The Dividend Timing Trading Strategy

Post on: 16 Март, 2015 No Comment

Related Mixing Speculation and Investing articles

The Dividend Timing Trading Strategy

One method for combining technical and fundamental is a trading system based on the timing of a stocks ex-dividend date. This maximizes your return on capital through dividend yield, while also allowing you to move in and out of positions.

The ex-dividend date (also called the record date ) is the day that stockholders earn dividends. Anyone owning stock before the preannounced ex-dividend date gets the dividend, although actual payment does not occur until several weeks later. Anyone who buys stock after that date does not earn the dividend.

When the ex-dividend date arrives, the value of stock is likely to drop to reflect the value of dividends to be paid out. So if you buy stock timed to show you as the recorded owner as of the ex-dividend date, you will get the dividend but your shares will be reduced in value.

Key Point

The stock price will fall on ex-dividend date, so the key to this strategy is to pick exceptionally strong companies so the stock price will rebound sooner rather than later.

A strategy involving timing of purchases like this is clearly a trading strategy. The idea is to get in so that you earn the dividend, and then to get out as quickly as possible. Because the value will drop on or right before that date, you need to alter the strategy with a few trading rules:

- Limit the activity to the strongest companies only. A trading strategy like this should not be tried on a highly volatile stock, because it relies on the likelihood that the price will rebound quickly after the ex-date decline. A strong demand for shares will be likely to replace the decline in price by a fast recovery; the decline will not be substantial because it merely offsets the dividend, but the strategy relies on strong demand for shares.

- Be willing to hold shares until price rebounds. You might need to hold onto shares for some period of time until the price rebounds from the drop on ex-date. In theory, the dividend effect will be completely recovered on the date the dividend is actually paid. Without other influences on the stock price, the ex-date decline should be matched by the value of dividends paid. In reality, though, many other influences are in play. You need to be able and willing to hold shares until the price comes back, because the timing is not going to be certain. Some stocks may take weeks; others will come back the next day or even on the ex-date.

- Reinvest dividends in partial shares. You have the choice when you buy shares to take dividends in cash or to reinvest them by purchasing additional partial shares. The reinvestment choice makes sense because (a) it creates a compound return in the dividend, and (b) you may move in and out of the same stock on each quarters ex-date, so accumulating shares adds to your overall portfolio value and dividend income.

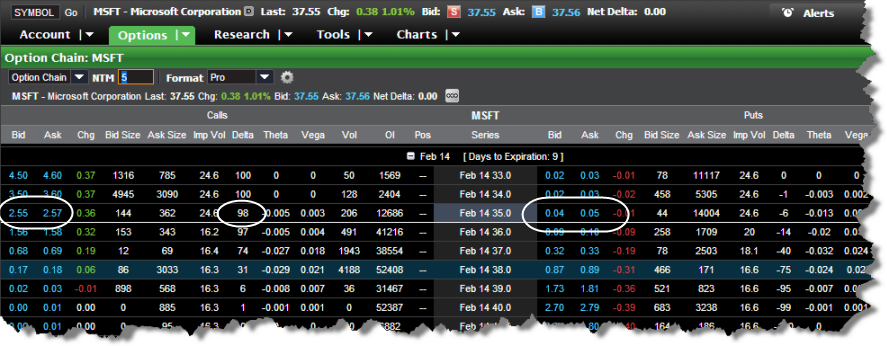

- Offset decline with purchase of a put at the money or closer to it, if practical. Another choice is to buy a short-term at-the-money put to offset the expected decline in the stocks price. Short-term means the put will expire within a matter of days or weeks. A put will increase in value point for point with a price decline in the stock once it is in the money. For a put, this means the price has to be lower than the strike price of the put. This is explained in more detail in Options to Leverage and Manage Your Portfolio. The problem with buying a put is whether you can find one priced cheaply enough. If the put is too expensive, it could completely wipe out your dividend income, making the strategy pointless. This only works if and when you can achieve a marginal profit in the increased value of the put to offset a lower price of stock. If this results in a net loss, that loss needs to be lower than the dividend income.

The dividend-based trading strategy uses timing of a fundamental (dividend) to increase short-term income through a trading system. It can create exceptional gains if you are using the same capital to move in and out of stock ownership positions.

Key Point

Timing stock positions to ex-dividend date means you earn the annual rate every month instead of every quarter. This means you can earn four times the stated annual dividend rate.

For example, assume that you have $5,000 to invest in 100 shares of three different stocks, all priced about the same and all yielding a 2 percent dividend each year. If you buy 100 shares of stock A before ex-dividend date, then sell at breakeven or a small profit within one month, the funds are freed up to repeat the trade in stock B, whose ex-dividend date comes in the second month. The same steps are repeated to move into stock C in the third month. Three stocks could be exchanged in this manner for the full year, maximizing dividend yield.

In this simplified example, you turn a 2 percent annual yield into a much higher annual yield by timing your moves. The quarterly dividend, 0.5 percent, is earned every month by moving money in and out of stock. That quadruples the annual dividend income to 8 percent instead of 2 percent.

Is this improvement worth the risk? To a conservative investor focused on fundamentals, it might not be. Such an investor will probably prefer to find a high-quality company as a long-term value investment paying a higher-than-average dividend and simply hold onto shares for the long term. However, a trader who is willing to take greater market risks will find this timing strategy very attractive and will be more willing to pursue it.

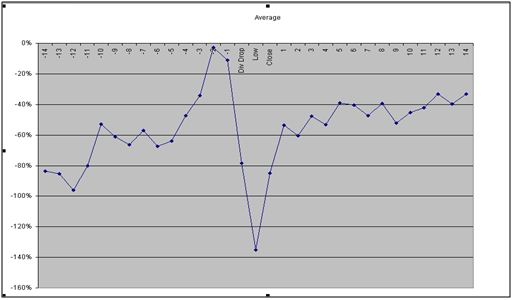

As with any trading strategy, the companies used to time dividends in this manner must be strong enough to rebound in price after the expected decline on ex-dividend date. The strategy works only if the best stocks are used for the strategy. Many high-quality companies yield an exceptional dividend, making this approach reasonable. The following chart provides an example of three companies for which this strategy could be employed. This is not a recommendation to invest in these companies, but only a means for showing how the strategy works.

Dividend timing strategy

This strategy yields an average of 6.9 percent. However, actual annual yield, based on holding each stop for 30 days, would yield: