The predictive power of yield spread evidence from wavelet analysis

Post on: 16 Март, 2015 No Comment

Page 1

123

Empirical Economics

Journal of the Institute for Advanced

Studies, Vienna, Austria

ISSN 0377-7332

Empir Econ

DOI 10.1007/s00181-013-0705-6

The predictive power of yield spread:

evidence from wavelet analysis

123

all rights are held exclusively by Springer-

Verlag Berlin Heidelberg. This e-offprint is

for personal use only and shall not be self-

archived in electronic repositories. If you wish

to self-archive your article, please use the

accepted manuscript version for posting on

your own website. You may further deposit

Arif Billah Dar · Amaresh Samantaraya ·

Firdous Ahmad Shah

Received: 12 June 2012 / Accepted: 5 February 2013

© Springer-Verlag Berlin Heidelberg 2013

Abstract This paper examines whether the spread between long- and short-term

interest rates contains information about future economic activity in India. Using

the yields on securities with maturities ranging from three months to ten years, we

1 Introduction

Information about a country’s future economic activity is important to consumers,

investors, and policy makers. A large portion of the recent macro-finance literature

suggests that financial variables have useful information content in predicting future

economic activity. The advantage of forecasts based on financial variables is based on

the fact that these forecasts are simple to implement, the data are readily available and

less prone to measurement errors. One financial variable that has been particularly

becoming popular in forecasting real economic activity is the difference between

long-term and short-term risk-free interest rates, usually known as the yield spread.

Yield spread has an edge over simple interest rates because short-term rates do not

contain all the information that can help to predict future economic activity. The

yield spread has been found useful for forecasting such variables as output growth,

inflation, industrial production, consumption, and recessions, and the ability of the

spread to predict economic activity has become something of a stylized fact among

macroeconomists.

Considerable research has been carried out examining the relationship between

yield spread and future economic activity. Stock and Watson (1989) found that yield

spreads were important to be included in their newly constructed index of leading

economic indicators. Estrella and Hardouvelis (1991) have thoroughly studied the

leading indicator property of the yield spreads for the economic activity in the United

States (US), and according to them, the slope of the yield curve is positively related

to future economic activity in the US. According to the influential paper in this line

of research by Estrella and Mishkin (1997), the term spread has significant predictive

power for both real activity and inflation in four major European countries (France,

Germany, Italy, and the UK). Bonser-Neal and Morley (1997), after examining eleven

developed economies, found that the yield spread is a good predictive instrument for

future economic activity. In the same vein, Venetis et al. (2003) reached the same

conclusions, as did Hamilton and Kim (2002). Ang et al. (2006), after modeling

regressor endogeneity and using data for the period 1952–2001, conclude that term

spreadhaspowertopredicteconomicactivity.BordoandHaubrich(2008)examinethe

predictive power of the yield curve in the US over the period from 1875 to 1997. They

findthatrealgrowthcanbepredictedmoreaccuratelyusingboththelevelandtheslope

of the yield curve. Other studies that link yield spread and future economic activity

such as Peel and Taylor (1998), Fisher and Felmingham (1998), Dotsey (1998), and

Stock and Watson (2003) also confirm the ability of yield spread to predict economic

activity.

While most of the studies find yield spread as good predictor of economic activity,

Page 5

The predictive power of yield spread

premium in yield spreads (see Rosenberg and Maurer 2008) have also been cited as

reasons for not finding the predictive power of yield spreads.

The empirical validity of predictive power of the yield spread is therefore still an

unsettled debate. Much of the work has focussed on developed countries, whereas its

empirical verification has received least attention in developing countries like India.

This is partly because, till recent past, many developing countries did not form a suit-

able test case owing to their regulated interest rate regimes which did not allow the

emergence of market determined yield curve. In India, after the emergence of yield

curve, attempt has been made to establish the predictive power of yield spread. Kana-

gasabapathyandGoyal(2002)arguethatIndianyieldspreadpost1996issuccessfulin

predicting future economic activity. Using probit estimation procedure, Bhaduri and

Saraogi (2010) have shown that yield spread in India is able to time stock markets.

