THE FINANCIAL PHILOSOPHER Socrates Stocks and SelfAdvice

Post on: 20 Июнь, 2015 No Comment

October 23, 2007

Socrates, Stocks, and Self-Advice

The average man doesn’t wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He doesn’t even wish to have to think. — Jesse Livermore (1877 — 1940)

As the Bulls and Bears fight over bragging rights on correctly forecasting the short-term direction of financial markets, the prudent investor only invests in a way that is suitable for his or her own objectives and personal tolerance for risk without regard for the opinion of others. I often refer to this position as neither Bull nor Bear but right. The key to getting to this position is knowing yourself and, yes, thinking.

This post is about discovering your investment personality and offering a reference model to prudent asset allocation that YOU can follow and apply to your own use — not spoon-fed advice — but self advice.

First, something I call the Socratic Model of investing, patterned after the Socratic Method of inquiry, is actually a method of advice any financial planner or investment adviser worth their fees will apply. Put simply, it is self advice and is the primary objective here at TFP: Asking questions and making observations that provoke the reader to think for themselves by applying their own reasoning to the particular issue at hand and, ultimately, to make informed, prudent investment decisions. This method is certainly not for the lazy mind — the mind that only wants answers without care for reasoning, as Jesse Livermore expresses in today’s quote.

Know Thyself

Secondly, the adage, know thyself, plays an important role in the investment process and finds itself at the core of the Socratic Model. An investor is certainly not wrong to be indifferent to matters regarding the financial markets. What would be wrong is if the investor chooses an active investing. do it yourself, style when the passive investing. low maintenance, style (i.e. index funds, ETFs, target-dated funds) would be appropriate.

If you want to learn more about risk and investment styles, you may find a recent TFP post, Know Thy Risk. to be useful. For guidance in finding a suitable asset allocation for you, I suggest beginning with this risk tolerance/capacity questionnaire.

Ahead of the Herd

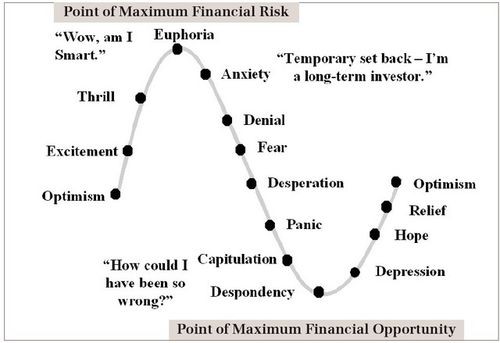

The prudent investor will also resist speculation or pure market timing and focus, rather, on time in the market while attempting to stay one step ahead of the investor herd. This style will often find an investor buying when the herd is selling and selling when the herd is buying, which can be referred to as a contrarian style of investing or buying on weakness and selling on strength.

Finally, the Socratic Model does not choose a bull or bear position — it chooses the right position for the individual. It does not utilize dynamic charts or pure forecasting techniques — it utilizes the rhyme of history combined with common sense and seeks a big picture view of economic and market cycles as opposed to missing the forest for the trees.

I find it helpful to use an example of a static (unchanging) chart that shows the relation of the market (bull/bear) cycle with the economic (growth/recession) cycle. I do not necessarily use this graph to time the market or condone sector trading but to illustrate how the stock market cycle historically leads the economic cycle:

While one may argue that, since oil and gold (numbers 9 & 11, respectively) are the hottest sectors now, that we are at a Bull market top, although it is useless and foolish to predict such a thing. Other static references I refer to from time to time include The Callan Chart and this article on understanding cycles. Keep in mind that, as Twain put it, history does not repeat itself, but it does rhyme; therefore, there is no need to study dynamic charts, financial indicators, or read tremendous amounts of information. With regard to the current cycle, all an investor needs to know is that this Bull market is older than average and every day that passes brings us closer to the next Bear market. An investor’s allocation simply reflects that fact.

For further reference, I’ll provide allocation ranges for typical mutual fund categories and how a relatively-aggressive, long-term investor may apply these allocations now and for considering where to invest in 2008:

- 15-25% Foreign Stock Large-Cap: This position would have increased from around 15 percent (under-weight) in early 2006 to around 20 percent in 2007, which is an appropriate range for 2008. More aggressive investors could be at 25 percent but should begin scaling back now.

- 5-30% Small Cap Domestic: Small companies do best starting in the earlier stages of the economic cycle (full recession/early Bull through middle Bull). I was around 30 percent (over-weight) small-cap stocks in 2002, following the last recession, and gradually decreased this position starting in 2006 to around 5 percent now, which is where it will stay until it is clear we are in a recession again. Then, I will slowly increase the allocation back to 30% as the recession ends and the next Bull begins.

- 30-45% Large Cap Stock: I prefer Index funds here but actively-managed funds can be advantageous in down markets. Large company stocks gain favor in the latter stages of the economic cycle as investors reduce exposure to the more speculative small-cap stocks in favor of the old familiar Blue-Chip names, which is occurring now. In 2006, I was around 20% (under-weight) large-cap and began increasing to around 35%, which is where it is now. I will likely move it as high as 40% in early 2008, which is where it will stay until it at least middle recession.

- 10-15% Sectors / Defensive Stock: Certain stocks are called defensive because they have low correlation (tend to move in different directions) to the broader market. Health Care (lower on pharmaceuticals, higher on bio-tech) is the best bet now. I had no Health care funds in 2006 and added one early in 2007. I also added a small position in Real Estate (REIT) and Large-Cap Financials during the big drop in August 2007. I’m around 10% Health Care, 5% REIT, and 5% Financials now and will likely stay there in 2008.

- 0-20% Multi-Sector Bond: I bought into bonds early in 2007 for the first time in several years. I’m at 15% now and may move it higher early in 2008. I prefer not to navigate the complexities of the bond market. Instead, I leverage the experience and knowledge of a seasoned bond fund manager. Multi-Sector gives the fund manager(s) room to buy and sell all types of bonds with varying maturities and credit ratings. You only need one good, diverse bond fund.

- 0-10% Cash: I began selling into strength early in 2007 and my cash moved from around 2% to nearly 10% by September. I’m now at 5%, which is where I will remain until I see opportunity to buy on weakness again.

You’ll notice that I’m never completely out of the market and that I never make sudden, large or frequent moves based on short-term market conditions and seven or eight mutual funds gets the job done. I also have no idea when the next recession will begin (if it hasn’t already) and I will never try to predict that. I just know, based on history, that we are getting closer so my asset allocation will slowly evolve with the age of the cycles.

Regardless of financial market environment, it’s never too late to begin a prudent investment strategy. Active management is not for the lazy or indifferent. A great deal of the return received in active management is the intrinsic value in doing it. Since it is quite difficult to achieve on a regular basis, out-performing the market should be a secondary pursuit to the primary reward of personal fulfillment in the investment process itself. If an investor has no passion for personal finance and investing, they should employ a passive investing style or a good fee-only investment adviser or financial planner.