The Simple Guide to ETF Portfolio Building

Post on: 2 Июль, 2015 No Comment

As investment products increase in number, complexity and cost, many individuals are searching for an investment approach guided by two very basic principles: Keep it simple, and Keep it economical. Exchange-traded funds (ETFs) offer a useful starting point for such an investment approach. However with hundreds of different exchange-traded funds to choose from, and a never-ending number of ETF portfolio combinations, how can you keep it simple? First, building a diversified portfolio of exchange-traded funds is not nearly as complicated as it may at first seem.

Traditional portfolio-building strategies tend to think that investors all have similar levels of time, effort and knowledge to devote to their portfolios. But, of course, these qualities vary enormously. One option is to view portfolio-building based on the level of complexity, with portfolios ranging from a basic, bare-minimum portfolio to one that is very complex. This concept can be effortlessly applied to exchange-traded funds. Using basic and more complex portfolios, you can build a simple portfolio of exchange-traded funds that requires little maintenance and is low cost.

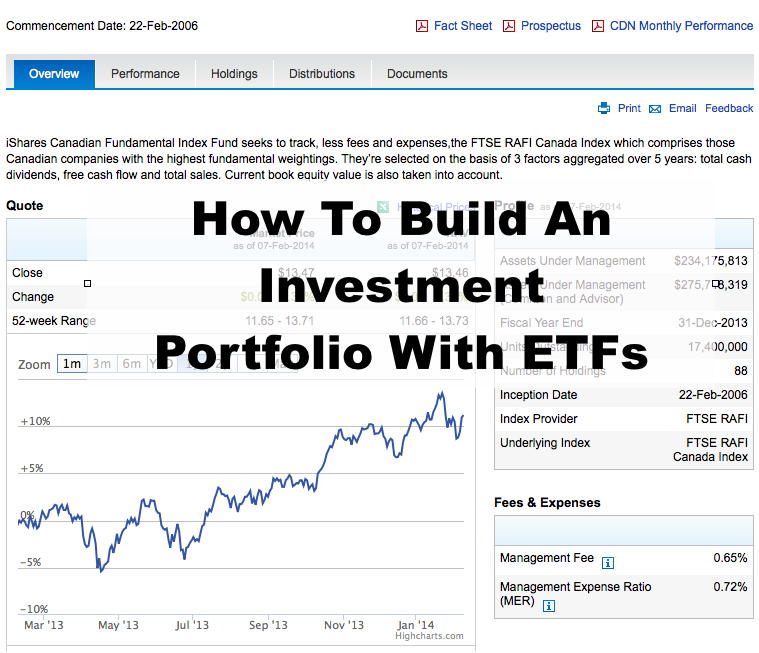

A portfolio must meet your financial goals and match your risk tolerance. Your asset allocation is driven by your investor profile. Secondly, it must be broadly diversified among major market segments. With those constants in mind, the simplest approach is to build your entire portfolio around index funds. Index funds are passively managed portfolios, they also provide automatic diversification, and they are by definition, completely diversified within the market the index covers. Lastly, they are low maintenance investments because they are the benchmarks. ETFs provide all of the advantages of traditional index mutual funds, including diversification, tax efficiency and low maintenance. They also feature rock-bottom costs, with expense ratios that are even lower than their mutual fund counterparts.

The BASIC Portfolio The total U.S. stock market index ETF is just that: broad-based, with U.S. common stocks of all capitalization sizes large, mid- and small-cap. While these ETFs hold thousands of stocks, the key is not the number but the weightings. A total domestic market index ETF covers the U.S. markets, but your portfolio needs to be global in scope. Even if the allocation to foreign stocks is small, it does add to overall diversification and risk reduction. The BASIC portfolio also includes an all-in-one total international stock ETF that covers the primary regional economic zones: Europe, Asia/Pacific, and Latin America. This covers both developed and emerging international economies, but developed economies dominate the index, as does Europe, since capitalization weighting determines exposure and diversification. The third component in the BASIC portfolio is an intermediate-term government bond ETF. Intermediate-term maturities (average maturity of seven to 10 years) capture most of the yield and total return of a long-term bond fund with substantially less fund volatility caused by changing market interest rates.

The COMPLEX Portfolio- you want to be able to control asset allocation and diversification more precisely but still employ the efficiency and simplicity of an index approach. The COMPLEX Portfolio breaks the total U.S. stock market index into several components: Either a large-cap ETF plus an extended-market ETF, or a large-cap fund plus a mid-cap ETF, a small-cap ETF and possibly even a micro-cap ETF. The COMPLEX Portfolio should be thought of as an opportunity to mix and match with the BASIC rather than as either/or choice. Similarly, the foreign markets are broken down into a European stock ETF, a Pacific stock ETF and an emerging markets stock ETF, allowing choice in allocation between the more developed markets and the emerging markets of the Pacific Rim and Eastern Europe. For the bond holdings, COMPLEX offers a short-term U.S. government bond ETF and a long-term government bond ETF, enabling you to create your own maturity level. A long-term government bond ETF can provide a higher return, although with more volatility; combining it with a more stable, although lower-yielding short-term government bond ETF allows you to control how much extra risk you are willing to take on for added yield.

Despite the large number of ETFs available, it is possible to quickly narrow down your choices and build a simple, low-cost portfolio of exchange-traded funds. These portfolio approaches requires very little time and energy to manage, is relatively low cost, and yet provides substantial diversification.