The Case For Higher Stock Prices After Tax Increases

Post on: 23 Апрель, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Capital gains and dividend taxes are likely going up considerably in 2013 for people who have higher incomes. Many people believe this will depress stock prices. I don’t see that happening. In fact, prices may go higher if there are offsetting corporate tax cuts.

As it stands today, the capital gains tax will increase from 0% to 10% for investors in the 15% bracket (8% for gains held more than 5 years) and from 15% to 20% for all others brackets (18% for gains held more than 5 years). Taxes on qualified dividends will more than double for many investors because it will be taxed as ordinary income. In addition, investors with higher income will be subject to a 3.8% Medicare tax on capital gains and dividend income. See Facing the Tax Mountain for a list of pending tax increases on investments.

We know that the only rational objective for most long-term investors is to earn a real total return after taxes and inflation. Sir John Templeton summed it up well, “Any investment strategy that fails to recognize the insidious effect of taxes and inflation fails to recognize the true nature of the investment environment and thus is severely handicapped.”

The pending tax hikes facing investors certainly has many people thinking twice about stocks. It’s only logical, they say, that the market will go down once taxes go up because the after-tax return to investors will be less.

Not so fast. Let’s look at the historic relationship between taxes and stock prices before jumping to conclusions.

CXO Advisory Group analyzed different capital gains tax rates and their effect on stocks returns, and how changes in capital gains rates over time affected returns. Their conclusion was inconclusive.

The following scatter plot from CXO relates S&P 500 Index annual return to same-year maximum capital gains tax rate over the sample period. The R-squared statistic for the relationship is practically zero, indicating no relationship between the two series.

The next scatter plot relates S&P 500 Index annual return to same-year change in maximum capital gains tax rate over the sample period. The R-squared statistic for this relationship is also practically zero, again indicating no relationship.

In summary, CXO Advisory Group found no connection between the maximum U.S. capital gains tax rate and U.S. stock market returns, and no relationship between changes in the maximum capital gains rate and stock returns.

Why would this be so? Quite simply, individual U.S. investors are not the only people investing in the U.S. stock market. In fact, more than 70 percent of the market is institutional money that typically has no tax mandate on their returns. This means pension funds, endowments, foundations, foreign investors, hedge funds, banks, insurance companies, and a host of other entities that are either not taxed or taxed using a different structure than individuals.

If an individual investor sells stock because they think the market is heading south due to higher personal income taxes, this becomes a buying opportunity for those who are not hindered by the same tax treatment. Earnings of companies do not change when there is a change in individual tax rates, so the value of their common stock does not change for most institutional investors.

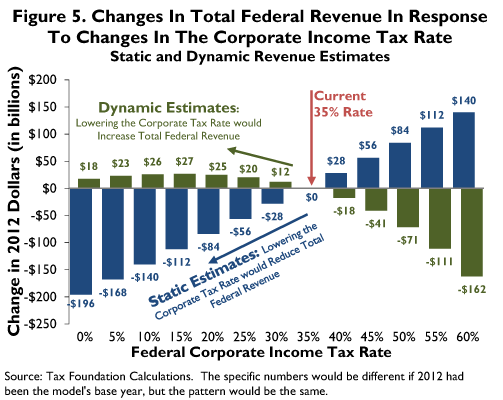

There’s another dimension to the stock market that few people have talked about in relation to taxes. Both President Obama and the Republican leadership believe that corporate tax rates in the U.S. are too high. This rate makes U.S. companies less attractive in a global economy. Currently, the top corporate rate is 35%. There’s a good chance that that corporate tax rates will fall in a budget compromise.

If corporate tax rates fall, it will immediately increase corporate after-tax profits in the U.S. and this should make stocks more attractive to all investors.

Every cloud has a silver lining. Higher taxes on capital gains and dividends will not be pleasant for anyone. However, if individual tax increases are accompanied by a lower corporate tax structure, there might be an unexpected boost in stock prices.

You might also like: