The risks and opportunities of smart beta investments

Post on: 20 Апрель, 2015 No Comment

Fund data for this article

By James Williams Smart beta. Alternative beta. Beta plus. Many names. One objective: to outperform traditional market cap-weighted indices that have long been the preserve of passive investing.

Weve been designing strategies which harvest beta cheaply in a bespoke way for years, says Tim Gardener (pictured), Global Head of Consultant Relations at AXA Investment Managers. How we describe smart beta is harvesting beta in a cheap, transparent and efficient manner.

The opportunities for investors looking to tap into this middle ground that straddles passive and active management continue to grow. Last year, AXA IM launched a series of smart beta credit strategies, while in February this year it launched its SmartBeta Equity strategy.

The former, which consists of three strategies (UK, eurozone, global), offers investors a low-cost solution to accessing corporate bonds without the limitations of a cap-weighted index approach. The equity strategy goes a step further, avoiding alternative weightings as well as traditional index tracking.

Its a predictable, transparent and common sense approach that we take, rather than slavishly follow rules. In the equity strategy (and the credit strategies) we use three elements: filter, diversify, implement. We essentially filter out the rubbish, stocks that no savvy investor would invest their money in. At the diversify stage, within the equity strategy only, we look at the market cap of a stock and construct the portfolio so as to avoid concentration risk, explains Gardener.

The equity strategy uses four long-term beta harvesting guidelines to reduce exposure to wealth destroying elements exposure to poorly compensated risks, poor diversification, failure to look to the future and cost leakage.

With other firms such as US-based First Trust Advisors launching three of its AlphaDEX ETFs this April in Europe, there appears to be growing investor interest in smart betas.

But for all those who champion the merits of smart beta there are just as many who lambast them.

Youre probably paying more for smart betas and thats because they are effectively an active strategy. In the same way that all active strategies ex ante look as if they are going to outperform, ex post they tend not to. So maybe smart betas should be treated with a pinch of salt, says Dr Peter Westaway, Chief Economist Europe, Vanguard Asset Management.

To us the elements of the strategy that are passive are good because youre not relying on an overpaid manager to implement the strategy, you can do it with low-cost building blocks. But what is undoubtedly an active choice is to have an index portfolio that is, for example, overweight in value stocks. To say that its some form of natural index is slightly disingenuous in our view.

David Blitz, Head of Quant Equity Research at Robeco, a Dutch-based pure-play asset manager, argues that one of the biggest attractions to smart betas namely their simplicity is also their biggest weakness. Moreover, the tilt towards factor premia such as value, minimum volatility (i.e. the rules that Gardener is at pains to avoid) can create significant risks.

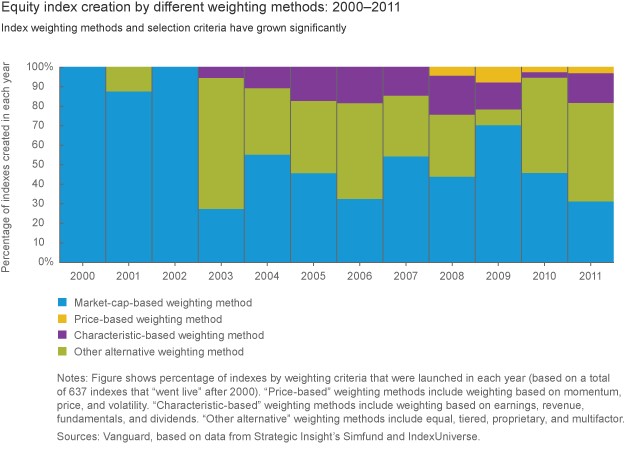

Fundamental weightings that weight stocks according to their book value or earnings: thats easy to explain. Low volatility indices that select stocks with the lowest implied volatility: again, easy to explain. But is this the most efficient way of capturing underlying market anomalies?

