The Ship of Theseus The Paradox of Warren Buffett s Investing Style

Post on: 16 Март, 2015 No Comment

The Ship of Theseus is a paradox widely believed to have originated from Greek historian and biographer Plutarch who lived from 46AD to 120AD.

Imagine the Ship of Theseus to have thirty oars, and as they became damaged by storms and battered by the sea, they were gradually replaced. The hull of the ship were made of planks, and they too were stripped when they started to spring a leak. The sails, valiantly catching the wind and allowing the ship to make good speed became torn and tattered as the days went by. They too were taken down and new sails were hoisted.

What if, as Plutarch was to have suggested in his writings, that the ship that eventually arrived in Athens was entirely replaced part by part over the course of the journey. So much so that every plank, nail, sail and oar was replaced and not a single original item remained.

Is it still the ship of Theseus then?

How about if all the items that were replaced were kept in the ship and upon reaching port, unload and laid out onto the dock. Which should we claim to be the original Ship of Theseus, the majestic docked ship or the pile of discarded material?

And to mess around with our minds even more, English philosopher Thomas Hobbes asked what if all parts from the original ship was picked up and used to build another similar ship. Which then would be the original Ship of Theseus?

Warren Buffett and Benjamin Graham

Warren Buffett is the worlds most successful investor. His company Berkshire Hathaway has returned 23% over the past four decades.

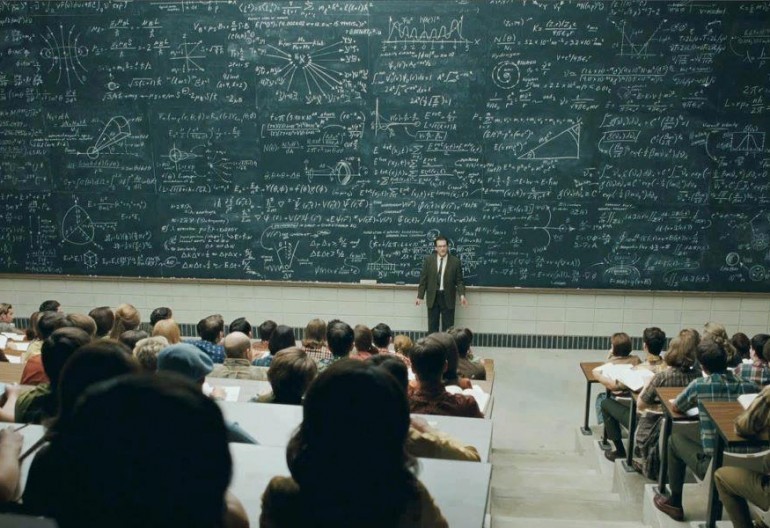

The very foundation of Buffetts success lies in his investing mentor Benjamin Graham. Warren Buffett enrolled in Columbia University where Graham taught just to learn from him. Buffetts success is often attributed to Graham and it is taken as validation that Graham is indeed the Father of Value Investing.

Graham is also the author of the arguably the greatest investing book of all time The Intelligent Investor.

Yet over the years, and especially under the influence of his partner Charlie Munger, Buffetts investment style has slowly evolved. In fact, he has stepped away from some of Grahams teachings, and is now taking an opposing stance on some issues. Two very fundamental instances come to mind.

Graham was a big proponent of diversification. He believed in buying a large number of good stocks with superior characteristics (such as low Price to Book and low Price to Earnings). Some of these stocks might turn out to be duds, but Graham believed that over time and as long as the number of stocks are large enough, this basket of undervalued and unloved stocks will outperform the market.

Buffett on the other hand is a firm believer of a concentrated portfolio, keeping his holdings in as few good companies as possible. Buffett and Munger waits and watches more than they act. When a company does make it past their acquisition criteria, they will not hesitate to make a huge investment. He famously remarked that

Diversification is protection against ignorance, it makes little sense if you know what you are doing.

Graham also believed that investment success will follow if one behaves like an actuary and plays the odds well. He functions like one, buying stocks based on reported financial statements and reports, seldom looking beyond these financial ratios in his analysis.

Buffett though, has made a fortune for himself by looking beyond the numbers. Rather, he is a great qualitative student of companies. He studies them and tries to understand them from the point of view of a businessman, examining the business environment, the companys product, their competitive advantage and the quality of the companys management team. This is very much at odds with Grahams teachings.

Which is the Original Ship of Theseus?

If Grahams teachings make up the original Ship of Theseus that Buffett is sailing on, the oars and sails and planks are slowly being replaced item by item.

If every item on the entire ship has been replaced, will it still be known as the original Ship of Theseus? If the day comes when Buffett no longer practices the Benjamin Graham style of investing, will he still be known as the disciple of Graham? Only time will tell.

Would you like to find out more about how Benjamin Graham invests? Come join us for the one day Value Investing Mastery Course. Find out more about it here!

>>> Warren Buffett’s secrets to investing is buying a great company at a fair price. Now you can use this simple yet powerful spreadsheet to determine the intrinsic value of a stock. You can download it here for FREE.

DO YOU KNOW: Blue chips stocks are expensive to buy and slow to profit. Discover the uncommon approach to stock gains. Find off radar stocks for profits (Hint: They often give triple-digit returns). Simple method you wished you knew in our 1-day content packed course. Click here to register

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D80&r=G /%