The long memory of volatility

Post on: 26 Май, 2015 No Comment

The long memory of volatility

In our just-released Q4 2013 Financial Professional Outlook Survey. we look back at some of the most popular and persistent conversations between advisors and their clients . Even though it’s been more muted lately, advisors continue to tell us that volatility is the second most popular conversation their clients initiate. This isnt a new phenomenon. Advisors have said market volatility has been a consistent theme with their clients, ranking among the top two investor-initiated conversations since May 2011. So we think it’s worth exploring.

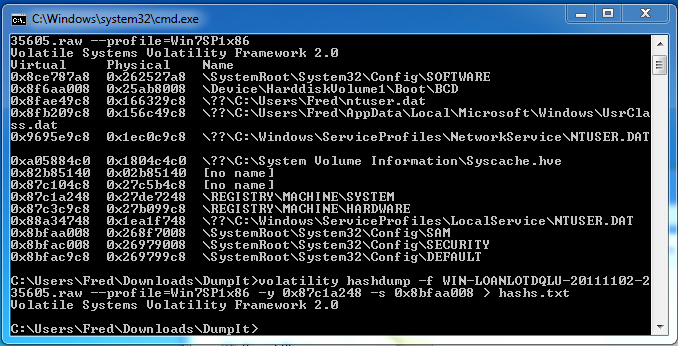

It seems investors have not been able to completely shake off the sting of high volatility that set in during the credit crisis in 2008 2009 and, more recently, the elevated levels during the summer and fall of 2011. The chart below may help us understand why.

If we look at the VIX (considered by many to be the prime barometer of investor sentiment and market volatility) over the last 20 years and slice it into five-year increments, the most recent five-year stretch has clearly been the most volatile. From 2008 to 2013, the VIX registered a 36.19 standard deviation. That high of a number represents a large dispersion and an elevated amount of risk thats pretty scary for investors to stomach. So even though we have not seen huge spikes in the VIX in 2013 – and the December 2013 reading of Russells Economic Indicators Dashboard shows that its solidly within the historically typical range investors may not have fully recovered from the rollercoaster ride that began in 2008.

Annualized Standard Deviation from December 1993 through September 2013.

Standard Deviation is a statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution. The greater the degree of dispersion, the greater the risk.

The unfortunate part of the story is that many investors may have also not fully participated in the U.S. equity market’s 175% cumulative rise from the lows of March 2009. 1. 2 We believe investors may be getting a little too comfortable now, and that is likely reflected in the higher investor optimism reading we see today. Its something to be mindful of as we enter a new year and client conversations turn to market expectations going forward .

Russells Asset Class Dashboard can be a useful tool to help with these kinds of conversations. Many advisors use it to help clients understand how different asset classes are performing currently, and in historical terms.

The bottom line

It seems investors have not been able to completely shake off the sting of high volatility that set in during the credit crisis in 2008 2009 and, more recently, the elevated levels during the summer and fall of 2011. The Economic Indicators Dashboard and Asset Class Dashboard may help them contextualize today’s less volatile environment – so they can make informed investment decisions, rather than emotional ones .

1 As represented by the Russell 3000® Index which closed at 389 on 3/10/2009 and 1079 on 12/10/2013. Source: Bloomberg.

www.moneynews.com/InvestingAnalysis/Spano-small-investors-stocks/2013/11/05/id/534805

Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

The Russell 3000 ® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market.

The Chicago Board Options Exchange Volatility Index (CBOE VIX) measures annualized implied volatility and is considered by many to be the prime barometer of investor sentiment and market volatility.