The perils of trading in a Vshaped market Smarter Investing

Post on: 14 Октябрь, 2016 No Comment

The latest investment news from Covestor

The perils of trading in a V-shaped market

U.S stocks rode a roller coaster in October. After briefly closing above 2,000, the S&P 500 Index dived more than 7%.

Later in the month, the market reversed and rallied back up to the 2,000 level within a few days. The recovery speed surprised many market participants, including myself.

In my opinion, stocks seem poised for a deeper correction, but every minor dip still gets aggressively bought. The V-shaped market reversals have been a major pattern during the last two years.

Zigging and zagging

The V-pattern is not easy to trade because it requires aggressive buying into an overbought markets after the initial rally.

To alternatively buy into the selloff can be suicidal since the V pattern might stop working one day and markets could keep declining.

Still, Im pleased with the Technical Swing portfolio performance during October.

I went into the month with various short positions, but kept taking profits into the decline. I knew there was the possibility that the V could occur again so one had to be careful on the short side.

After the middle of October, the question became what to buy to participate on the long side. I observed how former market leaders behaved during the selloff and subsequent recovery.

Airlines

One of the most interesting sectors has been the airlines. These carriers are benefiting from the U.S. economic recovery and declining fuel costs.

Our favorite holding, Southwest Airlines (LUV). rallied strongly after the selloff, suggesting to me that buyers still favor this sector.

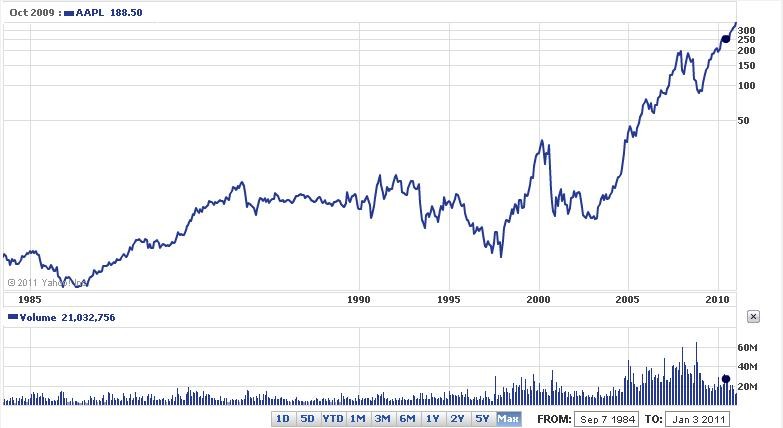

Large cap tech stocks have been showing good relative strength. Apple (AAPL) and Microsoft (MSFT) are current long positions in the portfolio.

I added the SPDR Gold Shares ETF (GLD) as a short position. This trade is technically driven. The price of the ETF broke through an important support level last month in my opinion and continued its long-term downtrend.

It was telling to me at least that metals failed to rally despite the bad news in October worries such as Russia, ISIS and the equity market selloff.

Europe

So where could equities go from here? Quite simply, the uptrend is still intact in my opinion and the environment for stocks remains favorable.

A potential catalyst from overseas could push equity prices higher. Many European countries are still struggling economically.

European Central Bank President Mario Draghi may be preparing a major European quantitative easing (QE) program, which could launch at the beginning of next year.

I am considering ways to play this theme, possibly through some currency hedged ETF in order to offset a possible decline in the Euro.

In any case, a weaker Euro means a stronger dollar and therefore also pressures the price of gold. Another reason for our current gold short position discussed above.

Subscribe to our once-weekly email newsletter and get the best posts delivered to you in one convenient place, to browse at your leisure: