The Rise Of The Bond Market And Its Impact On Portfolio Allocations

Post on: 19 Сентябрь, 2015 No Comment

Matthew Klein has a very good piece over at FT Alphaville (which, by the way, could be the single best overall financial blog on the internet, so if you don’t read it then get your act together) discussing the rise of the bond market and the surge in issuance in recent years. He talks about how the supply of corporate bonds has doubled since the financial crisis and what this could mean for the broader economy and the markets. I want to get even more macro than Klein gets because this could have big ramifications for how we allocate our financial assets going forward.

If you look at broader corporate debt issuance the trend has actually been much more pronounced over the last 20 years. Since 1996 total corporate bond market issuance in the USA has quadrupled. But what’s interesting about the issuance of debt is that equity issuance has lagged significantly. Equity issuance has barely doubled since 1996 and the overall size of the bond issuance has dwarfed the equity issuance by a wide margin:

What’s most interesting about this is the underlying driver. Of course, the surge in bond issuance has coincided with declining interest rates. So it’s become significantly less expensive to finance operations via debt than it has to issue equity. Equity issuance is always viewed as a very expensive form of financing through the eyes of firm owners, but the debt markets are even more attractive than ever because of the low cost of capital.

This has had a tremendous impact on the aggregate of outstanding financial assets over the last 40 years. We know that the bond market now makes up the majority of outstanding financial assets. That wasn’t always the case. Back in the 1970’s the Global Financial Asset Portfolio was actually a stock heavy portfolio roughly equal to a 60/40 stock/bond portfolio (in large part because debt issuance was so expensive then). That has almost completely flip flopped in the last 40 years as interest rates have declined and the GFAP currently sits at roughly a 45/55 stock/bond portfolio.

Here’s the cool takeaway from this though. If the markets were efficient and you were a true adherent to passive investing you’d just accept what the current allocation of this aggregate portfolio currently is. You wouldn’t go against the grain. In other words, you wouldn’t say that the current 45/55 allocation is wrong. Of course, we know that that’s just silly. Someone who followed that line of thinking was positioned precisely wrong for the last 45 years. In fact, being almost entirely bonds over the period from 1970 to 2014 was the best place to be on a risk adjusted basis. Saying that the market is wrong was actually a very smart thing to say way back then. And I am inclined to say that we’re in a similar situation today. The issuance of shares is, to a large degree, the result of an ex-post snapshot of the structure of interest rates and corporate managers are REACTING to this change in the markets HOPING they will be positioned correctly going forward. But what it actually means is that equity could become increasingly valuable relative to bonds going forward. In other words, the investor who says the 45/55 weighting is wrong could be rewarded with healthy risk adjusted returns by being even more overweight stocks relative to bonds going forward.

Said differently, the idea that the current market capitalization of outstanding shares is efficient and that you should passively allocate into a global cap weighted portfolio is very likely to be wrong going forward because the actual issuance of debt, thereby locking in a low cost of capital, could very well be the driver of higher equity market valuations in the coming decades. And if that turns out to be correct then stocks could significantly outperform bonds in both nominal and risk adjusted basis. And this means that the efficient market thinkers and passive indexing crowd is precisely wrong. Some active management and going against the market might just be a very smart thing to be doing in the coming decades. Especially if you can do so in a low cost and tax efficient manner.

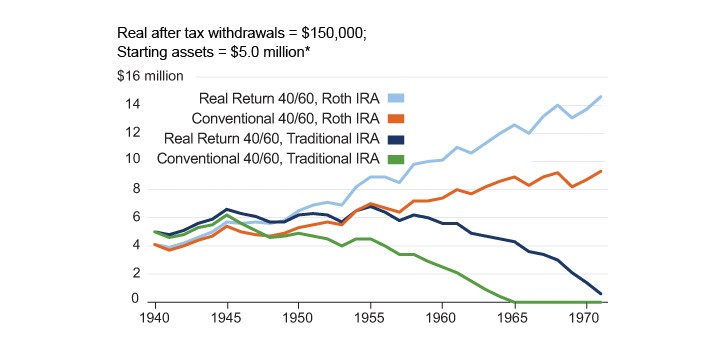

I’ve referred to a related issue in a balanced portfolio as the problem of bonds and the likelihood of low future returns. Bonds present a tremendous problem for asset allocators at present. And those who aren’t implementing a thoughtful and somewhat active approach (at a minimum, deviating from global cap weighting) could actually be putting themselves at a significant disadvantage in the coming decades.