The Difference Between the MultiplyBy25 Rule and the 4Percent Rule

Post on: 1 Апрель, 2015 No Comment

There are two rules often cited by investors that sound similar but that in fact make very different claims. In this article, Ill describe the differences between the two rules the Multiply-by-25 Rule and the 4-Percent Rule .

The Multiply-by-25 Rule

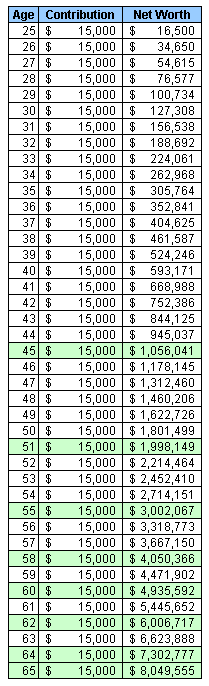

The purpose of The Multiply-by-25 Rule is to tell an investor how much he needs to save to generate an income stream of a specified size. Say that you need an inflation-adjusted $50,000 to live on in retirement. The Multiply-by-25 Rule tells you that you need to save $1.25 million to meet your goal ($50,000 times 25 equals $1.25 million)

The rule assumes that you will be able to generate an annualized real return of at least 4 percent on your investments. A return of 4 percent real on a portfolio of $1.25 million yields $50,000. If you needed $40,000 to live on, you would need to save $1 million. If you needed $60,000, you would need to save $1.5 million. The amount you need to save to generate a specified annual income is always 25 times the annual income amount so long as you assume a 4 percent real return on your investments .

For those who think it better to assume a real return of only 3 percent, the Multiply-by-25 Rule should be changed to the Multiply-by-33 Rule. For those who think it safe to assume a 5 percent return, the Multiply-by-25 Rule should be changed to the Multiply-by-20 Rule. Whatever Multiply-By Rule is used will work so long as the underlying assumption employed with it works. So you obviously increase your chances of having the rule work by using conservative return assumptions.

The 4-Percent Rule

The 4-Percent Rule is often confused with the Multiply-by-25 Rule because the Multiply-by-25 Rule assumes a 4 percent return. However, the reality is that the 4-Percent Rule addresses a far more sophisticated question and is rooted in far more questionable assumptions.

How much do you need to save to finance a safe retirement plan?

The 4 Percent Rule was developed during the huge bull market, when most investors were heavily invested in stocks. Aspiring retirees came to see that the Multiply-by-25 Rule (or any of the possible variations of it) does not answer their most important question how much does an investor heavily invested in stocks need to save to finance a safe retirement plan?

The problem is that, when it comes to stock investment, the return obtained is not the only variable that matters in determining whether a retirement withdrawal amount will work out or not. Stocks have for a long time provided an average annual return of something close to 7 percent real. But there are many cases in the historical record in which retirees taking a 7 percent withdrawal would have experienced busted retirements.

If stocks provided a steady 7 percent return, the 4-Percent Rule would instead be the 7-Percent Rule. Retirees could withdrawal 7 percent of their portfolios each year and be sure of their retirement plans working out. But it doesnt work like that in the real world.

Stocks are a highly volatile asset class. While they provide an average return of close to 7 percent, there are years when they offer returns far greater than that and other years when they offer returns far less than that. What sort of returns sequence pops up in your particular retirement plays a big role in determining whether your retirement plan works out or not.

For retirees, timing is everything

The key to retirement survival is for the retiree to experience good results in the first 10 years of the retirement. If you knew in advance that the first 10 years were going to be better-than-average years, you could actually take more than 7 percent as your withdrawal. The converse is also true. If you knew in advance that the first 10 years were going to be worse-than-average years, you would need to take a withdrawal of a good bit less than 7 percent to be sure that your retirement plan was going to work out.

The Safe Withdrawal Rate

The studies responsible for the 4-Percent Rule tried to answer the question How much less? The answer they came to is 3 percent less. or 4 percent. The studies look at all of the returns sequences in the historical record and identify a withdrawal of 4 percent as the highest withdrawal that works in every possible case. Hence, the claim that a 4 percent withdrawal is “safe.”

The claim that a 4 percent withdrawal is safe is not a claim that the investor will obtain a return of 4 percent. The studies that produced this rule look at what works in the event that the investor is willing to see his retirement account reduced to zero over the course of 30 years. With this assumption, a return of zero percent would generate a safe withdrawal rate of 3.3 percent. The fact that the studies show the safe withdrawal rate to be only 4 percent suggests that stocks provide a level of long-term safety not much better than that provided by an asset class providing an asset class offering a stable return of something only a little better than zero percent.

Thats shocking, isnt it?

It is. Its also revealing.

What the low withdrawal rate is telling us is that the volatility of stocks is a far more negative force than most of us imagine it to be. The assumed rate of return in the studies is neither zero percent nor 4 percent; it is actually something close to 7 percent, the normal return for stocks. The reason why the safe withdrawal rate is so much lower is that volatility creates the possibility of frighteningly poor returns in the early years of a retirement, and poor returns in the early years are devastating to the hopes of long-term retirement success.

Say that you knew two retirees, one who retired last July (just prior to the huge stock crash ) and one who retired last week. Say that both had the same amount in savings on the day of retirement and both were planning on the same annual withdrawal. Which of the two enjoys the safer retirement today? Its obviously the one who retired last week. The earlier retiree has a far smaller portfolio and needs it to last nearly as long. Big losses in the early years of a retirement are bone-crushers.

Conclusion

My personal belief is that both of these rules bring to light useful insights as to how investing works but that neither by itself tells the full story. I believe strongly that the 4-Percent Rule at some times overstates and at other times understates the amount needed for a safe retirement; at times of high valuations the true safe withdrawal can drop to as low as 2 percent and at times of low valuations it can rise to as high as 9 percent. The Multiply-by-25 Rule isnt by itself perfect either. There are times when obtaining a 4 percent return is childs play and there are times when you need to go hunting for a mix of asset classes that will provide that level of return.

Effective retirement planning requires the mining of insights from a variety of sources. Both the Multiply-by-25 Rule and the 4-Percent Rule offer valuable insights. But neither the Multiply-by-25 Rule nor the 4 Percent Rule tell you all that you need to know. Even combined, these two rules do not tell you all that you need to know.