The Role of the as Reserve Currency

Post on: 16 Март, 2015 No Comment

Is the Dollar in Danger?

Comments ( )

By Luke Burgess

Thursday, January 29th, 2009

Over the past several decades, the U.S. dollar has enjoyed its status as the world’s most important and dominant reserve currency.

Every major government and financial institution in the world now holds significant quantities of U.S. dollars as part of their foreign exchange reserves. These dollar reserves create a hedge for them against their own presumably less stable currencies.

This dominating reserve currency status also means that every major commodityincluding crude oil, gold, wheat, cattle, orange juice, coffee, sugar, etc.is priced and traded only in U.S. dollars. This helps to create a constant demand for the American currency as traders must hold U.S. dollars to access commodities.

The demand generated from its prime reserve currency status has added significantly to the value of the U.S. dollar over the past several decades.

However, there is evidence that the dollar’s role as the world’s dominant reserve currency may be drawing to an end.

And if this is the case, the value of the U.S. dollar could rapidly decline .

Even if you don’t buy into the idea that the dollar may lose its standing as the world’s main reserve currency, the scenario should still be considered plausible and may be worth hedging against on a long-term basis to reduce portfolio volatility if nothing else.

With that in mind, I would like to make a new buy recommendation on what I consider an acceptably-balanced fund that will return significant profits in a weak U.S. dollar environment.

But before we get into that, let me show you why I think the the U.S. dollar could slowly be losing its reserve currency status, which could lead to a major devaluation of the currency.

Role of the U.S. Dollar as a Reserve Currency

In 1965, the United States of America was the largest creditor nation in the world.

Today, it is the world’s largest debtor nation.

Brother, can you spare a couple billion?

The most widely quoted figure for the debt of the United States is called the national public debt. This public debt is currently $10.64 trillion.

This is the figured quoted on the famous U.S National Debt Clock in Manhattan.

It has increased 385,465% in the past 100 years.

The national public debt is all U.S. federal debt that is held by states, corporations, individuals, and foreign governments. This debt is money owed by the U.S. government to its creditors, whether they are nationals or foreigners.

But the national public debt doesn’t tell the whole story.

The United States is responsible for many other financial obligations that are not included in this calculation.

The national public debt does not include intragovernmental debt obligations or contractual requirements of the U.S. government. These obligations include military and civilian pensions, retiree health benefits, federal insurance payouts, loan guarantees, and leases. They add another $1.5 trillion in financial obligations of the United States.

But they pale in comparison to what is owed in the form of Social Security and Medicare benefits.

The Best Free Investment You’ll Ever Make

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Gold & Silver Mining Stocks.

Enter your email:

Current and future promised Social Security and Medicare benefits amount to about $7 trillion and $35 trillion, respectively.

Add it all up, and the United States is really responsible for covering $54 trillion in total financial obligations including public debt.

These obligations burden every American with more than $175,000 in federal liabilities and unfunded government promises.

And each year in which no down payments or reforms are made to these obligations, the total grows by $2 trillion to $3 trillion, or $6,500 to $10,000 per person.

But here’s what really shocked me after looking at the numbers.

America’s $54 trillion financial obligation is almost 400% higher than estimates for 2008 U.S. GDP.

In fact, the sum of these obligations are nearly the equivalent of estimates for 2008 world GDP.

The shear size of this financial responsibility is fair grounds to even question the solvency of the United States.

The Euro is Establishing a Stronger Position as Reserve Currency

The massive debt obligation of the United States government threatens to help strip the U.S. dollar of its title as the world’s most widely held reserve currency.

This idea is not as alarmist or as far-fetched as it may sound.

The possibility of the euro rivaling or surpassing the U.S. dollar as the main reserve currency is now widely debated among economists.

These arguments generally suggest that as the European Union expands, poorly managed macroeconomic policieslike those that have lead to a current $54 trillion debt obligationwill continue to undermine the confidence in the value of the dollar. Then, as the euro gains in value, world power, and exposure, it will replace the ailing U.S. dollar as dominant reserve currency.

An actual shift in reserve currency power would send the value of the U.S. dollar spiraling down. quite likely all-time crashing lows.

Former Federal Reserve Chairman Alan Greenspan gave his opinion in September 2007 that the euro could indeed replace the U.S. dollar as the world’s primary reserve currency. He said that it is, absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency.

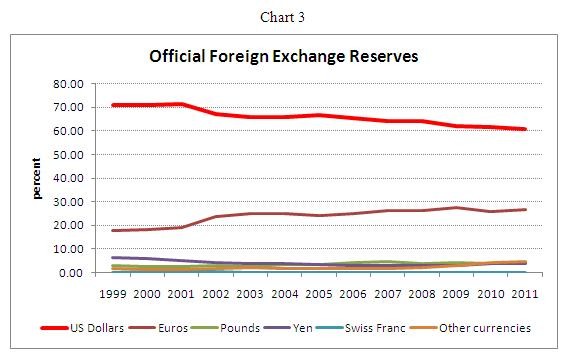

The euro has already taken a noticeable slice of the reserve currency pie. Total claims of allocated world foreign exchange reserves denominated in euros have increased 367% since 1999.

As a result, the percentage of U.S. dollars held in foreign exchange reserves has dropped noticeably in the past decade.

U.S. dollar claims in total allocated foreign exchange reserves have increased in value by $1.8 trillion over the past ten years. But, the percentage of U.S. dollars held in foreign exchange reserves has noticeably dropped. This is represented in the chart below by the progressively growing gap between total allocated foreign exchange reserves and claims in U.S. dollars between 1999 and 2008.

*average of first three quarters

In 1999, over 71% of the world’s official foreign exchange reserves were denominated in U.S. dollars.

Today, only 63% of the world’s official foreign exchange reserves are denominated in U.S. dollars.

*average of first three quarters

It’s an 8% drop in ten years. And it’s not the end of the world. However, it really could be the beginning of a long-term trend that ends with the U.S. dollar losing its dominat reserve currency position if there are not major policy changes soon.

As the current financial crisis only continues to deepen the debts and obligations of the United States, demand for the U.S. dollar for foreign exchange reserves may continue to shrink, ultimately leading to a lower market value.

There are a few ETFs and funds that can help set up additional hedge support in a weakening U.S. dollar environment. In the next issue of Gold World, I’ll share them in detail.

Good Investing,

Luke Burgess

Managing Editor, Gold World