The Debate Between Buy and Hold vs Timing The Market

Post on: 21 Апрель, 2015 No Comment

Wise Bread Picks

It’s interesting to see that with the advent of computerized trading and value discount brokers, a new era of people investing with the idea of getting rich overnight has exploded, even as statistics show that most short term investors do not make money over the long term. This is in the heart of an interesting debate that rages on in financial circles: should we buy and hold on to our investments for the long term or is timing the market the way to go?

The buy and hold faction is quick to say that you’d be crazy to think you can beat the market over time, and that an eye on the long term is how you’re going to make money via the stock market. But the other side those market timers who’ve decided to cut their teeth on stock and options trading via their trusty TradeKing accounts make the point that many investors who’ve held on to their investments are now lamenting that as a result of buy and hold, they’ll need to be part of the work force for quite a bit longer than they expected.

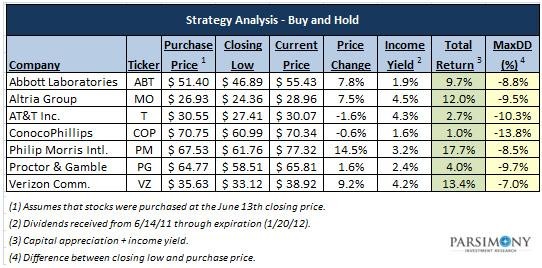

A Closer Look At Buy And Hold

Let’s take a closer look at buy and hold investing. shall we? So how about a quick game of one question Jeopardy: the most famous buy and hold investor? If you answered, who is Warren Buffett? then congratulations, you know your investment gurus! Warren Buffett is not only one of the most famous investors around, but also one of the most successful investors in history. Buffett is a market mover whose track record has been scrutinized by the investing public. When asked how long he intends to hold his chosen stocks, he gives a somewhat surprising reply, we will hold stocks forever. And while this sounds somewhat extreme, he’s also been extremely successful with employing a value investing stance over time.

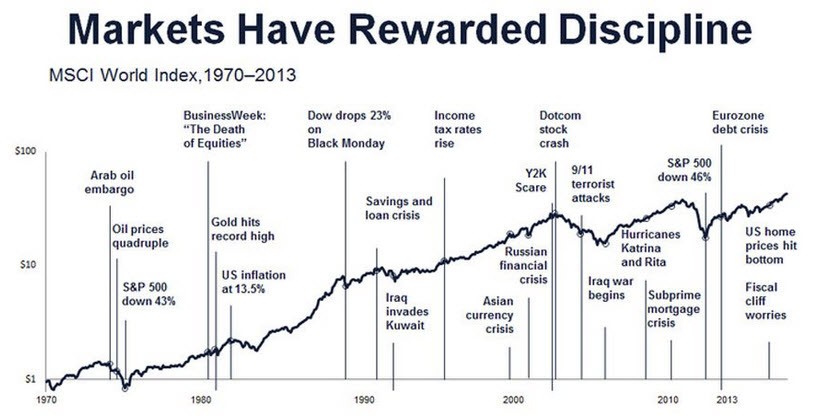

The buy and hold proponents argue that predicting short term market moves is nearly impossible, and according to them, you can expect long term investing to give you much better results. But what about the recent stock market debacle that’s decimated many a long term portfolio? While recent stock market numbers dont look great, if you ask nearly anybody who has been involved in buy and hold investing, they will tell you that while their portfolio has decreased in value, its still up significantly from when they first opened their investment broker account, even after taking inflation into consideration. The key to this positive outcome lies in the assumption that you started investing a long time ago, when assets, in general, were quite cheap.

The World of Market Timing

The market timers and stock traders take the short term approach. These folks enjoy online stock trading, believing that they can make short term investments and predict those small day to day stock price changes well enough to make a decent profit over time. They use technical indicators and other economic data to make their educated predictions. When their trading dashboard numbers flash green, they quickly sell their positions to bag a profit. Their stance here is that by buying and selling quickly, they quickly lock in a profit and feel more in control of their financial destinies. Turn on any of the financial news networks and you’ll find that many of the analysts here are short term traders who are trying to time the market. There are shows on these networks that sometimes spend an entire hour or more asking the question, what will the market do tomorrow?

Best Moves For The Average Investor

While I would stop short of offering a hard and fast position on this debate, I’ll say this: any investor has heard that the stock market rewards patience. So take a look at your portfolio. If you have done well with your current strategy, then stick to what you’ve been doing; but if your results are flat or negative, perhaps you should try something new and consider beefing up your investment knowledge. After all, arent we all doing this for one reason? We all want to make money!