The Pros and Cons of Preferred Stocks Financial Web

Post on: 27 Апрель, 2015 No Comment

Preferred stocks are a type of investment that provides you with some features of debt and equity instruments at the same time. With this investment, you can receive regular interest payments and have a higher claim on the assets of a company, in the event that the company went out of business. Here are some of the pros and cons of investing in preferred stocks.

Pros

One of the biggest advantages of investing in preferred stock is that you can bring in a steady income. With this type of investment, you will receive a regular dividend payments from the company. The good thing about this is that the dividend payments are going to be paid before any dividends for common stock are paid. You will also build dividends, which means that if the company decides to skip a payment, they will have to pay you back in the future and the payments will be higher than what you could get by purchasing bonds from the same company. This means that investors who want to create a regular source of steady income for themselves should definitely consider investing in preferred stocks.

Another advantage of preferred stocks is that they are subject to less price volatility, when compared to common stock. Common stocks can fluctuate significantly from one moment to the next. This makes it very difficult for certain investors to keep up with the value of their investments. With preferred stocks, this is not the case and the volatility of the stock remains more stable.

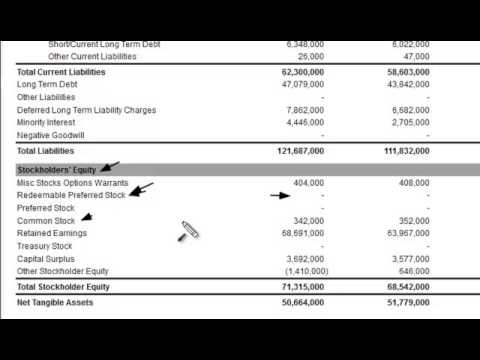

Also, you will also be in a better position than common stockholders if the company goes out of business. When it comes to liquidation proceedings, preferred stocks are listed above common stock.

Cons

Preferred stocks are callable. This means that the company could decide to pay you back for your initial investment at any point. This makes it very unpredictable and makes it hard to determine how much money you will be able to earn in dividends over the years.

When you invest in preferred stocks, you will also not have any voting rights in the company. For common stockholders, you get one vote for every share of stock that you own with most companies. This means that for important company matters such as electing a Board of Directors or deciding whether or not to merge with another company, common stockholders will have a say. Preferred stockholders must abide by the rules of the common stockholders in these types of situations.

$7 Online Trading. Fast executions. Only at Scottrade