The stock market is back but the economy isn Congres Washington Post

Post on: 21 Май, 2015 No Comment

By Neil Irwin March 6, 2013 Follow @Neil_Irwin

Huzzah! Hang the celebratory banners! Unleash the confetti! Happy days are here again. The Dow Jones industrial average closed yesterday at 14,253.77!

As scores of breathless headlines made clear Tuesday, that was a new record for the index, higher than it has been since its previous all-time high in October 2007. There are plenty of caveats to add—it’s not a record when adjusted for inflation. for example, and the Dow is a less reliable indicator of the overall stock market than, say, the Standard & Poor’s 500 (though the S&P closed yesterday only 1.6 percent below its all-time high, so it could burst through that level any day).

No worries on Wall Street. (Scott Eells/BLOOMBERG)

But the biggest reason to discount the importance of the stock market reaching a new high is this: It hasn’t been matched by a similar increase in the incomes and job prospects of Americans. The Dow may be back to its old highs, but it sure doesn’t feel like it. There is nearly a $1 trillion gap between what the U.S. economy is capable of producing and what it’s actually producing, the unemployment rate is hovering around 8 percent, and the average earnings in the private sector, adjusted for inflation, have barely budged for five years.

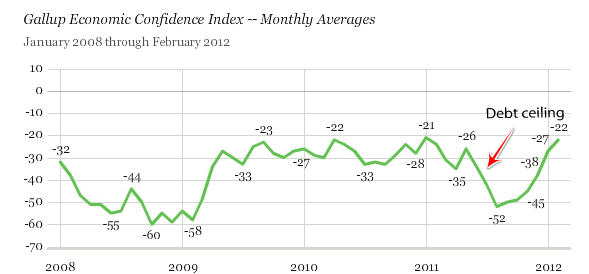

There is often a disconnect between financial markets and the economy as experienced by ordinary American, but it has not in memory been as large as it is now. And the reasons this time around are rooted in Washington.

The initial government response to the deepening of the recession in late 2008 was shared across the government. Congress and the new Obama administration enacted an $800 billion stimulus act. The Federal Reserve unveiled zero interest rate policies and pledged to pump more than $1 trillion into credit markets. The Treasury used its emergency bailout dollars to pump money directly into banks. It was a strategy of throwing everything the government had at the problem and hoping that it would work—and indeed, hoping that the different prongs of the crisis-response would complement each other and be greater than the sum of their parts. (For example, that efforts to repair the banking system would make monetary policy more effective, and vice verse).

But since the initial Obama stimulus has tapered off, and the banks strengthened, the throw-it-all-at-the-wall strategy has given way to a world where Congress sits on its hands and avoids anything that gives off a whiff of being “stimulus” (even Democrats avoid the term). And the Fed has been the only game in town, trying to spur growth through a series of unconventional steps.

But here’s where that ties in with the disconnect between financial markets and how the economy feels. The Fed operates with exceptionally blunt tools. It has great power over how much money is pumped into the economy, but very little over where that money goes.

So right now, the Fed’s quantitative easing policies are now pushing an extra $85 billion per month into the financial system, on top of about $2 trillion from its previous efforts. It is buying a mix of Treasury bonds (which help lower U.S. government borrowing costs) and mortgage backed securities (which help lower mortgage rates). A key operating theory at the Fed of how these help growth is known as the “portfolio balance channel.” The Fed buys securities. The investors who otherwise would have bought those bonds have to invest in something else. Maybe it’s corporate debt, maybe it’s the stock market, but either way it props up private asset prices and makes it cheaper and more desirable for companies to invest. Higher prices for stocks and other assets also has “wealth effects,” making the people who own those securities feel richer and therefore more willing to spend. It is no coincidence that the rally in the stock market over the last few days has come about following speeches by the No. 1 and No. 2 Fed officials that suggested that QE policies aren’t going away anytime soon.

But the problem is those effects largely benefit the wealthy, at least through their direct effects. Among families in the top 10 percent of income, 47.8 percent owned stocks directly and 90.1 percent had a retirement account, according to 2010 data from the Fed’s Survey of Consumer Finances. Among the middle income bracket, those in the 40 to 60 th percentile, only 11.7 percent owned stocks and 52.8 percent had a retirement account. The gap is even more dramatic when one looks at the value of those holdings. Of the high-income people who had retirement accounts, the median value was $277,000, compared to the $22,800 median value for the middle-income people who had accounts.

This isn’t the Fed’s fault; they’re just trying to use the tools they have to get enough growth to bring down unemployment, and it just happens that the tools they have work through channels that favor those with lots of financial assets. It would be within the power of Congress to do something to ensure those policies benefit the masses. It even had one such policy in place until a couple of months ago: A payroll tax holiday, in which the government, with its ultra-low borrowing costs courtesy of the Fed, increased Americans’ after-tax paycheck by two percent. It was going to have to go away eventually to keep the finances of Social Security sustainable, but in fiscal cliff negotiations at the end of the year, there was no strong push to replace it with any other policies to try to pump money into the hands of ordinary Americans.

The Fed has basically one tool to affect the economy: It decides whether to make money cheaper or more expensive. As long as the central bank is the only entity in Washington doing anything to try to strengthen growth, no one should be surprised if Wall Street keeps rallying and the real economy is slow to keep up.