT too provides detailed financial news with global coverage and categorized view.

However, the challenge with both the WSJ and the FT is that one gets only the headlines for free. Detailed news items usually require a paid subscription, which will also enable access to expert comments, editorials and diversified content useful to desired traders.

· CNBC. The homepage of CNBC contains the up to date developments across the global markets. The dedicated news section has category wise listing which includes news grouped by industry types (for US stocks) and region wise for Asia and Europe.

· The news aggregating sites: Many sites work in a pure aggregator role i.e. collect news from multiple sources and published them in their news sections.

1. Google Finance. Backed by the robust search functionality, the results page integrates lots on information including news, price quotes, charts, related competitor companies, key ratios, earnings reports and links to important information. However, the news items available may be delayed by couple of minutes to few hours and is not necessarily real-time.

2. Yahoo Finance. This has a similar news aggregator role with similar features and coverage for finance related news

3. Seeking Alpha. Another commonly followed news aggregator site.

Most of the above mentioned portals allow free access to information. Creating a personal login on these portals is optional, but comes with added functionality of email news alerts to user mailbox, for the selected stocks.

· Official exchange websites :

Exchanges too keep a dedicated section for news items for each stock. However, the available news items there are usually based on information filed by the company and hence it may be delayed (depending on the regulations). For e.g. a company announces dividend at their AGM and that info is instantly covered by various independent news portals. The info on exchange site may be updated later as company may take time to file those details to exchange. All price action, due to the dividend payment news, gets into the market even before the exchange site may officially list it. Hence, exchange sites should be verified for their real-time coverage, before deciding to trade on exchange based news.

· Top websites having dedicated finance news sections :

Each news portal has a dedicated section for Business & Economy news. Examples include CNN Money. USA Today. US News. etc. Care should be taken to check on timeliness of availability.

The Bottom Line

Both free and paid access to business news is available for interested traders on online portals. However, trading on news is not for everyone — timely availability and quick action is needed to capitalize on the profit potential as markets are efficient. Along with available online sources, active traders pay close attention to other media – like live TV coverage of a company AGM for stocks they are trading on – to benefit from news based trading.