The Debt Ceiling Debate And Interest Rates

Post on: 28 Май, 2015 No Comment

With a partial U.S. government shutdown under way investors are turning their attention to the debt-ceiling debate and the potential for a downgrading by various credit agencies. Standard & Poor’s made it clear that this level of political discord is precisely why the U.S. is not triple-A rated anymore. However S&P has indicated that most likely it will not downgrade the U.S.’ credit rating but warned of a possibility of the Treasury missing debt payments, and therefore the first-ever U.S. debt default.

S & P explained: The current impasse over the continuing resolution and the debt ceiling creates an atmosphere of uncertainty that could affect confidence, investment, and hiring in the U.S., indicating a short-lived shutdown. They added: This sort of political brinkmanship is the dominant reason the rating is no longer ‘AAA.’

It is difficult to assess the exact impact of a default but most likely it will affect financial markets and interest rates. Volatility is likely to increase over the next few weeks and declining confidence could affect markets and the economy as it did during the 2011 debt-ceiling crisis, which put a significant dent in both business and consumer confidence, and sent the stock market tumbling even though a debt-ceiling deal was eventually reached.

How will the debt debate affect interest rates?

Many things could happen over the next two weeks but most likely interest rates will be affected at least in the short term. If the government does not pay its bills but pays back the debt to avoid default then longer term interest rates would fall. But short-term rates might rise. The austerity from cutting 32% of federal spending overnight could cost jobs and if the debt-ceiling debate lasts more than a few days investors might start fleeing to the safety of U.S. government debt as they did in 2011.

The chart below shows the impact to U.S. Treasuries as investors turned to the ‘safety’ of government debt during the last debate as well as the results from the S&P downgrade. Longer-term Treasuries shown by the iShares 20+ Year Treasury Bond ETF (NYSEARCA:TLT ) in green and iShares 10-20 Year Treasury Bond ETF (NYSEARCA:TLH ) in red were up around 10% during the debate while the S&P 500 (NYSEARCA:SPY ) was mostly flat to down.

I would not expect interest rates to fall as much as they did after the S&P downgrade in 2011 but I believe there is a possibility of rising Treasury prices and lower rates as the current debates continue.

Of course there are also economists that believe the Treasury would not be able to prioritize the debt payments due to logistics and potential legal issues. This is the ‘chicken little ‘ scenario that could lead to severe austerity and declines in consumer confidence with the potential for a rise in rates from investors dumping Treasuries. I do not see this as a likely scenario.

How will this affect interest rate sensitive stocks?

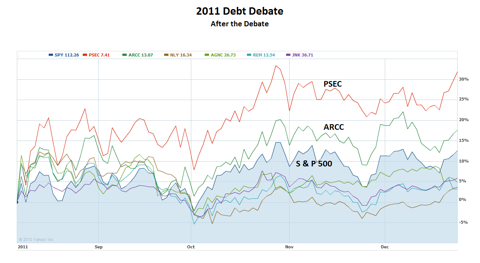

Obviously investors’ confidence and interest rates will impact rate sensitive investments differently. During the 2011 debates, these investments declined more than the S&P 500 probably due to sector volatility and the uncertainty about rates. The chart below shows how two of the larger BDCs, Prospect Capital (NASDAQ:PSEC ) and Ares Capital (NASDAQ:ARCC ), two of the larger mortgage REITs, Annaly Capital Management (NYSE:NLY ) and American Capital Agency (NASDAQ:AGNC ), and SPDR Barclays Capital High Yield Bond ETF (NYSEARCA:JNK ) performed during the 2011 debates (but before the S&P downgrade) compared to the S&P 500.

As Treasuries started to rise and rates fell, the S&P 500 recovered faster than JNK and the mortgage REITs while PSEC and ARCC climbed higher. However some BDCs such as PSEC had fallen more than other investments giving them more ground to make up for and I believe this should have been seen as a buying opportunity.

As investors regain confidence and the potential for the Fed tapering returns, interest rates will begin to rise and as discussed in my The FOMC Announcement: BDCs And REITs there will likely be another sell-off and an opportunity for BDC investors to buy and for REIT investors to sell (or at least hold). The chart below shows what happened directly after the June 19, 2013, Fed announcement with BDCs outperforming other rate sensitive investments:

Summary

Investors should watch the upcoming debt ceiling debates as we get closer to the October 17 deadline. Most likely volatility will increase and at some point investors might gravitate toward Treasuries. This would cause a short-term decline in equities, especially BDCs and REITs but ultimately this is an opportunity to buy for the long term.

Investors should only use this information as a starting point for due diligence. See the following for more information:

Disclosure: I am long PSEC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.