The Robinhood App Is Here

Post on: 16 Март, 2015 No Comment

Here’s How You’re Going To Get Rich On The Stock Market — This Ain’t Your Granddad’s Wall Street

Share on Twitter

Shares

First went brick-and-mortar brokerage houses now say buh-bye to trading stocks through a clunky old website.

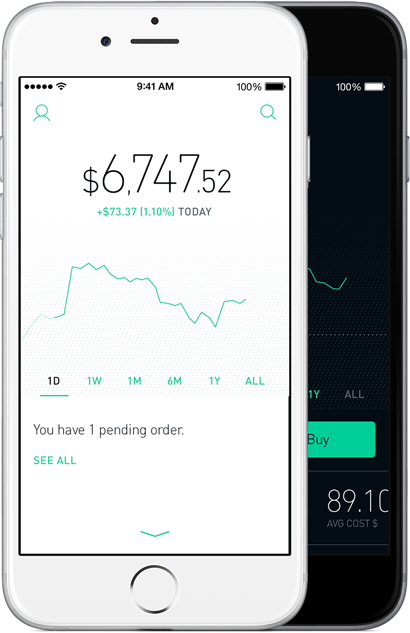

Enter Robinhood. Robinhood is a zero-commission stock brokerage company that wants to make trading stocks as easy as posting a picture to Instagram (which is a little too easy for some people, come to think of it). You know who Im talking about.

Unlike traditional brokerage houses that typically charge you $7 to $10 per trade, Robinhood charges you nothing. Its a zero-commission stock-trading platform available through an app as early as 2015.

Yes. An app. Tap, tap, tap, done. No more drunk driving your way around a cluttered brokerage website with green and red numbers flashing and a picture of a guy who looks like your grandpa in a suit with a phone next to his face saying, Call an advisor today!

The best part is theyre calling out the entire brokerage industry with their story:

After graduating from Stanford, roommates Vladimir Tenev and Baiju Bhatt moved to New York, where they built high-frequency trading platforms for some of the largest financial institutions in the world. They began to realize that electronic trading firms pay effectively nothing to place trades in the market yet charge investors up to $10 for each trade and thus the idea for Robinhood was born. They soon ventured back to California to begin solving the problem of democratizing access to the markets. — Robinhood.

Traditional brokerage houses charge you $10 for trades even though they pay little to execute said trades. Similar to brick-and-mortar banks, they have a lot of overhead. Someone has to pay for the overhead so it might as well be you.

Or not.

With slim overhead relative to traditional brokerage houses, Robinhood can pass this cost savings on to you with zero-commission trades.

So how do they plan to make money? Four ways:

Access to their data - The more users they get, the more data they have. They can then sell this data (their API) to other startups that want to build other businesses using that data.

Margin trading - They also plan to charge users to borrow money if their money is locked up. Meaning, if you sell a stock, your money is locked up for three days. But if you want to buy another stock, Robinhood will charge users to trade on margin.

Payment order flow - This is renumeration for providing trade volume listed on their site. They can receive payment for directing trades to different parties to be executed.

Additional services - They will charge premium services to active investors (so probably a lot of people since trading is free!)

With $16 million in funding, theyve given a high rise on Wall Street the Heisman. Instead theyre using their lean team to focus on building a safe and secure free stock trading platform for their users. Theyre planning for public access in early 2015 so keep your eye out!

Check out more buzzing money and finance topics on MakinSense Babe .