The Components of Risk

Post on: 29 Март, 2015 No Comment

The Components of Risk

When a firm makes an investment, in a new asset or a project, the return on that investment can be affected by several variables, most of which are not under the direct control of the firm. Some of the risk comes directly from the investment, a portion from competition, some from shifts in the industry, some from changes in exchange rates and some from macroeconomic factors. A portion of this risk, however, will be eliminated by the firm itself over the course of multiple investments and another portion by investors as they hold diversified portfolios.

The first source of risk is project-specific ; an individual project may have higher or lower cashflows than expected, either because the firm misestimated the cashflows for that project or because of factors specific to that project. When firms take a large number of similar projects, it can be argued that much of this risk should be diversified away in the normal course of business. For instance, Disney, while considering making a new movie, exposes itself to estimation error — it may under or over estimate the cost and time of making the movie, and may also err in its estimates of revenues from both theatrical release and the sale of merchandise. Since Disney releases several movies a year, it can be argued that some or much of this risk should be diversifiable across movies produced during the course of the year. [1]

The second source of risk is competitive risk. whereby the earnings and cashflows on a project are affected (positively or negatively) by the actions of competitors. While a good project analysis will build in the expected reactions of competitors into estimates of profit margins and growth, the actual actions taken by competitors may differ from these expectations. In most cases, this component of risk will affect more than one project, and is therefore more difficult to diversify away in the normal course of business by the firm. Disney, for instance, in its analysis of revenues from its Disney retail store division may err in its assessments of the strength and strategies of competitors like Toys�R�Us and WalMart. While Disney cannot diversify away its competitive risk, stockholders in Disney can, if they are willing to hold stock in the competitors. [2]

The third source of risk is industry-specific risk �� those factors that impact the earnings and cashflows of a specific industry. There are three sources of industry-specific risk. The first is technology risk. which reflects the effects of technologies that change or evolve in ways different from those expected when a project was originally analyzed. The second source is legal risk. which reflects the effect of changing laws and regulations. The third is commodity risk. which reflects the effects of price changes in commodities and services that are used or produced disproportionately by a specific industry. Disney, for instance, in assessing the prospects of its broadcasting division (ABC) is likely to be exposed to all three risks; to technology risk, as the lines between television entertainment and the internet are increasing blurred by companies like Microsoft, to legal risk, as the laws governing broadcasting change and to commodity risk, as the costs of making new television programs change over time. A firm cannot diversify away its industry-specific risk without diversifying across industries, either with new projects or through acquisitions. Stockholders in the firm should be able to diversify away industry-specific risk by holding portfolios of stocks from different industries.

The fourth source of risk is international risk. A firm faces this type of risk when it generates revenues or has costs outside its domestic market. In such cases, the earnings and cashflows will be affected by unexpected exchange rate movements or by political developments. Disney, for instance, was clearly exposed to this risk with its 33% stake in EuroDisney, the theme park it developed outside Paris. Some of this risk may be diversified away by the firm in the normal course of business by investing in projects in different countries whose currencies may not all move in the same direction. Citibank and McDonalds, for instance, operate in many different countries and are much less exposed to international risk than was Wal-Mart in 1994, when its foreign operations were restricted primarily to Mexico. Companies can also reduce their exposure to the exchange rate component of this risk by borrowing in the local currency to fund projects; for instance, by borrowing money in pesos to invest in Mexico. Investors should be able to reduce their exposure to international risk by diversifying globally.

The final source of risk is market risk : macroeconomic factors that affect essentially all companies and all projects, to varying degrees. For example, changes in interest rates will affect the value of projects already taken and those yet to be taken both directly, through the discount rates, and indirectly, through the cashflows. Other factors that affect all investments include the term structure (the difference between short and long term rates), the risk preferences of investors (as investors become more risk averse, more risky investments will lose value), inflation, and economic growth. While expected values of all these variables enter into project analysis, unexpected changes in these variables will affect the values of these investments. Neither investors nor firms can diversify away this risk since all risky investments bear some exposure to this risk.

Why Diversification Reduces or Eliminates Firm-Specific Risk

Why do we distinguish between the different types of risk? Risk that affect one of a few firms, i.e. firm specific risk, can be reduced or even eliminated by investors as they hold more diverse portfolios due to two reasons.

- The first is that each investment in a diversified portfolio is a much smaller percentage of that portfolio. Thus, any risk that increases or reduces the value of only that investment or a small group of investments will have only a small impact on the overall portfolio. The second is that the effects of firm-specific actions on the prices of individual assets in a portfolio can be either positive or negative for each asset for any period. Thus, in large portfolios, it can be reasonably argued that this risk will average out to be zero and thus not impact the overall value of the portfolio.

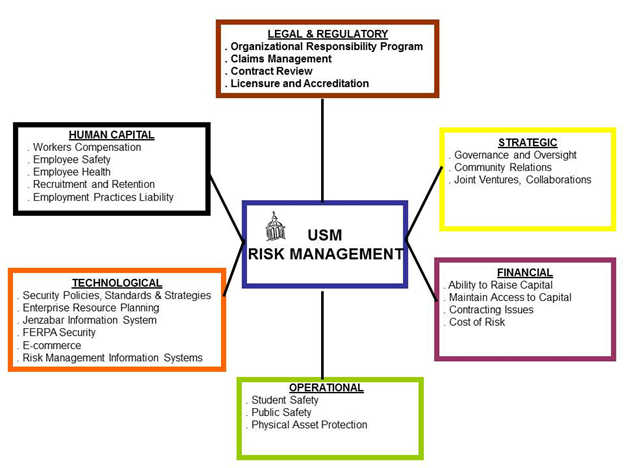

In contrast, risk that affects most of all assets in the market will continue to persist even in large and diversified portfolios. For instance, other things being equal, an increase in interest rates will lower the values of most assets in a portfolio. Figure 3.5 summarizes the different components of risk and the actions that can be taken by the firm and its investors to reduce or eliminate this risk.

While the intuition for diversification reducing risk is simple, the benefits of diversification can also be shown statistically. In the last section, we introduced standard deviation as the measure of risk in an investment and calculated the standard deviation for an individual stock (Disney). When you combine two investments that do not move together in a portfolio, the standard deviation of that portfolio can be lower than the standard deviation of the individual stocks in the portfolio. To see how the magic of diversification works, consider a portfolio of two assets. Asset A has an expected return of m A and a variance in returns of s 2 A. while asset B has an expected return of m B and a variance in returns of s 2 B. The correlation in returns between the two assets, which measures how the assets move together, is r AB . [3] The expected returns and variance of a two-asset portfolio can be written as a function of these inputs and the proportion of the portfolio going to each asset.

m portfolio = w A m A + (1 — w A ) m B

s 2 portfolio = w A 2 s 2 A + (1 — w A ) 2 s 2 B + 2 w A w B r AB s A s B

where

w A = Proportion of the portfolio in asset A

The last term in the variance formulation is sometimes written in terms of the covariance in returns between the two assets, which is

s AB = r AB s A s B

The savings that accrue from diversification are a function of the correlation coefficient. Other things remaining equal, the higher the correlation in returns between the two assets, the smaller are the potential benefits from diversification. The following example illustrates the savings from diversification.

Illustration 3.2: Variance of a portfolio: Disney and Aracruz

In illustration 3.1, we computed the average return and standard deviation of returns on Disney between January 1999 and December 2003. While Aracruz is a Brazilian stock, it has been listed and traded in the U.S. market over the same period. [4] Using the same 60 months of data on Aracruz, we computed the average return and standard deviation on its returns over the same period: