The DJIA Performance Year To Date and Why It Matters

Post on: 16 Март, 2015 No Comment

To subscribe to our daily Morning Markets Briefing email, click here .

The Dow Jones Industrial Average may be down 188 points on the year, but the internals of this market measure show just how closely U.S. stocks teeter between gain and loss in 2015. At first blush, youd think wed be down more than 1% on the year since 19 of the 30 names here are in negative territory YTD. And then you look at whats holding up the Dow: Boeing (158 points), UnitedHealth (80 points), Disney (58 points), Home Depot (53 points) and Dupont (34). Thats a total of 383 points or a positive 2.1% move on the Index. To get the Dow moving higher, youll need some of the heavyweights in this price-weighted measure to get moving: Visa (9.6% weight), Goldman (6.6%), 3M (5.9%), IBM (5.7%), and United Technologies (4.3%) would be good places to start. And if you say Wait, dont many of those have a lot of dollar exposure? well, you are catching on to what ails U.S. stocks. One last note about the upcoming Apple of the Dows eye: even if AAPL had been in the Dow all this year, the Dows return would still be negative.

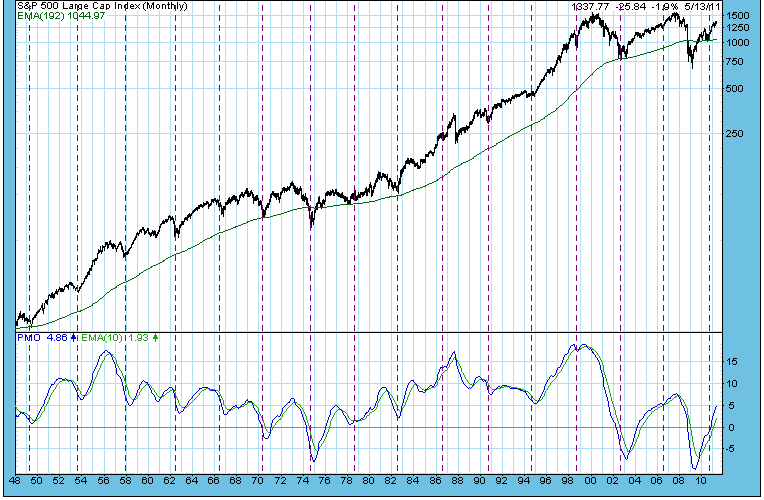

As a history buff, I love that the Dow Jones Industrial Average has been around since 1896. It is, in fact, the longest standing measure of general stock market performance we have. Want to know how American stocks fared in World War I? Or what the Great Depression did to equity values? The Dow is the only place to go. The S&P 500 didnt kick off until 1957 and the NASDAQ Composite dates from 1971.

But to get that long track record, you have to put up with some quirks, chief among them the fact that the Dow is not an index. Its an Average. What Charles Dow did to get the whole thing going +100 years ago was to take a list of 12 well known Industrial names and their stock prices and simply average them. This was cutting edge stuff at the time, being able to summarize a whole days price action with one measure. It did, of course, make the companies with high stock prices more influential on the Index than low priced stocks.

We live with that computational legacy to this day, with the top weighting in the Dow Jones Industrial Average belonging to Visa (9.6%) rather than larger capitalization companies like Microsoft (1.6%) or ExxonMobil (3.1%). To put that in further perspective, Visas weighting in the Dow is more than twice Apples 4.0% weight in the S&P 500. Does this all matter when you compare the performance of the Dow versus the S&P 500? A bit, to be honest. For all of 2015 the Dow is down 1.1%, and the S&P is 0.9% lower. Stretch that time frame out to five years, and the splits are S&P 500 +79.2% and Dow +66.9%. Go really long term like my entire Wall Street career (mid 1986-present) and the Dow (up 861%) outpaces the S&P 500 (up 742%).

Aside from its Galapagos tortoise-like longevity, the Dow is also simpler to track and analyze than the S&P 500. Instead of sectors, we can talk names and their contributions to performance over time. Weve broken out the YTD performance of each Dow component below, showing what each stock has meant to the Dows overall 2015 move:

Heres a summary of the data:

- The Dow is down 187.68 points year to date, or negative 1.05% on a price-based basis. Of the 30 names in the Average, 19 are down on the year, and 11 are higher.

The upshot here is pretty straightforward. It is easy to see why U.S. stocks are basically flat on the year with a lot of churn higher and lower but no real direction. There is plenty to like about domestic equities: good earnings, low interest rates, some chance of a modestly better economy, and not-yet-stupid valuations. OK, the last one is a bit of damning with faint praise, but thats the truth. At the same time, can you really expect fresh money to push the key Dow names we cited above to new highs given macro challenges like low oil prices or a strengthening dollar? Thats a big ask.

In the end, I still like U.S. stocks here, with the simply caveat that the easy money is gone. Equities should move higher this year. The Dow should set new records. It just wont be the low-volatility drift weve had the last 6 years.

For the full newsletter version of the Morning Markets Briefing, including our summary of yesterdays market action and accompanying charts and tables for todays post, go here .