The Daily Routine Of A Swing Trader

Post on: 28 Сентябрь, 2015 No Comment

The Daily Routine Of A Swing Trader

Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Swing trading can be difficult for the average retail trader. The professional traders have more experience, more leverage, more information and lower commissions; however, they are limited by the instruments they are allowed to trade, the risk they are capable of taking on and their large amount of capital. (Large institutions trade in sizes too big to move in and out of stocks quickly.) Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. In this article, we lay out what a good daily trading routine and strategy looks like, and show you how you can be similarly successful in your trading activities.

Pre-Market

The retail swing trader will often begin his or her day at 6am (EST), well before the opening bell. The time before open is crucial for getting an overall feel for the day’s market, finding potential trades, creating a daily watch list and, finally, checking up on existing positions.

Market Overview

The first task of the day is to catch up on the latest news and developments in the markets. The quickest way to do this is via the cable television channel CNBC or reputable websites such as Market Watch. The trader needs to keep an eye on three things in particular:

Overall market sentiment (bullish/bearish, key economic reports, inflation, currency, overseas trading sessions, etc.)

Sector sentiment (hot sectors, growing sectors, etc.)

Find Potential Trades

Next, the trader will scan for potential trades for the day. Typically, swing traders will enter a position with a fundamental catalyst and manage/exit the position with the aid of technical analysis. There are two good ways to find fundamental catalysts:

Special opportunities: These are best found via SEC filings and, in some cases, headline news. Such opportunities may include initial public offerings (IPOs), bankruptcies, insider buying, buyouts. takeovers, mergers, restructurings, acquisitions and other similar events. Typically, these are found by monitoring certain SEC filings, such as S-4 and 13D. This can be easily done with the help of sites such as SECFilings.com. which will send notifications as soon as such a filing is made. (For further reading, see Policing The Securities Market: An Overview Of The SEC .)

These types of opportunities often carry a large amount of risk, but they deliver many rewards to those who carefully research each opportunity. These types of plays involve the swing trader buying when most are selling and selling when everyone else is buying, in an attempt to fade over-reactions to news and events.

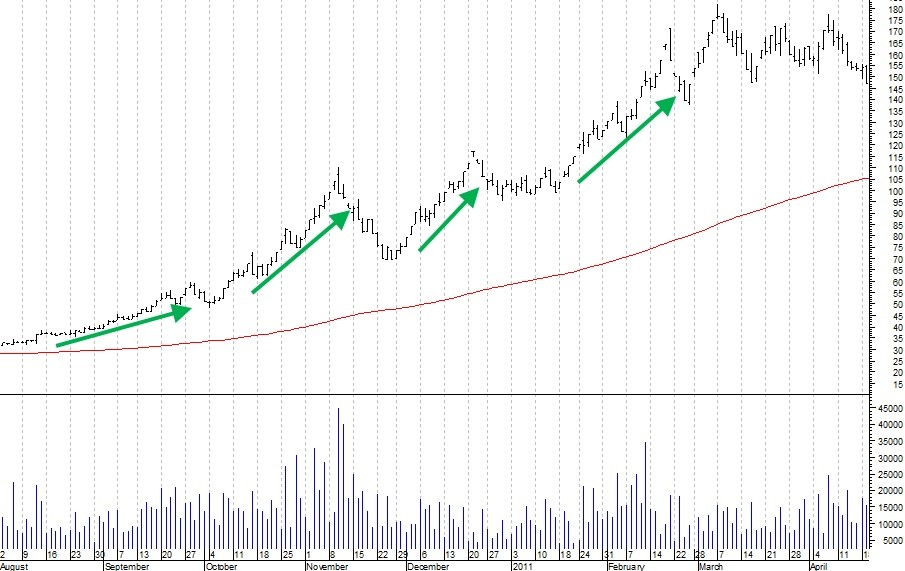

Chart breaks are a third type of opportunity available to swing traders. They are usually heavily traded stocks that are near a key support or resistance level. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves, Fibonacci levels, Gann levels and others. Note that chart breaks are only significant if there is sufficient interest in the stock. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. (To learn more about these specific patterns, see the Active Trading article archive.)

Make a Watch List

The next step is to create a watch list of stocks for the day. These are simply stocks that have a fundamental catalyst and a shot at being a good trade. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target prices and stop-loss prices.

Check Existing Positions

Finally, in the pre-market hours, the trader must check up on his or her existing positions. First, check the news to make sure that nothing material has happened to the stock overnight. This can be done by simply typing the stock symbol into a news service such as Google News. Next, check to see whether any filings have been made by searching the SEC’s EDGAR database. If there is material information, you have to analyze it and determine whether it affects your current trading plan. You may also have to adjust your stop-loss and take-profit points as a result.

Market Hours

The market hours are a time for watching and trading. Many swing traders look at level II quotes, which will show who is buying and selling and what amounts they are trading. Those coming from the world of day trading will also often check which market maker is making the trades (this can cue traders in to who is behind the market maker’s trades), and also be aware of head-fake bids and asks placed just to confuse retail traders. (For more information, see Introduction To Level II Quotes .)

As soon as a viable trade has been found and entered, traders begin to look for an exit. This is typically done using technical analysis. Many swing traders like to use Fibonacci extensions. simple resistance levels or price by volume. (For further reading, see Advanced Fibonacci Applications and [i] Gauging Support And Resistance With Price By Volume [/i].) Ideally, this is done before the trade has even been placed, but a lot will often depend on the day’s trading. Moreover, adjustments may need to be made later, depending on future trading. As a general rule, however, you should never adjust a position to take on more risk (e.g. move a stop-loss down): only adjust profit-taking levels if trading continues to look bullish, or adjust stop-loss levels upward to lock in profits.

You will often find that entering trades is more of an art than a science, and it tends to depend on the day’s trading activity. Trade management and exiting, on the other hand, should always be an exact science.

After-Hours Market

After-hours trading is rarely used as a time to place trades because the market is illiquid and the spread is often too much to justify. The most important component of after-hours trading is performance evaluation. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. Performance evaluation involves looking over all of your trading activity and identifying things that need improvement. Finally, you should review your open positions one last time, paying particular attention to after-hours earnings announcements, or other material events that may impact your holdings.

Conclusion

Looking at the daily routine of the typical swing trader, it is evident that the pre-market routine is paramount to successful trading. This is the time when trading opportunities are located and the day is planned. Market hours are simply a time of entering and exiting positions, not devising any new plans. And finally, after hours is just a time to review the trades for the day and assess performance. Adopting a daily trading routine such as this one can help you improve your trading and ultimately beat market returns. It just takes some good resources and proper planning and preparation.