The Pros and Cons of Floating Rate Funds Investment U

Post on: 16 Май, 2015 No Comment

by Jason Jenkins Friday, April 6, 2012 Income

Floating rate funds are closed-end mutual funds that seek to provide yields that match the prime rate. This attractive yield is often more than twice the federal funds rate and somewhat higher than the rate on five-year CDs.

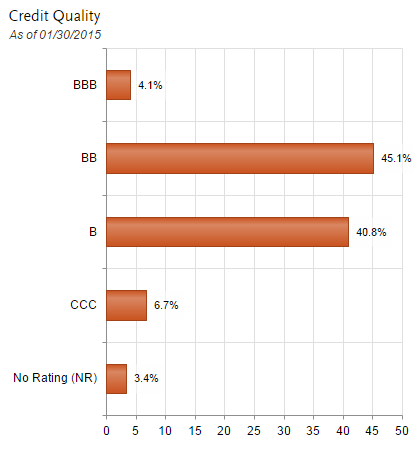

In order to get these kinds of yields, prime-rate funds invest in floating-rate, secured corporate loans. These loans have been made by commercial banks and insurance companies to corporations with “iffy” financial statements. In addition to borrowing money from the banks or insurance companies, the corporations may also have borrowed money by issuing junk bonds.

What you might like about floating rate funds:

The following may give you cause for concern:

Something else to keep in mind

Last July, the Financial Industry Regulatory Authority (FINRA) issued an investor alert warning that floating rate funds achieve their yields by investing in bank loans, which carry higher risk of default than investment-grade bonds. They’re also traded over the counter, as opposed to on an exchange, so they’re less liquid. The total effect, says FINRA, is that investors may be chasing the promise of higher returns without fully understanding the higher risk involved in these funds.

So, this market is experiencing a little of the herd mentality.

Fund managers argue…

Those who manage floating rate funds agree that they’re risky, but say the pros overshadow the cons. For one, they’re more conservative than high-yield bond funds, says Paul Massaro, the co-manager of the T. Rowe Price Floating Rate Fund (PRFRX ), If an underlying issue defaults, the long-term recovery prospects are better than for other high-yield bonds, because banks have priority over other bondholders in the event of a default.

Scott Page, co-manager of the Eaton Vance Floating Rate Fund (EVBLX ) says the securities are no less liquid than municipal bonds or mortgage-backed securities.

But when it’s all said and done, an investment of this complexity requires the necessary due diligence. And these are probably not a good idea until we see interest rates stabilize above their current miniscule levels.