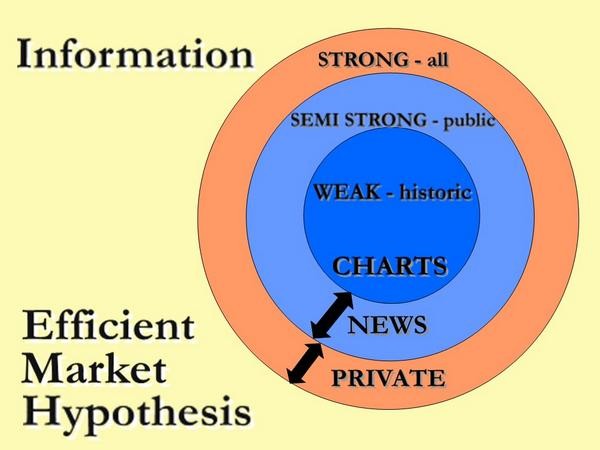

The Efficient Market Hypothesis

Post on: 7 Май, 2015 No Comment

Kurtis Hemmerling’s article, Do You Believe in The Efficient Markets Hypothesis Co-Out? caught my eye and I am always interested in what other writers have to say about the Efficient Market Hypothesis. Hemmerling writes the following:

If you choose to believe in the EMH, then you should simply invest in a broad market ETF such as one that tracks the S&P 500 ( SPY ), the NASDAQ 100 ( QQQ ) or the Dow Jones Industrial Average ( DIA ), since beating market averages can only be a fluke. Performing due diligence is a waste of time since the appropriate risk to reward is already reflected in the share price. You simply need to buy 20 random stocks or an index fund.

As an advocate of the Efficient Market Hypothesis, I don’t believe 20 random stock will provide sufficient diversification to meet EMH standards. William J. Bernstein concludes one must invest in hundreds of stocks from all over the globe to truly be diversified. Nor do I think purchasing only SPY, QQQ, or DIA is sufficient, particularly since the U.S. is no longer the dominate market in the world. The asset allocation plans available on this blog paint a different picture when it comes to meeting a well-diversified portfolio.

I agree with Hemmerling on the following point:

But if everyone bought an index fund, where would the rational expectations come in creating the ‘right price’ based on information? If all prices reflect all information, does this mean that trading ‘pump and dump’ penny stocks will provide me with average gain if I trade them long enough and in large enough quantity? How many individual investors do you know, that you would term ‘rational’, that buy and sell without greed and fear making them hit the order button? As well, no investor should be able to persistently beat the market and no investor should consistently underperform the market.

I don’t think the market will ever lack from individual investors as there will always be a high percentage of investors who have an inner feeling they are one of the few who can outperform the broad market. I want to quickly point out that there are investors who do perform better than the market and do it over long time frames. Following the EMH strategy does not automatically place one in a position of saying no one can do better than the broad market. The argument is that the law of averages is against one outperforming the market over a lifetime of investing — and that is what the overwhelming evidence shows.

Remember that the small investor who says they are outperforming the market are not charging for their time, equipment overhead, and cost of data sources. Further, I posit that they do not measure their performance against an appropriate benchmark. It is nearly impossible to prove the prior statements as we do not have access to all the data to prove these points. How many readers of this blog charge all expenses of portfolio management against the portfolio returns? I know I don’t. Assume a money manager earns $100,000 a year and then clip that off your returns and very few small investors will top the broad market.

Near the end of the article, Hemmerling draws his conclusion in this paragraph:

I find the notion of the EMH assaulting to the senses. I believe that investors are rewarded for due diligence and intelligent stock picking strategy. We belong to the school of thought that as long as you are willing to strategize a little longer than the next guy, or dig a little deeper, you will profit from a market that is neither random not perfectly priced based on all available information.

Once more, I will concede the fact that there are investors who are able to beat the market. However, where we have access to records of hundreds of mutual fund money managers, the evidence is quite the contrary. Just read Richard Ferri’s book, The Power of Passive Investing, if you need evidence that it is best to take a passive-index approach to investing. In other words, the EMH has a lot going for it in the real world when all the facts are taken into account.