The secret to great investment performance Value Patience

Post on: 16 Март, 2015 No Comment

Long Holds

The secret to great investment performance: Value + Patience

When I was in college in the mid 1990s a friend of mine inherited some money. About $100,000.

He didn’t know what to do with it, but he did know that it should be invested rather than spent on a brand new car, or an around-the-world vacation.

He was a English literature major, so naturally he decided to read the first edition of Benjamin Graham’s Security Analysis. and also Graham’s The Intelligent Investor .

He read them both cover to cover, and was smart enough to internalize the lessons in them.

He decided to try his hand at value investing.

This was before the explosion in online investment information, so he had to borrow an old-school, hard-copy stock guide from the business school library. He spent his days flipping through it by hand hunting for undervalued stocks.

His strategy was rudimentary, but it was a value investment strategy. He wanted stocks that were cheap, financially healthy, and looked like they could grow over the next five or ten years.

After skimming through a few hundred pages of the telephone-directory sized book, he found his first target.

While he was going through the process of setting up his online brokerage account, the stock ran up 20 percent.

By the time he was ready to trade, he felt that he had missed the opportunity, and decided not to buy it.

He kept flipping through the stock guide and eventually found 7 other stocks that fit his cheap-but-financially-healthy-and-growing strategy.

He bought them all for the portfolio, and then watched the stocks like a hawk.

He became obsessed. He checked it every day. And then twice a day. And then hourly. He knew the value of the portfolio to the cent.

Two of his picks fell early on, one by 30 percent, and the other by more than 40 percent, and the other 5 just meandered around.

He bought some more of the ones that dropped, and traded in and out of a few different stocks.

After six months, though he had checked it obsessively, and traded several of the original stocks for greener pastures, his portfolio was down about 17 percent.

He decided that he didn’t know what he was doing, and, anyway, that investing was really boring. He set up automatic dividend reinvestment plans for the stocks, and went back to being an Eng. Lit major. He graduated college 18 months later, got a job as a web designer, and left home.

He got busy at work and completely forget about the portfolio. Every now and again his parents got a snail mail missive from his online broker, which they gave to him, but he couldn’t bring himself to even open it. It’d just remind him that he was a bad investor. After a year or so his parents stopped giving him the statements.

A few years later he visited his parents for the holidays. He spied the pile of brokerage statements on his childhood bed, and, in a fit of nostalgia, checked in on his old hobby.

He was stunned when he read the statement. In the almost five years since he stopped looking at the portfolio, something miraculous had occurred.

The portfolio, which he had left down almost 20 percent, had almost quintupled—gone up 5 times—in value.

One of his positions was up more than twentyfold, and was paying him in dividends each year what he initially invested in it.

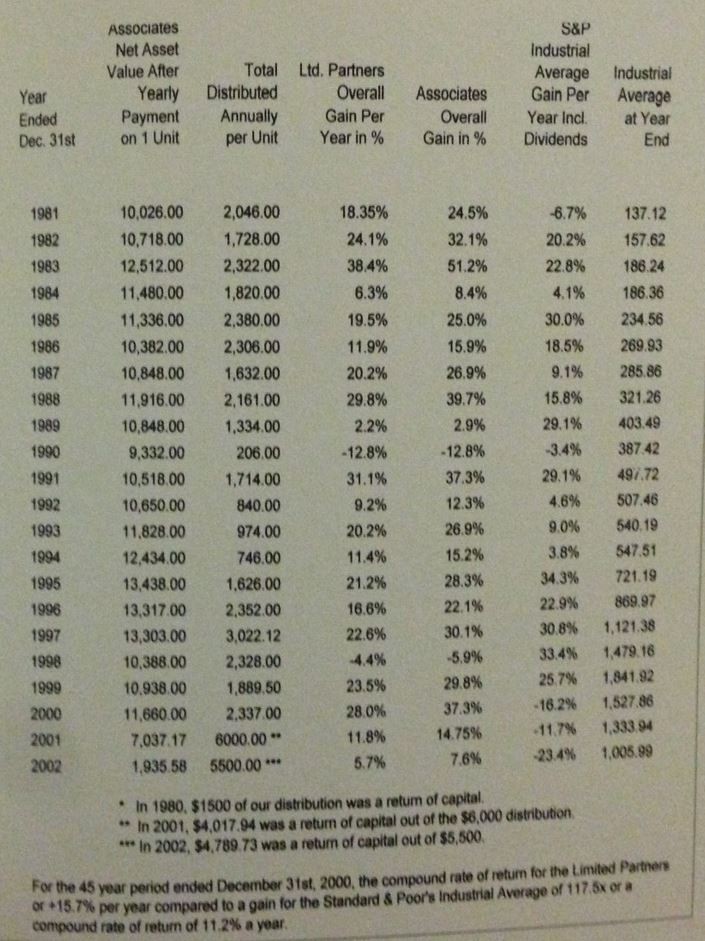

He calculated that he’d made more than 30 percent per year compound across the portfolio. And he had achieved it by buying the right stocks and then doing nothing with them for a very long time.

This is the power of compound growth.

In the short-term, it is imperceptible.

But over the long-term, it yields stunning results.

These are precisely the kind of stocks we search for Singular Diligence. Undervalued, financially healthy companies with businesses that can grow for the long term.

They need to be well bought, and they require patience to work.

Finding an above-average company at attractive price is no easy task. It requires meticulous diligence on its business, and its management, to ensure that both are first class. That’s our specialty.

The only way to give that kind of diligence its due is to look globally, and focus on a single idea at a time. That’s what we do.

We show our work. We explain why each company is a good buy and hold investment, and why it’s the best stock we could find this month. We put you in the position to make the portfolio manager’s informed purchase decision.

Our very long-term focus means that we never revisit the idea, and we’ll never tell you to sell. Like Warren Buffett, our favorite holding period is forever.

P.S. The one stock that my friend missed—the stock he avoided because it had run up 20 percent—would have been a 50-bagger five years later.

Posted to Singular Diligence on Dec 02, 2014 — 5:12 PM