The Ins And Outs Of Inflation

Post on: 28 Апрель, 2015 No Comment

Inflation, to one degree or another, is a fact of life. Consumers, businesses and investors are impacted by any upward trend in prices.

Financial Reporting and Changing Prices

Back in the period from 1979 to 1986, the Financial Accounting Standards Board (FASB) experimented with “inflation accounting,” which required that companies include supplemental constant dollar and current cost accounting information (unaudited) in their annual reports. The guidelines for this approach were laid out in Statement of Financial Accounting Standards (SFAS) No. 33, which contended that “inflation causes historical-cost financial statements to show illusionary profits and mask erosion of capital.”

With little fanfare or protest, SFAS No. 33 was quietly rescinded in 1986. Nevertheless, serious investors should have a reasonable understanding of how changing prices can affect financial statements, market environments and investment returns.

Corporate Financial Statements

In a balance sheet, fixed assets–property, plant and equipment –are valued at their purchase prices (historical cost), which may be significantly understated compared to the assets’ present day market values. It’s difficult to generalize, but for some firms, this historical/current cost differential could be added to a company’s assets, which would boost the company’s equity position and improve its debt/equity ratio .

In terms of accounting policies, firms using the last-in, first-out (LIFO) inventory-cost valuation are more closely matching costs and prices in an inflationary environment. Without going into all the accounting intricacies, LIFO understates inventory value, overstates the cost of sales and therefore lowers reported earnings. Financial analysts tend to like the understated or conservative impact on a company’s financial position and earnings that are generated by the application of LIFO valuations as opposed to other methods such as first-in, first-out and average cost. (To learn more, read “Inventory Valuation For Investors: FIFO And LIFO.” )

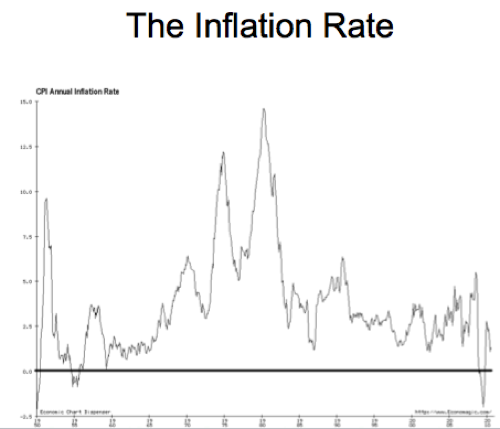

Every month, the U.S. Department of Commerce’s Bureau of Labor Statistics reports on two key inflation indicators: the Consumer Price Index (CPI) and the Producer Price Index (PPI). These indexes are the two most important measurements of retail and wholesale inflation, respectively. They are closely watched by financial analysts and receive a lot of media attention.

The CPI and PPI releases can move markets in either direction. Investors do not seem to mind an upward movement (low or moderating inflation reported) but get very worried when the market drops (high or accelerating inflation reported). The important thing to remember about this data is that it is the trend of both indicators over an extended period of time that is more relevant to investors than any single release. Investors are advised to digest this information slowly and not to overreact to the movements of the market. (To learn more, read “The Consumer Price Index: A Friend To Investors.” )

Interest Rates

One of the most reported issues in the financial press is what the Federal Reserve does with interest rates. The periodic meetings of the Federal Open Market Committee (FOMC) are major news events in the investment community. The FOMC uses the federal funds target rate as one of its principal tools for managing inflation and the pace of economic growth.

If inflationary pressures are building and economic growth is accelerating, the Fed will raise the fed-funds target rate to increase the cost of borrowing and slow down the economy. If the opposite occurs, the Fed will push its target rate lower. (To learn more, read “The Federal Reserve” .)

All of this makes sense to economists, but the stock market is much happier with a low interest rate environment than a high one, which translates into a low-to-moderate inflationary outlook. A so-called “Goldilocks “–not too high, not too low–inflation rate provides the best of times for stock investors.

It is generally assumed that stocks, because companies can raise their prices for goods and services, are a better hedge against inflation than fixed-income investments. For bond investors, inflation, whatever its level, eats away at their principal and reduces future purchasing power. Inflation has been fairly tame in recent history; however, it’s doubtful that investors can take this circumstance for granted. It would be prudent for even the most conservative investors to maintain a reasonable level of equities in their portfolios to protect themselves against the erosive effects of inflation. (For related reading, see “Curbing The Effects Of Inflation.” )

Inflation will always be with us; it’s an economic fact of life. It is not intrinsically good or bad, but it certainly does impact the investing environment. Investors need to understand the impacts of inflation and structure their portfolios accordingly. One thing is clear: depending on personal circumstances, investors need to maintain a blend of equity and fixed-income investments with adequate real returns to address inflationary issues.