The HighYield Dividends to Own for Decades (EXC FTR MCD NGG PCL PM)

Post on: 16 Март, 2015 No Comment

Go on, admit it! There’s nothing to be ashamed about. You love huge dividends.

In uncertain times, it’s great to have the security of dividends from stalwarts, and the bigger the payout, the better. But not only does it feel good: In fact, you have tons of research on your side. High-yielding stocks lead to attractive returns over the long term, according to a Tweedy, Browne review of the literature.

Below I highlight a few high-yield stocks that you should consider owning for decades, and I’ll offer you free access to a Fool tool that can help you stay updated on these dividend dynamos. So go on and love these high yielders!

It’s not just academic

Investment manager Tweedy, Browne looked at a range of studies — both from researchers and actual investors — that examined the returns of high yields across various eras. The upshot? According to Tweedy:

- There is substantial empirical evidence to support a direct correlation between high dividend yields and attractive total returns.

- At least one study demonstrated that the returns associated with market-beating high dividend yield stocks were also less volatile in terms of the standard deviation of returns.

- At least one study found that high dividend yield stocks outperformed other value strategies as well as the overall stock market return in declining markets.

So there you have it, the advantages of high-yield stocks — good total returns, less volatility, and better downside protection. That’s a great advantage for investors building a portfolio for the long term.

Importantly, Tweedy also notes that three studies show that the best returns were gained not by the highest-yielding tier of stocks but rather by the second-highest tier. High-yield investing is not simply buying the fattest dividends on the market, since enormous yields tend to signify that investors have lost confidence in the stock, often for good reason.

For example, wireline communications provider Frontier Communications ( NYSE: FTR ) offers a 9.3% yield currently. And while I’ve said before that it’s a good near-term pick as the stock appreciates and can cover its payout, the long-term prospects of that sector are not nearly so attractive as competition intensifies. Instead, it’s important to focus on high sustainable yields and businesses with solid prospects.

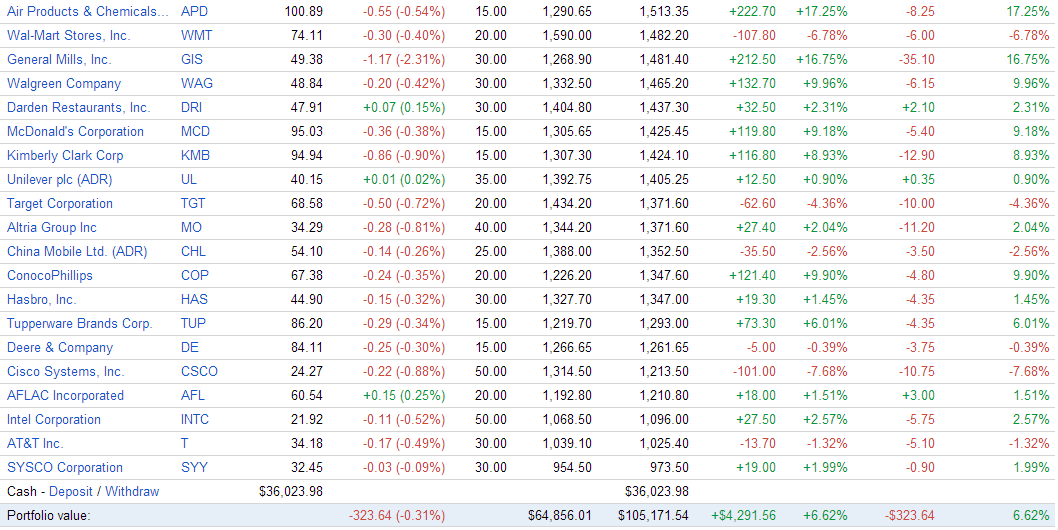

The high-yield contenders

So let’s take a look at six companies that I think you should consider owning for decades. Each company here has a stable franchise and a solid future. In addition, they all sport manageable payout ratios and have shown an ability to grow their payouts over time.