The Masters 100 Fund (MOFQX) Investment U

Post on: 11 Июль, 2015 No Comment

by Mark Skousen Friday, June 6, 2008 Wisdom of Wealth

by Dr. Mark Skousen. Advisory Panelist, Investment U

Friday, June 06, 2008: Issue #804

We can all identify the great money managers of the past, but how do we find the skilled money managers of the future? That’s the toughest question facing investors who want to maximize their returns without having to become Wall Street experts themselves.

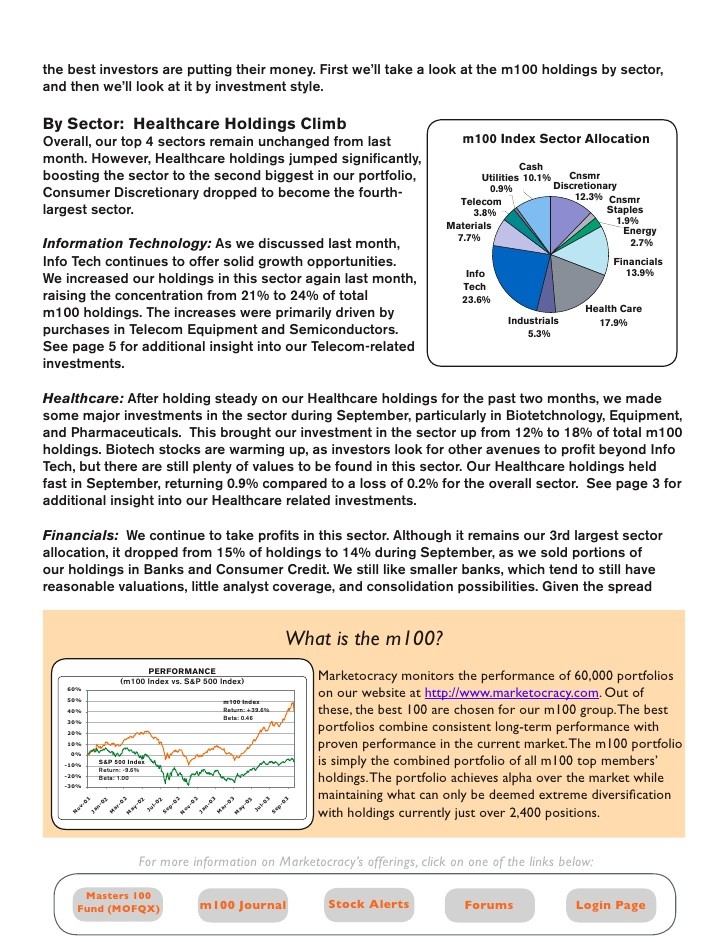

One of the best sources I know for discovering skilled money managers and profiting from them is through the Masters 100 Fund (MOFQX ), managed by Stanford MBA Ken Kam. Ken, a previous co-manager of the Firsthand Technological Value Funds, but left in 2000 (good timing) and started the website Marketocracy.com, where managers, analysts and everyone else can establish their own track record.

You can go to their website, www.marketocracy.com. to create your own model portfolio that is priced every day as if it were a mutual fund. I did this a couple of years ago and outperformed the markets for several months, until I was told I was out of compliance with their mutual fund rules. Still, it was fun and I recommend you try your hand at it.

Since Kam started this virtual portfolio idea eight years ago, more than 100,000 people have set up a model portfolio, and there are now over 30,000 whose track records are more than five years old. For each investor, Marketocracy analyzes each person’s track record stock-by-stock, and even trade-by-trade. But does it work?

Money Managers: Putting Theory into Practice

Ken Kam has gradually improved his ability to uncover skilled investors, as opposed to lucky traders. He and his staff constantly search the data to find good long-term traders. They are constantly working to quantify what makes a better investor.

For example, consider two investors who each delivered the same return over the last five years. Suppose one investor’s overall return was based entirely on a spectacular single trade, buying Google at its IPO price, and the other investor made hundreds of trades — of which 85% of the stocks were profitable?

The second money manager would definitely be the one to go with. Skilled investors have to do two things well — pick the right stocks and trade them well. The key is to find the investors who have this skill in both bull and bear markets.

The acid test of any active strategy is whether clients get a better return than an index fund. Since November 5, 2001, Ken Kam and the Masters 100 Fund have put this strategy to the test by using it to manage a mutual fund.

Their data shows that skilled investors exist, but they’re rare. Kam and company have selected and signed research contracts with roughly 500 investors who have demonstrated a high level of skillfulness. It is from this group that they select their research team, the top ten investors who trade stocks. From these recommendations, the Masters 100 Fund buys and sells stocks.

How well has the fund done?

Over time, it’s done better and better. It started out with a two-star rating from Morningstar and its now a five-star fund. For the three-year period ending April 30, 2008, the fund was up 54.7%, doubling the return of the S&P 500 Index, which was up 26.78% during the same period. Not bad.

You should consider adding the Masters 100 Fund to your portfolio.

Good trading,

Mark

Today’s Investment U Crib Sheet

Don’t be afraid to do your own research. Studies have shown that individual investors generally do better than the professional money managers. Remember, nobody is more concerned about your money than you are.

For those of you who are comfortable managing your own accounts, here are three resources you can put to work right away. They’re free.