The Key Differences Between Index Funds and Traditional Mutual Funds

Post on: 12 Октябрь, 2015 No Comment

For the sake of convenience, many investors do not look to manage their own portfolios or choose their own investments. Investors who don’t want to take the time to manage their own portfolios may be interested in purchasing shares in either an actively managed mutual fund or in an index fund. Although both types of funds seek to make things easier for investors, they have different objectives that may make one more appropriate than the other for certain investors.

Differences Between Index Funds and Actively Managed Mutual Funds

An index fund is set up to match the performance of a particular index, such as the S&P 500. The fund accomplishes this by simply purchasing the same investments in the index it represents, and since the securities in many indices stay relatively constant, there is no need for frequent buying and selling of index fund holdings.

An actively managed mutual fund, however, may frequently buy and sell securities according to the fund’s objective and the manager’s discretion. These funds have higher expenses than index funds, and seek to outperform instead of simply match a benchmark index. For example, an actively managed fund that invests in large cap domestic stocks may seek to outperform the S&P 500 index.

Due to the fact that index funds and actively managed mutual funds are structured differently, you will need to understand the advantages and disadvantages of each before you decide which is best for you.

Advantages of Actively Managed Mutual Funds

Actively managed mutual funds are goal-focused. They do not seek to match the returns of an index, but rather to provide what index funds do not.

- Potential to Outperform the Market. These mutual funds can provide investors with the opportunity to outperform the market. Although it is a difficult standard to meet, some funds are able to successfully achieve this, though few, if any, do on a consistent basis.

- Can Offer Greater Diversification. Actively managed funds can invest in many different types of securities. For example, they can hold stocks, bonds, derivatives, and real estate according to the fund’s objective and at the discretion of their management. In this way, they may be able to better limit themselves from the risks associated with any single market.

- Goal Oriented. Actively managed mutual funds are set up to provide a specific purpose for investors. This can be to provide high returns, minimal risk, or tax incentives. Since fund offerings and objectives are extensive, investors can focus on finding a fund that satisfies their individual needs and risk tolerance.

Advantages of Index Funds

Index funds, however, provide a variety of advantages relative to mutual funds.

- Lower Costs. Index funds are not actively managed. Therefore, they tend to have a significantly lower annual expense ratio than their actively managed counterparts.

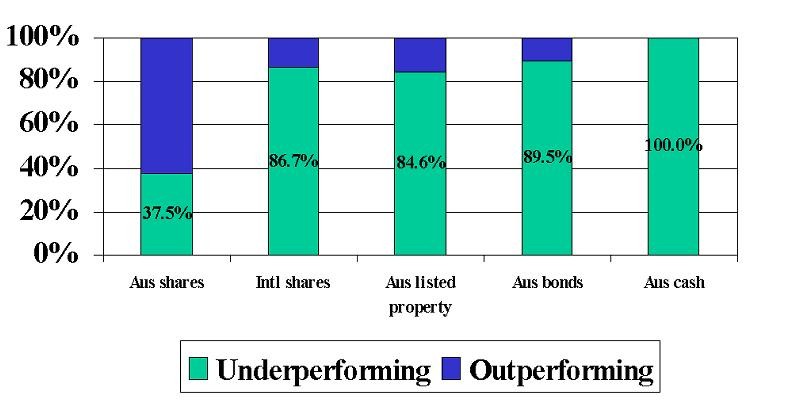

- Often Report Higher Returns. On average, index funds outperform the majority of actively managed mutual funds. In fact, some analysts have found that leading index funds outperform actively managed funds 85% of the time.

- Lower Capital Gains Taxes. Due to the fact that index funds aren’t actively managed, turnover is not as high. Therefore, investors are less likely to have to pay capital gains taxes than they would with actively managed funds, which typically sell holdings more regularly.

Which Fund Is Best for You?

You will need to consider your investing goals to choose which type of fund is best for you.

One of the most appealing things about index funds is their low-cost structure; especially if you’re investing for the long-term, annual expenses can significantly eat into your gains year after year. Also, index funds are advantageous for investors who are interested in saving on their taxes, as they rarely report capital gains comparable to most actively managed funds.

That being said, investors should also consider that there are a number of different types of both index and actively managed mutual funds, and with actively managed mutual funds, they may be able to find a more specialized fund that satisfies their investing needs. For example, an investor who is interested in investing in both bonds and stocks could purchase an actively managed balanced fund. To accomplish this in index funds, he or she would have to separately purchase both a stock index fund and a bond index fund.

Final Thoughts

While you may be tempted to invest in an actively managed mutual fund if you want to beat the stock market, you should be realistic about your chances of doing so. The majority of these funds do not outperform stock market indexes, so your best bet could be to invest in an index fund that replicates the index itself.

That said, if you’re willing to do the research required to find a winning fund, going the active management route could pay off. Regardless of whether you invest in an index or actively managed mutual fund, the most important thing is to make sure that you are investing in a fund that is consistent with your own financial goals.

Reposted with permission from YourSmartMoneyMoves.com.

All investments carry some level of risk, and may not be suitable for all investors. Before deciding on any investment, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Seek advice from an independent financial advisor if you have any questions or doubts.

Ted Jenkin is a founder and co-CEO of oXYGen Financial, Inc. After a distinguished tenure with American Express, Ted sought to focus his expertise on continuing education and the financial needs of students and recent grads. One of the foremost knowledgeable professionals in his field, Ted specializes in offering excellent financial advice and planning to Gen X and Y clients. For more information and a free consultation, visit oXYGen Financial .