The Perfect ETF for Higher Japanese Stocks and a Weaker Yen

Post on: 25 Июнь, 2015 No Comment

Feature Stories News:

Investors who think the Bank of Japan will be compelled to launch more monetary easing to weaken the yen and boost the economy might want to take a look at WisdomTree Japan Hedged Equity Fund (NYSEArca: DXJ).

The ETF tracks Japan’s stock market but is designed to hedge exposure to fluctuations between the value of the U.S. dollar and the Japanese yen. It can be thought of a pure play on Japanese equities without the influence of currency moves. The fund holds $643.4 million in assets and charges an expense ratio of 0.48%.

The largest Japanese stock ETF is iShares MSCI Japan Index Fund (NYSEArca: EWJ) with assets of $4.2 billion and fees of 0.51%. The fund does not hedge its foreign currency exposure. That means its performance will suffer when the yen weakens versus the dollar. The reverse it also true – a stronger yen will give the ETF a tailwind.

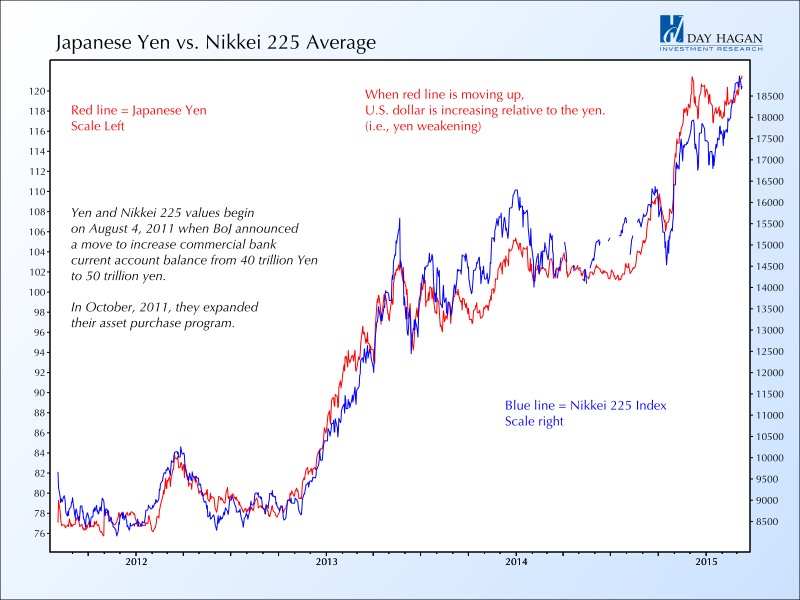

The yen has dropped against the dollar the past couple months on expectations the Bank of Japan will announce additional monetary stimulus to aid the flagging economy. Central bank stimulus weakens the yen and helps the country’s exporters.

CurrencyShares Japanese Yen Trust (NYSEArca: FXY). which tracks the movement of the yen versus the U.S. dollar, is down about 4% the last three months.

The favorite to become Japan’s next prime minister, Shinzo Abe, has pledged to pressure the Bank of Japan to launch unlimited monetary easing to revive the economy. [Japanese Yen ETF Drops to Seven-Month Low]

Increased focus on multinationals

The weaker yen has helped WisdomTree Japan Hedged Equity Fund (DXJ) outperform iShares MSCI Japan Index Fund (EWJ) recently.

DXJ is up 4.5% the past three months compared with a 0.7% gain for EWJ, according to Morningstar performance data. Of course, DXJ will trail EWJ during periods when the yen is rising against the greenback.

It should be noted that DXJ weights stocks by dividends while EWJ weights by market capitalization. This can result is different sector allocations and other contrasts between the two funds.

DXJ is also implementing an index methodology change after Friday’s close designed to add multinational companies that generate more revenue from global markets rather than the local Japanese market.

For example, companies that derive more than 80% of their revenue from Japan will be excluded from the index.

“We believe Japan-based multinational companies that generate the bulk of their revenues from markets outside of Japan are more likely to benefit from a weakening yen,” WisdomTree (NasdaqGM: WETF) says in a white paper. “Companies with a purely Japanese revenue base, on the other hand, are unlikely to benefit from a weakening yen, especially if imported materials are part of their production process. Essentially, while a weakening currency can make exports more attractive for foreign consumers, it can also make imports less attractive, as these prices would tend to increase as the currency weakened.”

WisdomTree’s director of research Jeremy Schwartz in a telephone interview said there tends to be a negative correlation between the yen and Japanese stocks.

“DXJ removes the currency effect from the equation for investors,” he said. “Unhedged Japanese yen ETFs can get a dampening effect from a weaker yen when stocks rise but the currency weakens. We think DXJ is a better implementation.”

The fund could also be used to bet against the yen if investors think the Bank of Japan will ease further, rather than shorting yen ETFs or using inverse currency ETFs.

“The equity market could go up more than the yen weakens,” Schwartz said.

WisdomTree Japan Hedged Equity Fund

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.