The Rebound In This Shipping Sector Is Real

Post on: 14 Апрель, 2015 No Comment

In early September, stocks in the long-beleaguered maritime shipping industry started to do something few observers expected them to do anytime soon — they started to rise in a meaningful way.

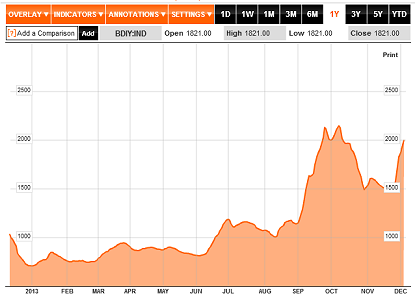

The rally from names like DryShips (Nasdaq: DRYS ) and Eagle Bulk Shipping (Nasdaq: EGLE ) was driven by a meteoric rise in the Baltic Dry Index, which reflects the change in the daily charter rate for dry bulk vessels. The index nearly doubled in value between mid-August and this month, providing a glimmer of hope of decent profits for maritime shippers.

But as is often the case with huge moves from stocks and indices, doubts started to set in about the sustainability of the Baltic Dry Index’s new price levels, and these stocks started to wane just as quickly as they’d heated up.

However, the rise from the Baltic Dry Index wasn’t the result of a little volatility. A handful of other data indicate the supply/demand balance in the dry bulk shipping sector has finally found a happy medium, making DryShips, Eagle Bulk, FreeSeas (Nasdaq: FREE ). Diana Shipping (NYSE: DSX ) and a few other names in the group worth a closer long-term look.

The Perfect Storm

To put things in perspective, the Baltic Dry Index advanced from a low of 996 in mid-August to a peak of 2,146 in early October, meaning the going rate to hire a bulk-transport boat more than doubled in a little over a month. It’s also the strongest price since around this time in 2011. And those rates were being quoted because that’s what shippers were getting — not just what they were hoping to get.

Doubts about the legitimacy of rising chart rates were understandable. After all, the industry had been plagued for years by too much capacity and not enough demand, and it seems unlikely that all those woes could be wiped away in a month. However, it appears the worst of the lull is behind maritime shippers. Specifically:

1. The number of ships being scrapped by the industry every week has now fallen from an average of more than 16 in mid-2012 to less than seven per week. The implication is shippers have more demand to satisfy, meaning they can utilize those vessels rather than retire them.

2. Shipping capacity is growing at its lowest rate in years. Capesize vessel capacity growth was a mere 4% annualized as of last month, while Supramax capacity growth is now at a multi-year annualized low of 9%. Meanwhile, AMC Shipping Group says demand for dry bulk shipping services is expected to grow by 10% next year, based on current growth trends. It’s the first time in a long time that demand has been projected to outpace capacity growth.

3. Although China’s economic growth has slowed, it hasn’t stopped growing. Last month, the country imported 74 million tonnes of iron ore and an average of 6.25 million barrels of oil a day. These record-setting figures officially made China the world’s biggest resource importer, finally topping the United States. None of these trends are expected to reverse anytime soon, either, which should keep dry bulk shippers busy for years to come.

Point is, the spike in the Baltic Dry Index’s value isn’t an errant one. It’s built to last.

Pick Of The Litter

FreeSeas, DryShips and Eagle Bulk Shipping are all decent ways to invest in the rebound in dry bulk shipping, but the most attractive company in the space right now may be Diana Shipping.