Notwithstandingconsiderableresearcheffortsonanalyzingthepredictiveabilityof

theyieldspreadforeconomicactivity,fewquestionsstillremainopentodebate.Some

of such questions are flagged as follows: Are there other reasons besides government

regulations, asymmetric monetary policy effect and time varying term premium in

spreads that diminish the predictive power of yield spreads? Does the informational

content depend on time patterns? In other words, is there any variability in the predic-

tions, when time periods of short-run, medium-run, and long-run are considered? Are

their switching signs of the coefficients and does their significance change, when one

regresseslaggedtermspreadsonoutputintheshort-,medium-,andlonger-timescale?

Empirical analysts have paid scant attention toward the role of time scales in estimat-

ing the predictive ability of term spreads. Standard econometric methods like vector

error correction and co-integration models generally employed in economics have

been designed to deal with just two time frames: the short and the long run. However,

recent developments in statistical techniques have made it possible to think of more

than two time scales. In this direction, studies like Zagaglia (2006), and Tabak and

Feitosa (2009, 2010) have used the wavelets to test the multi-scale predictive ability

of yield spreads.

Inthispaper,weemploywaveletmethodologytotesttheabilityoftheyieldspreads

to predict economic growth in India. The present study improvises upon the previous

studies in several respects. Previous studies have used discrete wavelet transform

(DWT) to decompose the yield spread and output; we use maximal overlap discrete

transform (MODWT) to decompose them into different time scales. MODWT comes

with extra benefits which are discussed in Sect. 4. Secondly, following Tkacz (2004),

wetestthepredictiveabilityofyieldspreadsconstructedatshorterend,longerend,and

policy relevant areas of yield curve. The results stemming the aggregate (unfiltered)

A. B. Dar et al.

in the study. In Sect. 4, the results of the analysis are discussed, and finally, Sect. 5

gathers the main conclusions.

2 Motivation and methodology

Until recent past, the predictive ability of yield spread has been estimated using con-

ventionaltimedomainapproach,andunderlyingtimescaleshavealmostbeenignored.

Nevertheless,itisclearthatthestrategiesusedbybothemployersandemployeesdiffer

by time scale; that is, employers, for example, may adjust hours worked in the short-

run, to redesigning the plant in the longer-run, to moving manufacturing abroad in the

longest run (see Gallegati et al. 2011). This leads to heterogeneous frequency con-

tents in the production time series. Similarly, monetary policy, which drives the most

predictive power of the yield spread, is also a heterogeneous process. Central banks

have different objectives in the short and long run, and they operate at different time

scales separately (see Aguiar-Conraria et al. 2008). This operation of central banks

at different time scales also leads to heterogeneous frequency contents in the yield

spreads. Essentially, the actual time series of both yield spread and output growth are

generated by the combination of different frequencies or time scales. Therefore, when

the relationship between output and yield spread is modeled in time domain frame-

work, it leads to time or frequency aggregation bias, with true relationships remaining

veiled under frequencies or time scales.1

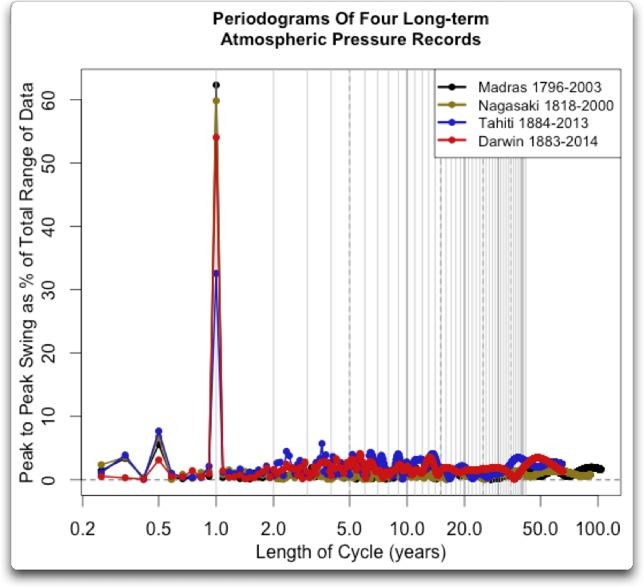

In the existing literature, it has been a common practice to utilize Fourier analysis

