The Equity Collar A Risk Reduction Strategy

Post on: 1 Июль, 2015 No Comment

P reet, a high net worth financial planner (and former race car driver), is back again! This time, instead of explaining the basics of call options, he shows us a risk reducing options strategy called The Equity Collar. If you are interested in reading more about Preet, you can visit him on his blog WhereDoesAllMyMoneyGo .

I had the opportunity to write about the basics of call options for Million Dollar Journey a few months back and thought I would continue on that theme by presenting a common option strategy known as the Equity Collar .

Speculation and Hedging are the two main reasons for using derivatives. Speculation is the taking on of risk, and Hedging is the reduction of risk. Within both broad categories, there are varying degrees of each. The Equity Collar is very much a hedging strategy designed to reduce risk.

An Example

Perhaps as a means to facilitate understanding I will start with an investor profile and then work in the strategy as a solution to her problem. Lets say that Sally is 64 years old and has accumulated a sizeable portfolio that is strictly invested in an ETF that tracks the entire stock market (collars work with individual stocks too though). Lets say that this stock market is trading at 10,000 right now and the ETFs unit value is $100. The markets have pulled back recently, and Sally is unsure if we have hit bottom or if there is more downside to the markets.

She would like to retire at the end of this year (9 months from now) at which point she has decided she will then switch her portfolio to 50% equities and 50% fixed income. She owns 5000 units of the ETF for a total portfolio value of $500,000.

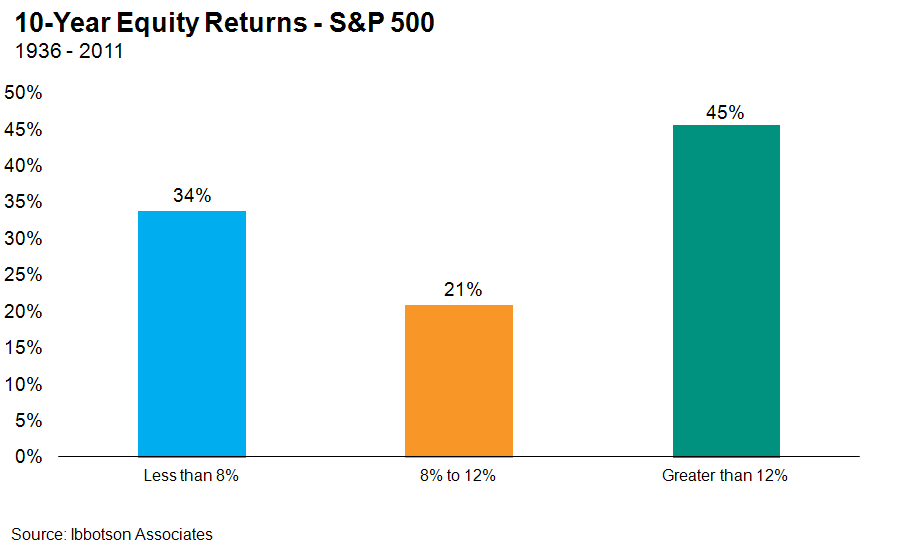

She feels strongly that with the recent pull-back in the markets that if we are at a bottom, the market will have a positive year and end up at maybe 10,800 points, or up 8%. At the same time, she realizes that in the short term the markets can pull back further and doesnt want to erode her retirement savings any further if that were to happen as she is 9 months away from retirement as mentioned.

If she wanted to protect her portfolio (or insure it from further losses) she could buy a put option on the ETF with a strike price of $100. This put option gives Sally the right (but not the obligation) to sell her ETF shares at the strike price of $100/unit up until the option contract expires. This now protects her from losses in her portfolio up until the expiry date of the option (which in her case would be 9 months from now).

So for example, at the end of the year if the market had dropped from 10,000 down to 9,200 (a loss of 8%), her ETF units will have similarly dropped from $100/unit to $92/unit. However, Sally could exercise her right to sell her units for $100/unit. Therefore she protected her portfolio from loss.

Of course, as with any insurance there is a cost involved which I have omitted up to this point. Lets assume that the cost of the put options are $2/share to purchase. In this case, to completely protect her portfolio she would need to buy 50 put option contracts (an option contract is for 100 shares) to insure her entire $500,000 portfolio. This would cost her $10,000 in total ($2/share x 5000 shares). Once you factor in this cost, then really the portfolio is insured to not fall below $490,000 because you would have to pay this $10,000 cost no matter what happened.

For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. If Sally were to turn around and SELL a call option (this means she is giving someone ELSE the right, but not the obligation, to buy her units) for a strike price of $110, she might get $1.50/share from the sale of that contract. This is what is known as writing a covered call .

In this case, if she wrote (sold) 50 call option contracts with a strike price of $110/unit, she would receive $7,500 in premiums ($1.50/share x 5000 shares). This could be used to offset the purchase of the put options of $10,000 for a net cost to Sally of $2,500 versus $10,000.

The trade-off is that she is now guaranteed no more than a 10% gain on her portfolio as the call option holder would exercise their right to buy Sallys shares once they reached over $110/unit.

The Results

What is the end result? Sally is guaranteed to have between $497,500 and $547,500 by the time she retires. She has protected her portfolio from a loss of no more than 0.50%, but has limited herself to a maximum possible gain of 9.5%.

It is possible to completely offset the bought put options premiums with the sold call options premiums if Sally were to lower the strike price on the call options she sells to perhaps $108. In this case she might command a higher premium of $2/share for selling the call options which would completely offset the cost of the put options. In this case her portfolio would be bound between $500,000 and $540,000 (guaranteed return between 0% and 8%). Again though, Sally is trading off even more upside potential for her portfolio.

- The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar .

Final Thoughts

I mentioned that an Equity Collar can be implemented with individual stocks and in fact it can be implemented with any optionable security. For a perfect hedge, you would match the options to the underlying security. However, if you have a portfolio of 20 Canadian blue chip stocks, this is a lot of work for a perfect hedge.

An imperfect hedge would use an option on a proxy of your portfolio which in the case of a portfolio of 20 Canadian blue chip stocks would be options on the TSX/60 index. This would have a high enough degree of correlation to your portfolio that you could accomplish the same results, give or take 50-100 basis points perhaps, with only having to worry about 1 set of puts and calls.

As always, consult with a qualified financial advisor before engaging in any investment strategies.