We argue that all these smart beta indices leverage on classic ideas fundamental indexing is really just value investing and if you believe there are inefficiencies in the market it may be a bit nave to presume that a simple smart beta index is the most efficient way to capture these.

Smart betas are a good start, but its possible to do better, says Blitz.

This could be achievable by avoiding unrewarded risks that may be present in a strategy and by moving away from focusing on only one factor premium. Turnover inefficiency can also be improved upon says Blitz, whose white paper How Smart is Smart Beta Investing? (January 2013) discusses these issues.

The paper deals with the risks and potential ways of improving a variety of smart index methodologies. With respect to fundamental weighting and minimum volatility, Blitz sets out his argument accordingly:

1. Fundamental indices tend to be tilted towards financially distressed firms. One would expect that taking on the risk of holding cheap distressed stocks would generate the requisite value premium. However, if you sort stocks on their financial distress risk what you actually find is that theres a negative relationship: higher distress risk, on average, is associated with lower returns in the index.

If you remove these distressed value trap companies when selecting cheap stocks in the index you can reduce the risk in the strategy and still preserve the return, opines Blitz.

2. Minimum volatility indices are one-dimensional in their risk appraisal. The focus tends to be on past volatility and correlation but there should also be a forward-looking element. Blitz says that Robeco measures bankruptcy risk using a similar model to that used by Moodys which automatically red flags a company when its leverage ratio shoots up (as a result of issuing new debt).

Another risk to minimum volatility strategies is that they tend to be expensive from a valuation perspective. What we find is that two thirds of the time low volatility stocks are cheap, but one third of the time they are expensive.

What we suggest is that within the subset of low vol stocks you filter out the ones that are most expensive to reduce valuation risk.

Its a two-step approach. We first augment historical risk measures such as past volatility with forward-looking risk measures, examples of which could be credit spreads or implied volatilities. Then, from the pool of low vol stocks we filter out the expensive ones selecting only those that are attractive from an expected return perspective.

Vanguards Westaway says that there are no immediate prospects to offer anything in the smart beta space in Europe which remains a smoke and mirrors market segment because the underlying objectives of many smart betas just arent clear enough.

Greater transparency is something that EDHEC-Risk Institute is calling for improvements on, arguing that too many smart beta products are pre-packaged and sold to investors who have no idea what risks are being taken or how alternatively weighted indices are being constructed.

Investors dont have enough controls over the risk parameters being used in smart betas. The risk exposures are already chosen for investors to a certain extent. Our viewpoint is that they should be allowed to make those choices themselves. They should choose which risks they want to be exposed to, and which ones they dont, says Peter O Kelly, ERI Scientific Betas Director of Marketing.

Phil Tindall, senior investment consultant at Towers Watson adds: We think, all things being equal, that transparency and simplicity are important. You need to understand the risks, the exposures that are being run. Our phrase is as simple as possible, as complicated as necessary. We do think more ownership for performance falls with the asset owner rather than the fund manager in this space.

EDHEC-Risk refers to this investor-centric approach to managing risk and having access to better transparency as Smart Beta 2.0. The authors behind this study, Nol Amenc, Felix Goltz and Lionel Martellini show that Smart Beta 1.0 indices present systematic and specific risks that are neither documented nor explicitly controlled by their promoters.

They argue that specific risk, which is often characterised as model and parameter estimation risk, can be both measured and managed. Being able to better diversify the specific risk of smart beta products significantly lowers the specific risk of smart beta benchmarks says the authors.

Were in favour of investors having the ability to do research effectively on a smart beta product and be in control of the risks before they allocate. They should be deciding whats in the product, rather than being presented with it, says O Kelly.

Michael John Lytle, Chief Development Officer at Source, the independent ETF provider, says that continuous work needs to be done to bring transparency to all indices, not just alternatively weighted indices.

Everyone assumes that big benchmarks provide complete transparency with respect to their indices but there are always different degrees of transparency. Commercial index providers have a business model that involves selling their data. They give away some information but usually implement delays in distribution of granular constituents.

