The Long Straddle and Gamma Scalping

Post on: 23 Апрель, 2015 No Comment

The Long Straddle

The long straddle is a limited risk strategy used when the tactical option investor is forecasting a large move in the underlying or an increase in the implied volatility or both.

I don’t believe that traders should have a strategy bias. Traders should study the market and apply the strategy that best applies to their market forecast. Traders with a strategy bias tend to limit their opportunities.

However, I do think that it’s ok to have a few favorite strategies that you employ when you think that the time is right. One of my preferred strategies is the long straddle. For those of you unfamiliar with the strategy, the long straddle is the simultaneous purchase of at the money call and put. For example if XYZ stock is trading at $25, an investor would purchase the 25 strike call and put at the same time. The long straddle is a limited risk, theoretically unlimited profit potential strategy.

Why purchase a straddle? A straddle should be purchased when the investor forecasts a large price move in the underlying or an increase in implied volatility, or both. It is easier to forecast a move in the implied volatility than to attempt to predict price movement. One of the best times to put on a long straddle is in the weeks preceding a quarterly earnings report. Implied volatilities can have a tendency to rise in anticipation of the earnings numbers and peak out just prior to the announcement.

A straddle purchased before the volatility increase can be profitable. Generally they should be put on 3-4 weeks before the announcement, so they can be purchased when the implied volatility is low and appreciate in value as the implied volatility increases as the earnings announcement date is approached.

What are the risks associated with the long straddle? Well the implied volatility may not increase and the stock price may remain very stable. In that case, the enemy of the option purchaser, time decay or theta will take its toll on the position. You may also want to consider the volatility of the broad market before purchasing a straddle. If the broad market has a very high volatility level due to some recent event, it may not be the best time for a straddle. If the VIX is at high levels you might want to consider another strategy. If the VIX is at normal levels or has declined and the investor is forecasting a rise in the VIX and a rise in the implied volatility of an individual equity due to an impending earnings announcement, a long straddle may be an appropriate strategy.

Is there any way to offset the effects of the time decay as measured by the theta? One tool that can be employed by aggressive traders is known as gamma scalping. When you purchase a straddle you have the right to buy or sell the underlying at the strike price. So, if you are long or short the stock in the same amount of shares as your equivalent number of straddle contracts, you have protection against an adverse move in your stock position regardless of whether you are long or short.

I like to do some scanning to find stocks with a history of implied volatility increase as the earnings date approaches. Then I use a 20-day window and try to locate issues that are trading near a strike price and at a 20 day moving average. I use soft numbers, so the entry can be plus or minus a few cents from either parameter. Then I calculate the daily standard deviation by dividing the annual standard deviation by sixteen.

Why use the number 16? The square root of time is used to calculate standard deviations across multiple time frames. There are 256 trading days in a year. The square root of 256 is 15.87, so that is rounded to sixteen.

So I have now entered my straddle when the price of the underlying is at a strike and near a moving average. My position is close to being delta neutral. The at the money calls and puts should have roughly the same delta. Again, I use soft numbers, so I consider a delta of -50 to +50 as being delta neutral. Because I have a long position it will be gamma positive, so that means that the delta can change rapidly with movement in the underlying and that I will profit from large price swings.

Once the option position is on, if the stock moves up by one standard deviation, I’ll short enough shares to make my position delta neutral again. If the stock moves down by one standard deviation, I’ll take a long position in the stock. Using round lots, I’ll buy enough shares to become delta neutral once again. When the stock returns to its mean, I’ll close the position for a small gain. Remember if the stock moves one standard deviation from its mean, there is a 68% probability that it will return to the mean. If it makes a two standard deviation move, there is a 95% chance that it will return to the mean.

By gamma scalping this way, the investor can attempt to earn day trading profits sufficient enough to offset the time decay of the position. When things go right, I have been able to earn enough day trading profits from this method to completely cover the cost of the straddle before it is liquidated around the time of the earnings announcement. I don’t have a hard rule for exiting the straddle. If profits are adequate from the implied volatility increase I may liquidate the entire position just before the announcement. On the other hand I may decide to sell part of the position and keep some through the announcement and try to profit from a large move in the stock. If the position has been paid for by gamma scalping on a daily basis along the way, the investor has a lot of flexibility with their money management strategy at the exit.

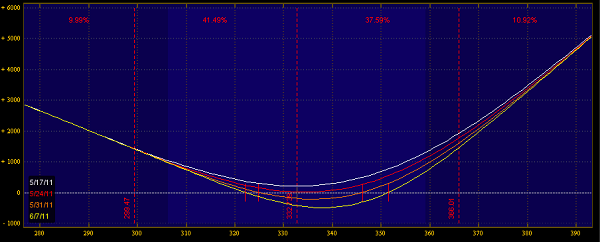

Alcoa Long Straddle P&L