The Top ETFs Used by the Top Wealth Managers Are They for You Too

Post on: 7 Май, 2015 No Comment

You may not have a yacht, but you can still invest like wealthy people. Photo: VerTego, via Wikimedia Commons

If you spend any time wishing you were wealthy so that you could have a huge house, a fancy car, and a wealth manager to oversee and advise you on your finances, I have a little bit of good news for you. I can’t get you the house or car, but I can tell you that many of the top wealth managers have parked some of their customers’ money in exchange-traded funds (ETFs) — ones that you, too, can invest in. And better still, they’re actually good investments.

Last year, the folks at Forbes listed the top 50 wealth managers ranking them by assets under management. (The top-ranker managed $13.1 billion, and No. 50 managed $2.5 million.) Among their findings was that though half of the managers parked assets in ETFs, they were only a small portion of assets, overall. The list of top ETFs used by these folks is interesting, because they’re good choices for many of us smaller investors, too — and they’re rather inexpensive, to boot.

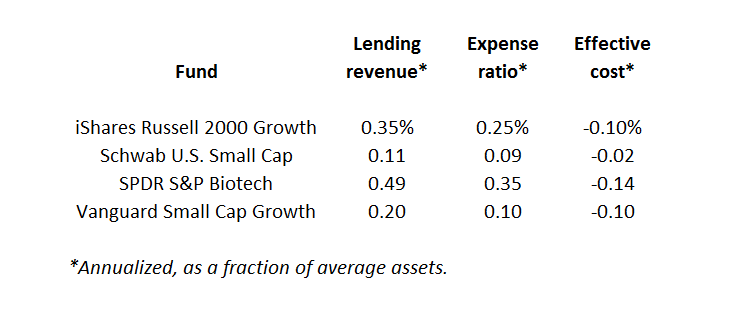

Data: Morningstar.com

Lots of great investments aren’t limited to the wealthy. Image: Pixabay

Are they for you?

These are all ETFs that would be suitable for most of us smaller investors. For starters, all are relatively inexpensive, if not downright cheap. Consider that the typical managed stock mutual fund charges around 1.00% per year, and that 0.07% will rightfully look like a bargain — especially when you consider that broad-market index funds tend to beat their managed counterparts over long periods. The 0.68% charge for the emerging markets ETF might look pricey, but international funds do generally cost more. So, compared to its global counterparts, it’s also a low rate.

Let’s consider their content now. The iShares Core S&P 500 ETF and the SPDR S&P 500 ETF are basically the same thing, just offered by different fund families. They park your money in the S&P 500 index’s component stocks, and lest you think that’s just a modest subset of the market that sports thousands of stocks, know that these 500 are big — and make up about 80% of the overall market’s value. For many, if not most, investors, simply parking all your long-term stock money in such an index fund is all you really need to do.

If you want to add some smaller companies, then the SPDR MidCap 400 ETF is perfect, as it adds the next 400 biggest US companies after those in the S&P 500, giving you a solid and diversified exposure to mid-cap stocks.

Finally, you might aim to boost your portfolio’s overall growth rate by adding some exposure to emerging markets. That’s because developing economies, such as those in China, India, and Brazil, can grow more rapidly than our big, established one. For that, the iShares Emerging Markets ETF and the Vanguard Emerging Markets ETF are solid choice, but I’d favor the latter, as it’s a bit cheaper, offers a bigger dividend yield, and has a track record that’s a bit stronger.

Note that all of these even offer you some dividend income. It’s not much, but with a $100,000 portfolio, you might receive $1,000 to $3,000 in cash per year.

Not being a millionaire or multimillionaire might keep you from tapping the services of many wealth managers, but you can still invest in some of their recommended investments — and do very well.

The $60K Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known Social Security secrets could ensure a boost in your retirement income of as much as $60,000. In fact, one MarketWatch reporter argues that if more Americans used them, the government would have to shell out an extra $10 billion. every year! And once you learn how to take advantage of these loopholes, you could retire confidently with the peace of mind we’re all after. Simply click here to receive your free copy of our new report that details how you can take advantage of these strategies.