EDHEC-Risk are offering indices that follow a different pricing model, charging a fixed fee and giving away a lot more data. The concept around index transparency is that investors should be able to calculate any index for themselves. The problem is that with more complicated indices you can explain to people exactly how they work in principle, but thats still a step away from making daily index calculations that require granular details.

Source already has a number of what it calls beta plus strategies in the market 11 in total as well as three alpha strategies. The likes of Man GLG Europe Plus Source ETF have proved hugely successful AuM is currently USD940million but they still represent a small percentage of Sources USD14billion in total assets. The majority of inflows are still going into plain vanilla traditional benchmark indices, of which Source offers 72 products covering both primary and secondary indices.

We have a number of smart beta products but were absolutely not trying to convert the broader ETF market, says Lytle, who thinks that the smart beta universe will evolve relatively slowly.

The majority of money will continue to flow into plain beta products in our view. You need to be on peoples list of core providers to ensure youre in the running for every piece of market exposure they are looking to replicate, says Lytle.

One area that Source might continue to focus on is fixed income, which remains a laggard in terms of total assets in the ETF space despite seeing some strong inflows last year. Lytle, though, adds the following caveat:

You have to figure out how to deliver fixed income strategies that investors find compelling. Smart strategies often take longer to build, explain and grow. Our success in following this path is why we have only got seven products with PIMCO, which have seen significant inflows in the last six months and are only now just taking off. The PIMCO EM Advantage Local Bond Source ETF, for example, launched Sep 2011.

At AXA IM, its smart beta credit strategies use the same three-step methodology as the recently launched equity strategy: filter, diversify, implement.

To build its corporate bond exposure AXA IM focuses on bond issuers rather than issues and filters out the least creditworthy issuers.

The global credit portfolio contains 200 issuers. The aim is to protect investors against fat tail events e.g. if an issuer goes bankrupt its overall impact on the portfolio will be mitigated.

Our bond filter is designed to ensure that none of the bad get through. This filter is even more important in our equity product; we cannot afford to remove stocks that could end up performing strongly. One of the four beta harvesting guidelines we use is to favour stocks with good earnings growth sustainability. As its not an (active) alpha generating strategy, as soon as earnings fall off in a particular stock it gets excluded by the filter and gets taken out of the portfolio, explains Gardener.

Whilst smart beta is far from perfect, there are signs that it is starting to evolve and drop the simplicity tag.

A second strand of smart betas based on alternative strategies to capture different premia is being developed, tapping into areas of the market such as reinsurance, commodities, FX carry, to reward investors for different premia.

Towers Watson believe that using smart betas this way could, over the long-term, help investors diversify their market risk and reduce their reliance on equities.

The thrust of the argument is that if you believe these alternative smart betas offer reasonable risk-adjusted returns then it would make sense, subject to governance, to not focus all your return generation on one asset class: i.e. equities, says Tindall.

However, these are more complex smart betas. They require more governance and are not mainstream. Also, investors must be prepared to use more than one of these diversifying strategies in their portfolio.

Its a relatively simple premise: identify interesting investment opportunities and structure them better using smart betas that can be implemented in a systematic cost-effective way.

These premia, says Tindall, might include: risk premium, complexity premium and liquidity premium. Take risk, for example. A long-term investor that can absorb left tail risks (outliers) over the short-term should receive a premium over other market participants less able to handle such shocks. The same applies to liquidity. The more illiquidity an investor can accommodate, the more they should be rewarded.

These are not new concepts. But the point Towers Watson are making is that smart betas can be used to harvest these different premia in myriad ways reinsurance, momentum strategies and in a sense take on return characteristics that look more hedge fund-like in their profile.

Were not saying that these premia accessed through smart betas are a free lunch. For left tail risks you need to understand your risk tolerance and whether you can potentially benefit as a longer-term investor. If so, its entirely rational that you should be rewarded for taking on those risks. Ditto for liquidity.