to uncover relations at different frequencies. In spite of its utility, under the Fourier

transform, the time information of a time series is completely lost. Because of this

loss of information, it is hard to distinguish transient relations or to identify structural

changes. Moreover, these techniques are only appropriate for time series with stable

statistical properties, i.e. stationary time series. Unfortunately, typical economic time

series are noisy, complex, and strongly non-stationary. To overcome the problems of

analyzing non-stationary data, Gabor (1946) introduced the short-time Fourier trans-

form (STFT). The basic idea of this transform is to break a time series into smaller

sub-samples and then apply the Fourier transform to each sub-sample. However, this

approachhasbeenfoundinefficientbecausethefrequencyresolutionisthesameacross

alldifferentfrequencies.AnalternativetotheSTFTforanalysisofnon-stationarysig-

nals is represented by the wavelet transform.

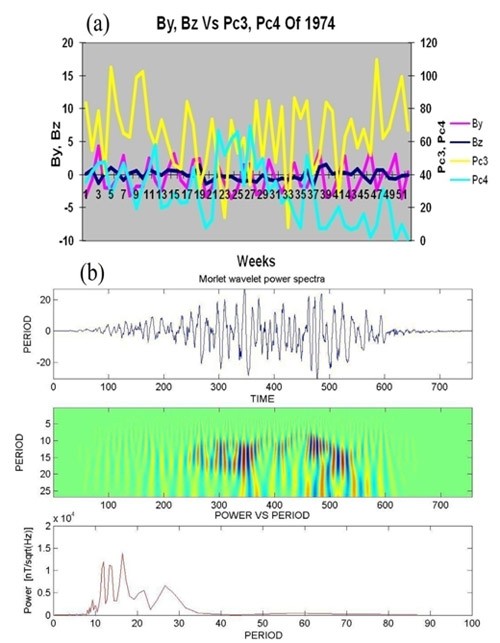

Wavelet analysis shares several features in common with Fourier analysis but has

the advantage of capturing features in the underlying series that vary across both time

and frequency. Wavelets are mathematical functions that decompose data into differ-

ent frequency components, after which each component is studied with a resolution

matched to its scale. These functions are generated by the dyadic dilations and inte-

ger shifts a single function called a mother wavelet. The key feature of wavelets is

the time-frequency localization. It means that most of the energy of the wavelet is

restricted to a finite time interval and its Fourier transform is band limited. When

1Since time and frequency are inversely related, higher time scales represent lower frequencies of time

series and vice-versa.

123

Page 7

The predictive power of yield spread

compared to STFT, the advantage of the time-frequency localization is that wavelet

analysis varies the time-frequency aspect ratio, producing good time resolution and

poor frequency resolution at high frequencies, and a good frequency resolution and

poor time resolution at low frequencies. This approach is logical when the signal on

hand has high-frequency components for short durations and low-frequency compo-

nentsforlongdurations.Fortunately,thesignalsthatareencounteredinmosteconomic

applications are often of this type.

The application of wavelet theory in modeling and analyzing economic data is a

recent phenomena and its applications in economics began in the late nineties by the

contribution of Ramsay and his collaborators (See for example Ramsay and Lampart

1998a,b). Since then wavelets have been used in many areas of economics and finance

(see Percival and Walden 2000; Gençay et al. 2002; Ramsey 2002; Crowley 2007),