The Case for Foreign Stocks

Post on: 16 Март, 2015 No Comment

Submitted by Martha Strebinger on Monday, March 9, 2015 — 3:00pm

The argument for owning international stocks is stronger than ever. And that’s despite their current low ebb. Most foreign markets had a bad 2014, but overseas stocks have often outpaced U.S. ones. Above all, a strong holding of overseas equities helps limit your risk, because they diversify your portfolio nicely.

Your overall U.S. market returns last year were likely modest compared with the double-digit fireworks of 2013, when the Standard & Poor’s 500 total return (appreciation plus interest) was 32.4%. The 2014 performance (13.8%) landed slightly above the historical average of 7%.

While such a wide gap in performance can frustrate you, realize first that the gap is, in fact, the hallmark of a well-diversified portfolio. Good diversification means that you may expect disappointment in at least one asset class every year. Domestic equities’ continued strong run might also tempt you to discard time-tested tactics of diversification, at least when it comes to investing overseas.

Such abandonment usually occurs because you get greedier or you get more scared. It’s important that you don’t panic out of an asset class after a large decline. Equally important, don’t panic into an asset class after a large and sustained rally.

If hesitant to invest abroad, you’re not alone – especially when the U.S. market outperforms overseas counterparts. Many compelling reasons nevertheless remain for keeping the big, global investing picture in mind.

Twice the opportunity. The American stock market represents just half of the publically investable stocks worldwide. While it may feel safer to invest in companies close to home, you risk missing out on half of global investment opportunities.

The upside becomes clearer with a look at blue-chip stocks of large, well-established companies. In Forbes’ recent list of the world’s biggest firms, only 11 of the top 25 were U.S.-based. Without foreign exposure in your portfolio, you miss out on some of the most successful (not to mention household-name) companies on the planet, including Nestle (NSRGY ), Novartis (NVS ), Toyota (TM ) and Samsung (SSNLF ).

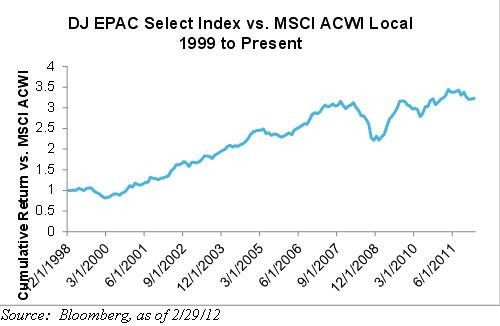

A smoother ride. While overseas equities’ performance this year lags behind domestic returns, foreign markets historically produced comparable returns. The chart below depicts annual returns of foreign-developed market stocks minus the returns of U.S. stocks from 1971 to 2014. Half the time, foreign stocks outperformed their American counterparts.

More importantly, foreign stocks often perform very differently than U.S. stocks in any given year. While long-term returns are similar, shorter-term disparities allow you to smooth out the occasional extremes (and jitters) from investing in one market. The differences also provide great opportunities to sell high and buy low as you rebalance holdings.

D iversification from currencies. Because the U.S. dollar strengthened in 2014, foreign stock returns shrank when translated from their currencies into the dollar. Foreign stocks in fact did not perform poorly if you look at returns in respective local currencies.

For example, compare the local return of the MSCI EAFE (Europe, Australasia, Far East) Index to its U.S. dollar return. The index, which tracks stocks of developed foreign markets, saw returns up nearly 6% in terms of its local currencies but down 5% when measured in U.S. dollars.

History suggests that the long-term effect of currency translation is largely neutral, as shown in the table below. Consider how in 2014, 2013 and 2008, translation into the U.S. dollar detracted from overseas returns. The opposite held true in 2010, 2009 and 2007.

Ever-fluctuating currencies also tend to move differently than stock prices from the same countries and regions, giving you yet another beneficial element of diversification.

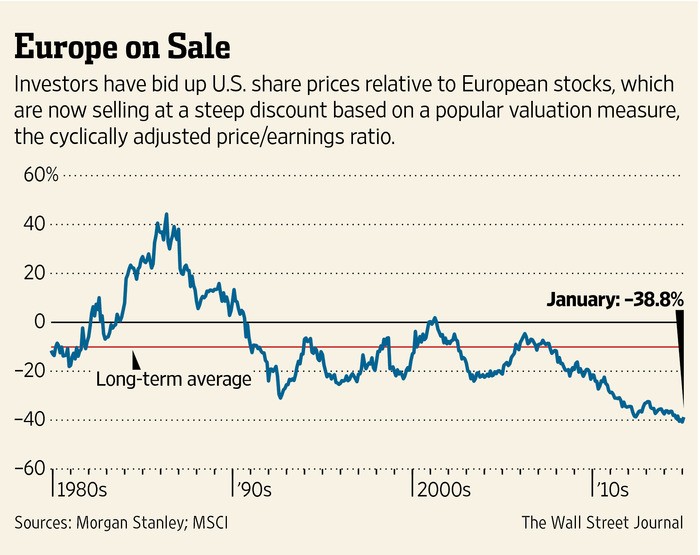

Value appeal. Debate rages over whether the U.S. market is overvalued; foreign markets’ valuation receives little attention. Yet foreign markets look quite attractive now: The MSCI EAFE Index is 20% below its peak level of eight years ago. The U.S. market already exceeds its peak from before the 2008 crisis.

True, valuations are unreliable when timing markets near-term. They are, on the other hand, a good predictor of long-term returns.

Overall reduction of risk. As overseas stocks recently saw slightly higher volatility than U.S. stocks, adding foreign exposure to lessen your portfolio risk seems counterintuitive. But remember: U.S. and foreign stocks tend to perform differently. What’s up today and down tomorrow historically reverse positions over time.

So, how to split your portfolio? We recommend a 40% allocation to foreign stocks for best overall benefits.

Follow AdviceIQ on Twitter at @adviceiq .

Martha Strebinger, CFA, is an investment specialist at Truepoint Wealth Counsel in Cincinnati.

AdviceIQ delivers quality personal finance articles by both financial advisors and AdviceIQ editors. It ranks advisors in your area by specialty, including small businesses, doctors and clients of modest means, for example. Those with the biggest number of clients in a given specialty rank the highest. AdviceIQ also vets ranked advisors so only those with pristine regulatory histories can participate. AdviceIQ was launched Jan. 9, 2012, by veteran Wall Street executives, editors and technologists. Right now, investors may see many advisor rankings, although in some areas only a few are ranked. Check back often as thousands of advisors are undergoing AdviceIQ screening. New advisors appear in rankings daily.