The rise and fall of Enron a brief history Business CBC News

Post on: 16 Март, 2015 No Comment

Related Stories

Enron’s origins date back to 1985 when it began life as an interstate pipeline company throughthe merger of Houston Natural Gas and Omaha-based InterNorth. Kenneth Lay, the former chief executive officerof Houston Natural Gas,became CEO, and the next year wonthe post of chairman.

From the pipeline sector, Enron began moving into new fields. In 1999, the company launched its broadband services unit and Enron Online, the company’s website for trading commodities, which soon became the largest business site in the world. About 90 per cent of its income eventually came from trades over Enron Online.

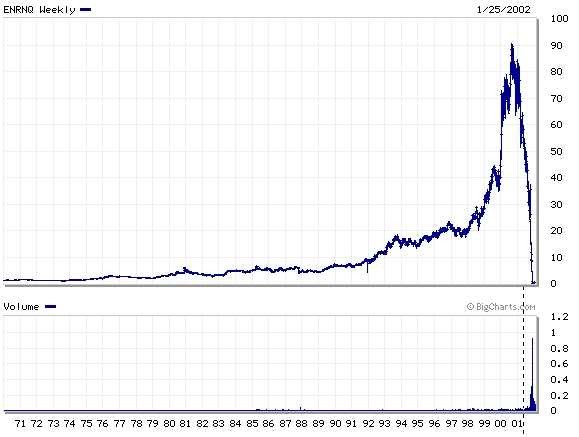

Growth for Enron was rapid.In 2000, the company’s annual revenue reached$100 billion US. Itranked as the seventh-largest company on the Fortune 500 and the sixth-largest energy company in the world. The company’s stock price peaked at $90 US.

However, cracks began to appear in 2001. In August of that year, Jeffrey Skilling, a driving force in Enron’s revamp and the company’s CEO of six months, announced his departure, and Lay resumed the post of CEO. In October 2001, Enron reported a loss of $618 million— its first quarterly loss in four years.

Chief financial officer Andrew Fastow was replaced, and the U.S. Securities and Exchange commission launched an investigation into investment partnerships led by Fastow. That investigation would later show that a complex web of partnerships was designed to hide Enron’s debt. By late November, the company’s stock was down to less than $1 US. Investors had lost billions of dollars.

On Dec. 2, 2001, Enron filed for bankruptcy protection in the biggest case of bankruptcy in the United States up to that point. (WorldCom’s collapse would later stealthat dubious honour.) Roughly 5,600 Enron employees subsequently lost their jobs.

The next month, the U.S. Justice Department opened its investigation of the company’s dealings, and Ken Lay quit as chairman and CEO.

In January 2004, Fastow agreed to a plea bargain and a 10-year sentence. He pleaded guilty to one count of conspiracy to commit wire fraud and one count of conspiracy to commit securities fraud. He also agreed to cooperate with federal prosecutors.

In February, Skilling entered a plea of not guiltyto 40 charges, including wire fraud, securities fraud, conspiracy, insider trading and making false statements on financial reports.

Lay was charged with fraud and making misleading statements in July. He pleaded not guilty to the 11 charges.

Lay, Skilling go on trial

The trial of Lay and Skilling began in January 2006. Lay and Skilling both testified for more than a week in their own defence. Some of the charges against them were dropped.

Prosecutors alleged that Lay and Skilling used accounting tricks, fiction, hocus-pocus, trickery, misleading statements, half-truths, omissions and outright lies to commit their crimes.

Lawyers for the two accused said their clients may be guilty of bad business judgment at Enron, but they never broke the law. The company failed, but it did not fail because of a fraud, Lay’s lawyer, Bruce Collins, told the jury in the case.

Defence lawyers also argued that former Enron executives who took plea deals and testified against Lay and Skilling accepted responsibility for crimes they didn’t commit.

Testimony wrapped up, with the jury beginning deliberations on May 17 and presenting the verdict on May 25.