The Concept of Dollar Cost Averaging Begin To Invest

Post on: 5 Май, 2015 No Comment

by Begin To Invest on November 8, 2012

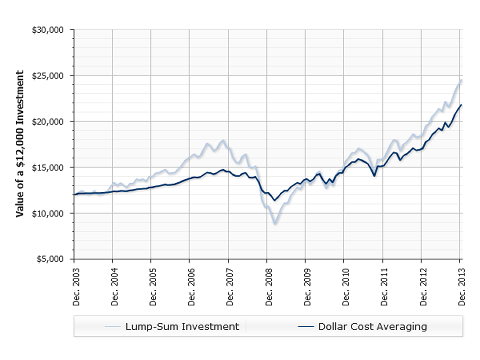

Many people put off investing because they fear what may happen in the future. Historically, investors have a terrible track record of trying to time the market. They buy the market at its highs and sell at its lows. Today I am going to show you how you can avoid this trap that most investors fall into and ensure you profit from declines in the market when they come.

Consider an investor in early 1929.

During mid 1929, the stock market was at an all time high, and for the first time really attracting individual investors. Thousands had been made by investors earlier in the decade, and now everyone wanted a piece of the action. Unfortunately, the actions of this hypothetical investor are all too common. When the stock market is up at its highs, people start investing with large lump sums of their savings.

This investor purchases $10,000 into a broad based stock index fund in September 1929 (they didn’t exist in 1929, but lets pretend), just one month before the beginning of the great depression and the worst decade of U.S. stock performance in history.

The market would drop by nearly 90%. This investor’s initial $10,000 investment would be worth a little over $1,000 at the bottom.

10 years later in 1939, their investment would have still only been worth about $7,200. In fact, they would have had to wait 25 years (1954) for the value of their investment to get back to $10,000!

Here is what the investor would have seen and experienced, a chart of the Dow Jones Industrial Average from 1900 until 1960. (chart provided by stockcharts.com):

We all have fears that a stock market crash like that which occurred in 1929 could happen again and wipe our hard earned savings out. And for that reason, many people avoid the stock market altogether.

Dollar Cost Averaging

But here is a simple strategy to help ensure that you never lose your shirt, like this investor did in 1929.

The idea of dollar cost averaging is that you invest money at regular intervals, no matter what the stock market is doing.

Lets say that you can afford to save $100 a month.

Each month, on the first day of the month you buy $100 of an S&P 500 index fund. This is possible today with the abundance of commission free ETFs available. (We highlight some in our “Fund Spotlight Series”, found here ) If the market is at a high, your $100 buys less shares, if the stock market is at a low, your $100 buys more shares.

Investing at regular intervals, instead of only one instant like our hypothetical 1929 investor did, ensures that you invest in at the lows of the stock market when they occur, and profit from future gains.

Lets see what happens if our 1929 investor invested a little smarter.

Consider someone in 1929 who invested $100 a month into that same stock index starting in 1929 for the next 10 years. This investor invested $100 whether the market was up 10% or down 90%. In fact, this investor would have had to have some guts to continue to buy the stock market all the way down. But it would pay off:

By 1939 this investor’s investment would have been worth more than $15,000! A gain of $5,000! (Remember the original investor’s investment was worth only $7,200, still -30% or so, at this time.)

In this example, the investor would have lost money on some of their investments from early 1929, but because they still have money available to invest they are also able to buy the market at its lows! This new investor buys every month, and ends up building a large position near the lows of the market. So a decade later when the stock market is recovering, they are in position to make a lot of money!

A disciplined, patient and persistent investor can make money even in the midst of the worst economic climate history has seen!

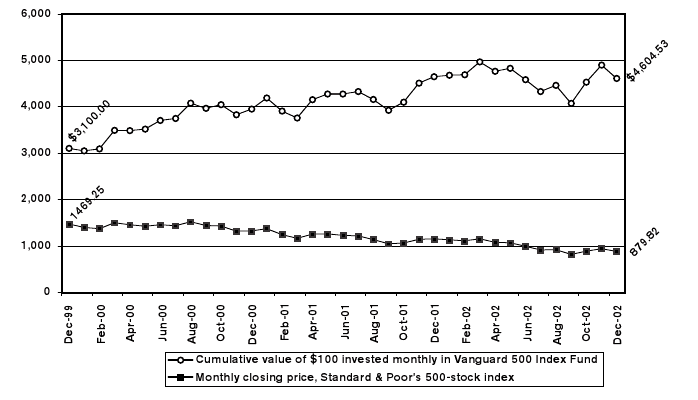

We can also relate this to a more recent example. During the tech bubble of the late 90’s and early 2000s stocks plunged as much as 90%. Many investors lost a large portion of their investments by buying in with all their money at the top (when some “experts” were telling investors to buy all they can), and holding all the way to the bottom.

But, consider an investor who started with $3000 and invested $100 a month starting in 1999.

This return is highlighted in the commentary of Chapter 5 in Benjamin Graham’s “The Intelligent Investor ” and Vanguard provides data.

Even though the S&P went from 1470 to 879 (roughly a 40% decline), an investor who invested wisely fared fine, and accumulated a portfolio that would have positioned themselves well for the recovery.

This idea is not new. Here is a quote from Benjamin Graham in 1963:

“Another approach that is practicable, but from a different point of view, is the “Dollar Averaging” method, in which you put the same amount of money in common stocks year after year, or quarter after quarter. In that way you buy more shares of stocks when the market level is low and fewer shares when its high. That method has worked extremely well for those who have had (a) the money, (b) the time and, (c) the character necessary to pursue a consistent policy over the years regardless of whether the market has been going up or down. If you can do that, you are guaranteed satisfactory results in your investments.”

This is one of the reasons 401ks have been so successful for Americans as a way to save. Investors have been investing small amounts of money every 2 weeks for decades. They buy when stocks are low and buy less when stocks are high. Over time their 401ks build up and provide the primary source of income during retirement.

Today as I write this the market is about 15% off of all time highs. Many are scared of Europe’s debt level, the potential for increased taxes in the future and a host of other issues. It would be easy to just declare this time period “too scary” to invest in. But that is not the right solution.

There will never be a time when there is no risk investing. As an investor you need to have a portfolio that can handle the ups and downs and generate wealth for decades to come. This means proper asset allocation, keeping investing fees low and perhaps most importantly, staying the course.

Ben Graham was fond of the idea of individual investors dollar cost averaging their investments. In his book The Interpretation of Financial Statements he brings up the strategy again:

In investment program under which the same dollar amount is placed in one or more common stocks at fixed successive intervals e.g. quarterly or annually over a good in many years. The result is to build up the investors common stock portfolio at in average cost per share somewhat below the actual average price for. Since he requires more shares at the lower levels than at the higher. This policy prevents the common air of concentrating stock buying during periods of high share prices.