The Real Way To Make Money Investing In The Stock Market

Post on: 11 Апрель, 2015 No Comment

Rate this post

In my last post, I wrote about why you need to start investing now. With the beauty of time and compound interest, you can afford to save a smaller amount and still have it grow into a large sum of money for you to enjoy. While this is great in theory, there is a problem with it. The fact is, most people don’t know how to invest. I’m not talking about the actual task of buying an investment, rather I am talking about the idea of holding onto an investment.

Emotions Are Your Greatest Enemy

When it comes to investing, many fail to hold an investment because they allow their emotions to get involved in the process. When stocks rise, we want to invest more and catch that train! When stocks decline, we want to get a far away from them as possible. The problem with this is that you are doing the exact opposite of what you should be doing.

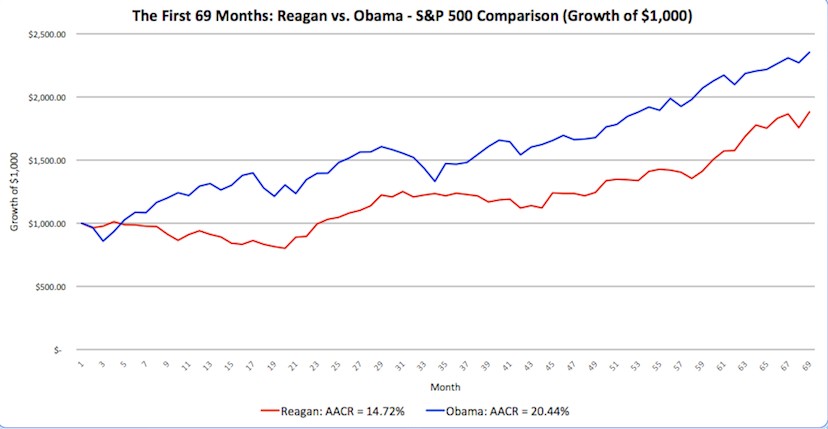

When you let greed and fear control you, you lose. Historically the stock market has return roughly 8% annually. Do you know what the average investor returned during this same period? A measly 2%. That’s it. That’s less than inflation! It’s no wonder so many are skeptical of the stock market.

To earn a higher return, you need to take your emotions out of the investing equation. Unfortunately, this is easier said than done.

Everyone Is Against You

You have everyone coming at you to try to convince you to buy or sell all of the time. Your friends or neighbors are telling you of a hot stock that can’t go down. The media is telling you that the stock market crashed today and the future is gloomy. The media is particularly good at this because they include images of distraught people along with scary colors and music to drive the point home.

Everyone wants you to trade. But this is exactly why you are only earning that 2%. In order to make money in the stock market, you need to stay invested over the long-term. How do you do this?

How To Make Money In The Stock Market

There are a few steps to follow to make money in the stock market. Here is the list you need to follow.

Have A Plan

If you don’t have a plan, how do you know where you are going? You need to know why you are investing. What’s your goal? What’s your time frame? Why are you investing the way you are? The more questions you can answer now, the better off you will be in the future.

Turn Off The Television

I said it before, everyone is out to get you to trade. Even Wall Street wants you to trade. Why? Because this is how they make money. Every time you trade a stock or exchange traded fund (ETF) you pay a commission. That is money in their pockets. When you buy and hold, they make no money.

eTrade is a discount online broker where $7.99 trades are just the beginning.

The same idea holds true for the news. How do they make money? Through advertising. In order to demand a high price to charge advertisers, they need a lot of people watching their channel. In order to do this, they need to get you emotionally involved in the story so you keep watching. This is why when the market drops, they tell you how much your 401k plan lost. Losing money is a great way to get someone emotionally hooked.

By ignoring these attempts, you save yourself the stress and the worry and you also save yourself a ton of money.

Stay Calm and Rational

I know it’s virtually impossible to tune out all media. After all, it’s everywhere now. Therefore, you need to stay rational. You do this by referring back to your investment plan that you created. By reading through it, you will remember why you are investing the way you are and this will give you comfort.

Additionally, you need to remember that you never make a sound decision when you are emotional. Think about that for a few minutes. I bet you can’t think of a time when you make a smart move when you were emotional. It just doesn’t happen.

For some of you, hiring a sound financial advisor might be a smart move. They cost money, but you can’t just look at what they cost you, you have to look at the benefit they provide. I worked for a firm for a few years and one day, a client told us that over the past 20 years, he totaled up how much he paid us and it came to over $100,000. He followed that up by saying it was the best money he ever spent because after the dot com bust and the housing crash, he would have ran from the stock market. We kept him invested and he has seen his portfolio grow by 12% even after taking into account that $100,000 he paid us.

Stay Invested

I realize that the point of everything that I’ve said above is to stay invested, but I felt the need to drive the point home by actually writing it out. You have to stay invested in both good times and bad. You can’t time the market. You don’t know when it will drop or rise, so why waste your time trying to outsmart it?

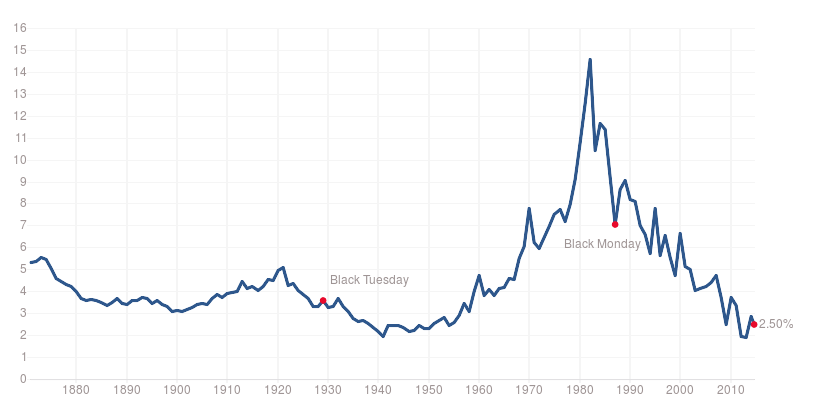

Always remember that over the short-term, there is going to be volatility. In other words, the market is always going to move up and down. It’s how it works. But over the long-term, the trend is up. Look at any historical chart and you’ll see that over the long-term, the stock market moves up.

If you need an analogy, think of the stock market like driving in a car. The drive is never 100% smooth. You hit bumps in the road all of the time. Sometimes you even hit a big pothole that rattles your teeth. But you don’t turn around and go home. You keep going because you know you are going to get to your destination. Have the same outlook with investing and you will be able to make money in the stock market.

Afterword From Brent

I couldnt agree more that you need to start investing today if you arent already. Time and compounding interest are magical.

One service I have been looking into lately is Personal Capital. Not only can you manage all of your account in one place (which is super cool) they also bring the type of wealth management formerly offered to the super rich, to you .

Click here to sign up and schedule your FREE 30 minute consultation where you will get matched with a financial advisor.

Here is a video where you can learn more about Personal Capital .