The Perfect ETF Porfolio Results For 2013

Post on: 2 Июль, 2015 No Comment

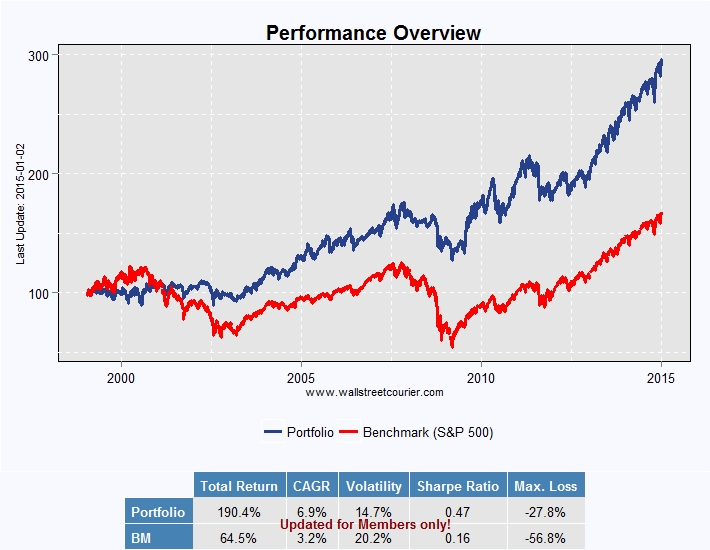

Today, I will be examining the Perfect ETF Portfolio and what it has achieved for investors over the past several years. This portfolio is specifically designed to avoid risk and provide a modest return. It is appropriate for IRAs and Roth retirement portfolios using ETFs. This portfolio is our most conservative portfolio and is designed to steadily plod along and protect capital with less risk than an outright position in the S&P 500 index.

With the Perfect ETF Portfolio. we track just four ETFs in non-correlating markets. You would divide your capital into four parts and trade equal dollar amounts in each of the ETFs.

GLD — SPDR Gold Shares Trust

This investment seeks to replicate the performance and net of expenses of the price of gold bullion. The trust holds gold and is expected to issue baskets in exchange for deposits of gold, and to distribute gold in connection with redemption of baskets. The gold held by the trust will only be sold on an as-needed basis to pay trust expenses, in the event the trust terminates and liquidates its assets, or as otherwise required by law or regulation.

USO — United States Oil

This investment seeks to reflect the performance, less expenses, of the spot price of West Texas Intermediate (WTI) light, sweet crude oil. The fund will invest in futures contracts for WTI light, sweet crude oil, other types of crude oil, heating oil, gasoline, natural gas and other petroleum based-fuels that are traded on exchanges. It may also invest in other oil interests such as cash-settled options on oil futures contracts, forward contracts for oil, and OTC transactions that are based on the price of oil.

SPY — SPDR S&P 500

This investment seeks to provide investment results that, before expenses, generally correspond to the price and yield performance of the S&P 500 Index. The Trust holds the Portfolio and cash and is not actively managed by traditional methods. To maintain the correspondence between the composition and weightings of Portfolio Securities and component stocks of the S&P 500 Index (Index Securities), the Trustee adjusts the Portfolio from time to time to conform to periodic changes in the identity and/or relative weightings of Index Securities.

FXE — CurrencyShares Euro Trust

This investment seeks to track the price of the Euro, net of trust expenses. The fund seeks to reflect the price of the Euro. The sponsor believes that for many investors, the shares represent a cost-effective investment relative to traditional means of investing in the foreign exchange market.

While 2013 was a stellar year for stocks in general, the Perfect ETF Portfolio underperformed. The ETF SPY produced a modest gain of $1,225.56, which was a very respectable 9.8% ROI.

The USO had a nondescript year and did not perform, with a rather flat ROI of 0.02%.

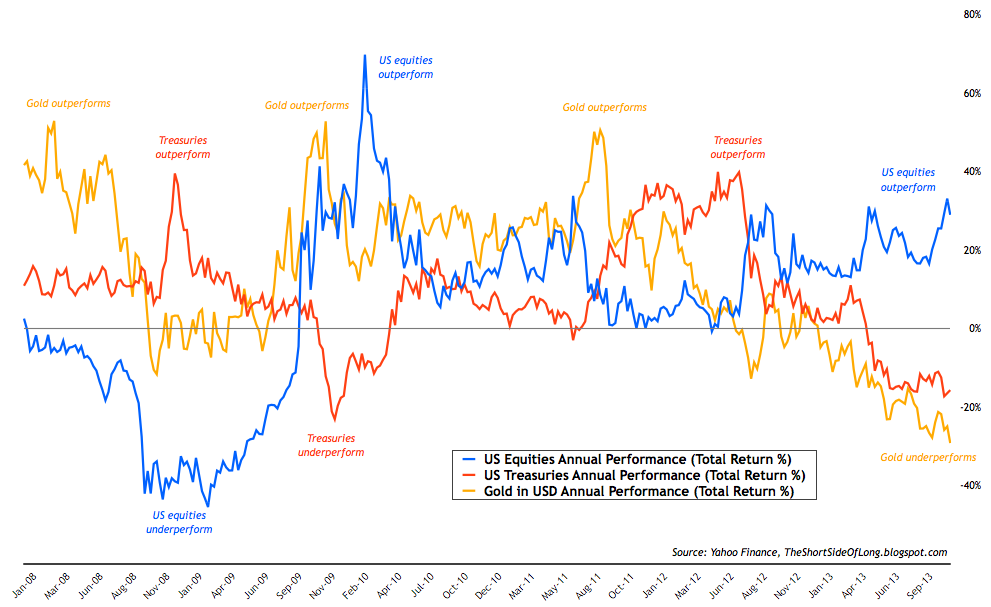

In 2013 the Perfect ETF portfolio was out of the ETF GLD for the entire year. The money put aside to trade this ETF would have earned a modest return on treasury bills. The FXE on the other hand, the ETF that mimics and tracks the Euro/USD, did not perform particularly well with a negative ROI of 1.6% for the year.