The Next Big Move in Commodities

Post on: 16 Март, 2015 No Comment

Jim Wyckoff

I have maintained for some time the overall raw commodity sector will, in the not-too-distant future, resume a bullish phase that will push most commodity market prices higher in 2012. But there are now some headwinds for raw commodities that cannot be ignored and also must be overcome for a bullish cycle to resume.

From a fundamental perspective, the resurgence of the U.S. dollar against the other major currencies of the world the past few months has been a bearish weight on the raw commodity sector. Most major world commodities are priced in U.S. dollars. When the greenback appreciates it makes those commodities more expensive to purchase with currencies other than the U.S. dollar. If the dollar continues to appreciate then raw commodities will only become more expensive for most of the world to purchase.

The other major bearish supply and demand fundamental overhanging the commodity sector is the European Union sovereign debt crisis that has not only sapped speculative interest in risk assets such as raw commodities, it has also raise fears of a worldwide debt contagion developing that could send the major world economies back into recession. Such would be very bearish for commodity markets, as the specter of price deflation would arise. Deflation is the archenemy of commodity market bulls.

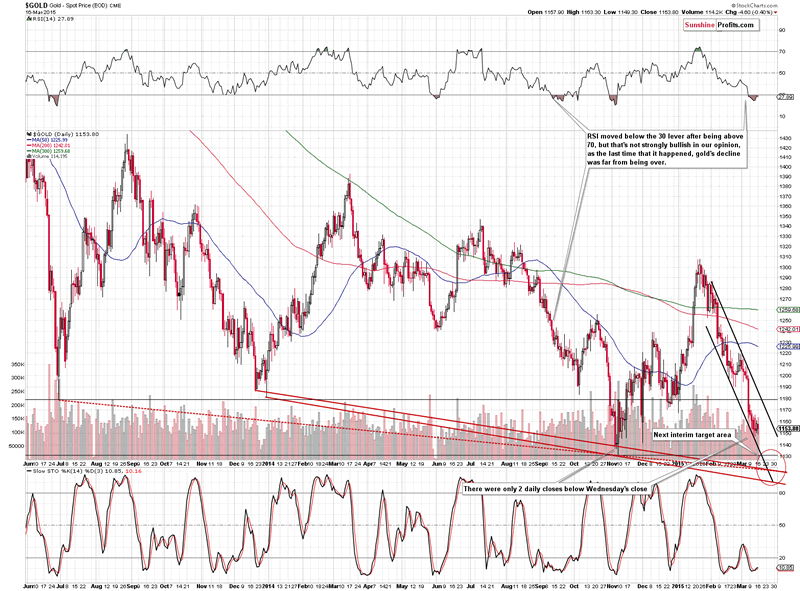

The technical posture of the raw commodity sector is also bearish. An examination of a weekly chart for the Continuous Commodity Index (which is a basket of 17 major raw commodity market prices rolled into one index price) shows prices have been trending lower since the second quarter of 2011. Until that price downtrend on the weekly CCI chart can be negated the path of least resistance, technically, for the index will continue to be sideways to lower.

Commodity Bulls Hold the Trump Cards

While the factors mentioned above do not paint a rosy picture for commodity markets at present, there are two very important fundamental elements which are likely to come more into play during 2012. Elements that are likely to turn the tide in the commodity sector in favor of the bulls.

First is the recent improving economic growth from most of the major industrialized nations of the world that will foster significantly better demand for commodities in the coming months. This week, commodity-consuming juggernaut China reported economic growth of near 9%, annually.

The second trump card the commodity bulls hold in their hand is the very accommodative monetary policies the major central banks of the world have implemented the past three years. This easy-money economic policy augurs for inflationary price pressures to surface at some point down the road. Economic theory suggests such is nearly unavoidable. Problematic price inflation is a major bullish fundamental for raw commodity markets.