The Impact of Cash Flow on Asset Allocation Decisions Alpha Architect

Post on: 24 Май, 2015 No Comment

- Guest Post: Chris Scott

Investors trying to make decisions on how to invest their savings face many complications that are frequently ignored in research papers on asset allocation. Often, it is assumed that a fixed lump sum of money is invested. But this is rarely the case in real world investing for the individual investor. Typically an investor will be either accumulating funds or drawing down funds, which results in regular cash flows into or out of investment accounts. These cash flows can have a significant impact on the investment results obtained, and therefore should influence asset selection and asset allocation decisions.

The objective of asset selection/asset allocation is to maximize return for a given amount of risk. When evaluating investment assets and making asset allocation decisions, asset volatility is a bad thing. Higher volatility typically means more risk. Higher volatility also reduces the geometric mean of returns (compound returns). When there are no cash flows into or out of an investment, this reduction in return from volatility drag (VD) can be estimated by:

Or to more precise, we can calculate:

VD is one of the reasons for generally trying to avoid or limit assets with high levels of volatility. However, periodic cash flow into an account changes the impact volatility can have on geometric returns. With regular contributions to an investment account you are dollar cost averaging into the investment. When the price of the investment increases, you purchase fewer shares. When the price of the investment decreases, you purchase more shares.

To see how periodic cash flows into an account affects the geometric return of volatile investments, I ran a monte carlo simulation utilizing a normally distributed zero return investment with varying levels of volatility. Regular periodic cash flows of a fixed size were invested on a monthly basis. The size of the monthly cash flow tested, ranged from 0.1% to 100% of the total initial account value. Each simulation trial was run for 60 months. After 100,000 trials for each set of parameters, the results of the trials were averaged. The graph below shows that even modest regular cash flows into an investment reduces the negative impact volatility drag can have on geometric returns.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

How do things change when using historical returns which exhibit serial auto-correlation, fat tails, and skewness? I repeated the simulation using monthly US stock market returns from 1926 to the present (returns are from the Ken French data library ). The returns were de-meaned and scaled to a desired standard deviation (average return is subtracted from each monthly return to produce a time series with an arithmetic average of zero, then multiplied by a scalar to increase/decrease the standard deviation). This results in 1000 5-year overlapping periods. The outcome shows that with actual returns there is slightly more reduction in volatility drag compared to the monte carlo simulation. For reference, the monthly standard deviation for US stock market returns since 1926 has been 5.4%.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

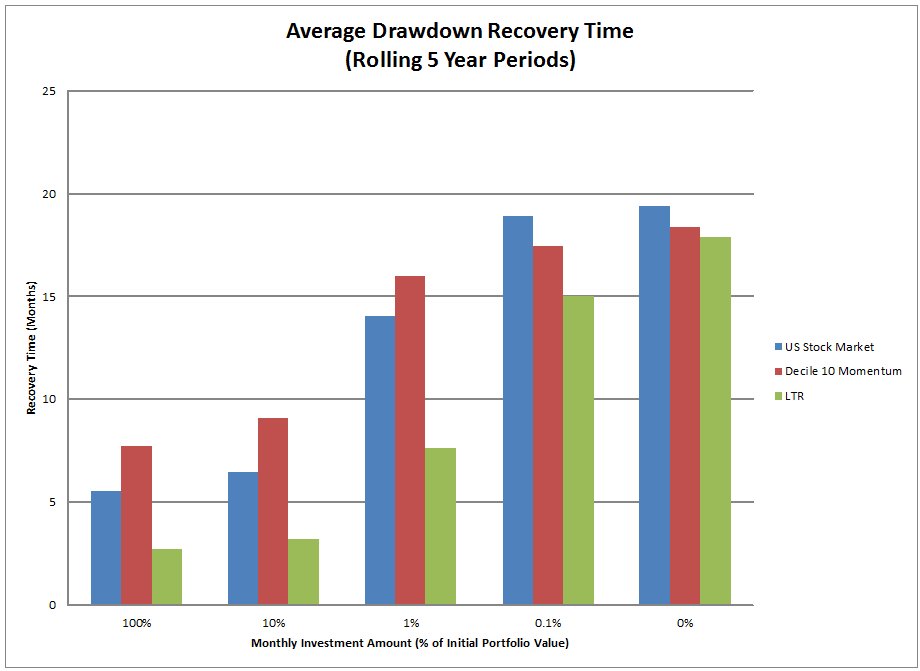

So we can see that positive cash flow into an investment reduces the negative impact of volatility on returns, but that doesn’t mean an investor should blindly seek out volatility when there are significant positive cash flows into an account. Volatility hurts geometric returns. Ultimately achieving good results is still about investing in assets with high expected returns. Typically an investor will avoid or limit investments in high volatility assets due to their risk. Positive cash flow into high expected return, high volatility investments can reduce their perceived riskiness. To illustrate this, let’s consider the following assets: US cap weighted stock market, US decile 10 momentum stocks – equal weighted, and long term US Treasury bonds (LTR). These three assets provide a set of risky assets with a range of returns and volatilities.