The Cost of Equity

Post on: 30 Май, 2015 No Comment

The annual rate of return that an investor expects to earn when investing in shares of a company is known as the cost of common equity. That return is composed of the dividends paid on the shares and any increase (or decrease) in the market value of the shares. For example, if an investor expects a 10% return from McDonald’s stock and she buys a share at $67.25, her expectation is to receive $6.72 during the year through a combination of dividends (currently $.34 per share during 1998) and the appreciation of the stock price (presumed to be $6.38 to give her the 10% expected return totaling $6.72) during the year.

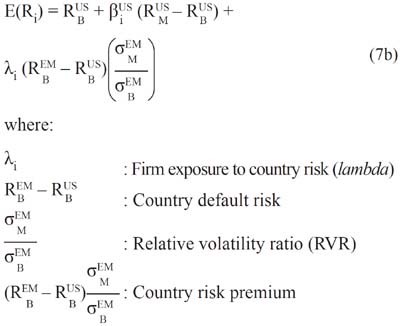

Let’s now take a look at what rate of return, in general, an investor should expect from a stock. The return expected of any risky common stock should be composed of at least three different return components: (1) a return commensurate with a risk-free security (Rf ); (2) a return that incorporates the market risk associated with common stocks as a whole (Rm ); and (3) a return that incorporates the business and financial risks specific to the stock of the company itself, known as the company’s beta.

The first measure of return (Rf) relates to what market rate of return is currently available from a risk-free security, like the yield associated with a long-term Treasury Bond. So if the yield on Treasury Bonds is 5%, an investor should expect a return greater than 5% for a common stock.

The second measure of return (Rm) relates to what market returns are currently available from and what risks are associated with stocks in general. There is a general risk premium (the equity risk premium ) associated with the stock market as a whole. That risk premium should be priced into any equity investment. For example, if you expect to earn 8% on average (from a diversified portfolio) in the stock market and the risk-free rate is 5%, the Equity Risk Premium (Rerp ) would be (Rerp) = (8% — 5%)= 3%.

Equity Risk Premium(Rerp) = Exp. Return on Market(Rm) — Risk Free Rate(Rf)

The third measure of return versus risk (beta) should be related to the specific stock being purchased—how risky is the type of business the firm does and how risky is the financial structure or leverage of the firm. Beta measures the risk of the company relative to the risk of the stock market in general. With greater risk, as measured by a larger variability of returns (business or operating risk), the company’s should have a larger beta. And with greater leverage (higher debt to value ratio) increasing financial risk, the company’s stock should also have a larger beta. And with a larger beta, an investor should expect a greater return. The beta of an average risk firm in the stock market is 1.00.

The financial risk model that uses beta as its sole measure of risk ( a single factor model ) is called the Capital Asset Pricing Model (CAPM ) and is used by many market analysts in their valuation process. The relationship between risk and return that comes out of that model and the one that is incorporated into our FCFF analysis and spreadsheet software is:

Exp.(Rs) = (Rf) + beta(Rerp)

which in English translates to The expected return on a stock (e.g. McDonald’s) is equal to the risk free rate (e.g. 5%) plus the specific stock’s beta (e.g. 0.97) times the equity risk premium (e.g. 3.0%). In numbers it looks like this: Expected Return on McDonald’s Stock = 5% + 0.97(3.0%) = 7.91%