The Power of Compound Interest

Post on: 7 Апрель, 2015 No Comment

How Compound Interest Can Make You Rich Through Sound Investments

Albert Einstein once noted that the most powerful force in the universe was the principle of compounding. In investing, this manifests itself through something called compound interest. Put in its simplest terms, the phrase compound interest means that you begin to earn interest income on your interest income, resulting in your money growing at an ever-accelerating rate. It is the reason for the success of every person on the Forbes 400 list and anyone can take advantage of the benefits through a disciplined investing program. Benjamin Franklin was famous explaining to people that it was the best way he knew

The Three Things That Determine Your Compound Interest Returns

There are three things that will influence the rate at which your money compounds. These are:

- The interest rate your earn on your investment or, alternatively, the profit you earn; e.g. if you are investing in stock. this would be your total profit from capital gains and dividends .

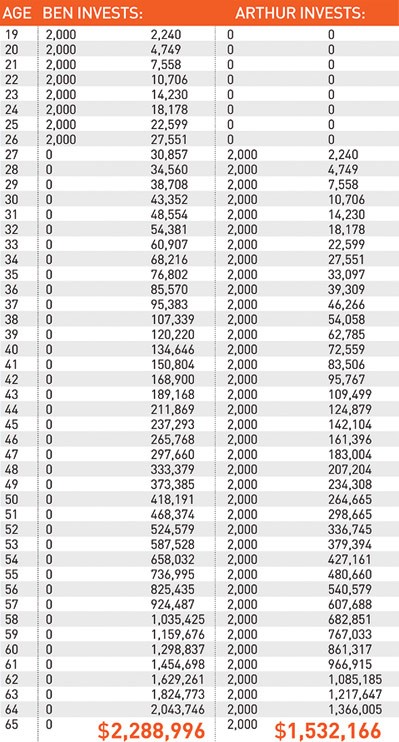

- The length of time you can leave your money to compound. The longer your money can remain uninterrupted, the bigger your fortune can grow. It’s no different than planting a tree. Naturally, the tree is going to be larger when it is 50 years old than it was when it was 20 years old.

- The tax rate. and the timing of the tax, you have to pay to the government. You will end up with far more money if you don’t have to pay taxes at all, or until the end of the compounding period rather than at the end of each year. That’s why accounts such as the Traditional IRA or Roth IRA. 401(k). SEP-IRA. and such are so important.

Compound Interest Results Over Time

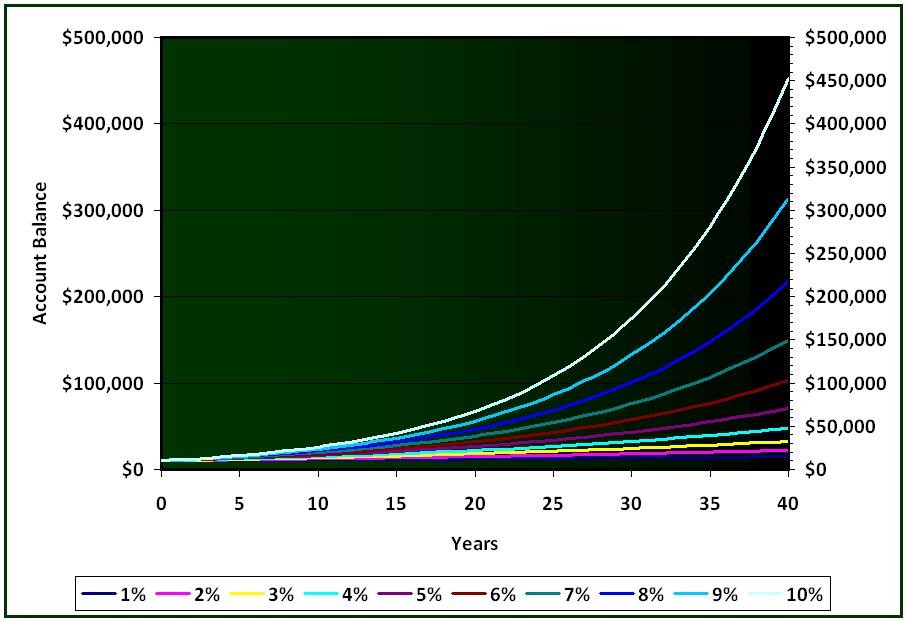

The best way to understand these concepts is to put them into a compound interest table that shows you just how substantially your wealth can be helped, or hindered, by small changes over time. Imagine you have an investor who sets aside a lump sum of $10,000. Take a look at the compound interest chart at the bottom of the page to see the influence of time and rate of return on his ultimate wealth. Once you understand this, it becomes evident that saving money alone doesn’t explain why some people have bigger fortunes than others.

For instance, a 20 year old that invests $10,000 today and parks it in Treasury bills, earning 4% on average for the next 50 years, will find himself with $71,067 if the purchases were made through a tax-free account such as a Roth IRA. Had he invested in stocks and real estate. earning a 12% average rate of return as a result of riding out the fluctuations, he would have ended up with $2,890,022. Adding higher returning asset classes would result in 40.67 times more money thanks to the power of compound interest. If that doesn’t convince you that taking the time to learn about and understand investing is worth the effort, I don’t know if anything ever will. You’ll have to console yourself as being part of the refrigerator problem.

Don’t Fall Prey to the Temptation of Getting Higher Returns Through Higher Risks

One glance at the compound interest chart and you may want to do whatever it takes to earn the higher rate of return — in this case, 16%. That can be dangerous. Unless you know what you’re doing, no matter how successful you are along the way, if you introduce wipe-out risk in your investments, any mistake, at any point in the chain of decisions between now and when you retire, you could destroy everything you built. In finance, 20%, 40%, 60% returns in the first years are great, but if there is a -80%, -90%, or -100% in there anywhere. it’s game over because you will have lost your capital. Without capital, you can’t make investments that will later grow.

Benjamin Graham was aware of this risk when he said that more money has been lost reaching for a little extra return or yield than has been lost to speculating. He warned that it is one of the greatest temptations new investors face when building a portfolio.